Security technology and services company ADT (NYSE: ADT) reported Q4 CY2024 results exceeding the market’s revenue expectations, with sales up 3.1% year on year to $1.26 billion. The company’s full-year revenue guidance of $5.13 billion at the midpoint came in 0.6% above analysts’ estimates. Its non-GAAP profit of $0.20 per share was 6.4% above analysts’ consensus estimates.

Is now the time to buy ADT? Find out by accessing our full research report, it’s free.

ADT (ADT) Q4 CY2024 Highlights:

- Revenue: $1.26 billion vs analyst estimates of $1.24 billion (3.1% year-on-year growth, 2% beat)

- Adjusted EPS: $0.20 vs analyst estimates of $0.19 (6.4% beat)

- Adjusted EBITDA: $653 million vs analyst estimates of $658.1 million (51.8% margin, 0.8% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $5.13 billion at the midpoint, beating analyst estimates by 0.6% and implying 4.2% growth (vs 1.6% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.81 at the midpoint, in line with analyst estimates

- EBITDA guidance for the upcoming financial year 2025 is $2.7 billion at the midpoint, below analyst estimates of $2.72 billion

- Operating Margin: 24.2%, up from 21.5% in the same quarter last year

- Free Cash Flow Margin: 33.8%, up from 7.7% in the same quarter last year

- Market Capitalization: $6.76 billion

“We delivered strong 2024 results including a record-high recurring monthly revenue balance, record customer retention, and very strong cash generation. All delivered while continuing to invest in ADT’s future which includes the launch of our proprietary ADT+ platform enabling unique and differentiated customer offerings such as Trusted Neighbor. Our successful 2024 performance is a testament to the dedication of our nearly 13,000 employees and approximately 140 dealer partners who are committed to serving our customers,” said ADT Chairman, President and CEO, Jim DeVries.

Company Overview

Founded in 1874 and headquartered in Boca Raton, Florida, ADT (NYSE: ADT) is a provider of security, automation, and smart home solutions, offering comprehensive services for home and business protection.

Specialized Consumer Services

Some consumer discretionary companies don’t fall neatly into a category because their products or services are unique. Although their offerings may be niche, these companies have often found more efficient or technology-enabled ways of doing or selling something that has existed for a while. Technology can be a double-edged sword, though, as it may lower the barriers to entry for new competitors and allow them to do serve customers better.

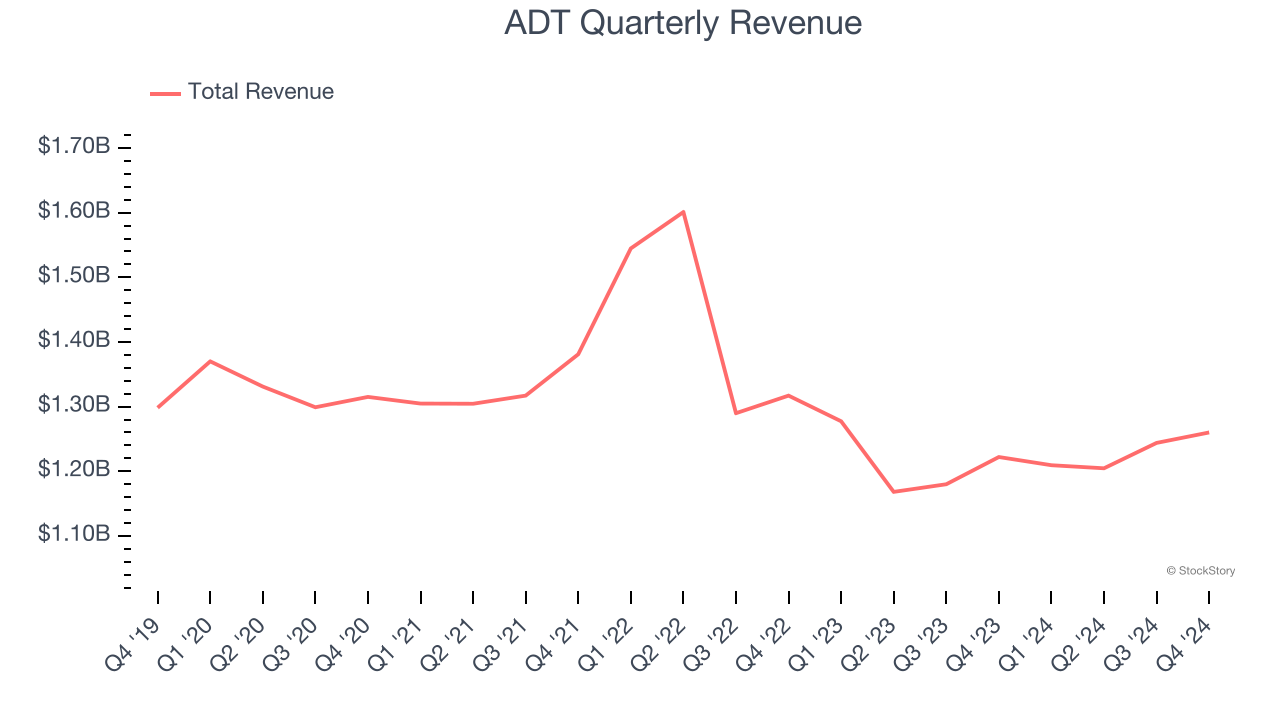

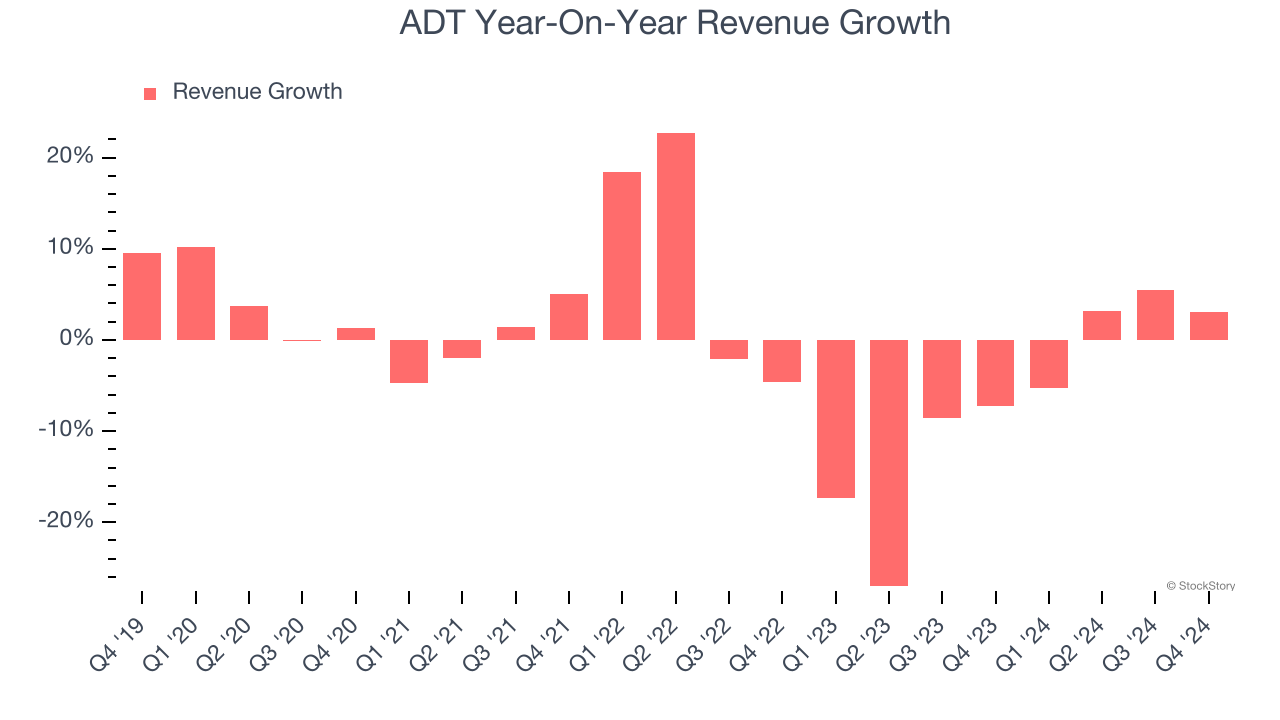

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, ADT struggled to consistently increase demand as its $4.92 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. ADT’s recent history shows its demand has stayed suppressed as its revenue has declined by 7.5% annually over the last two years.

This quarter, ADT reported modest year-on-year revenue growth of 3.1% but beat Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 3.6% over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

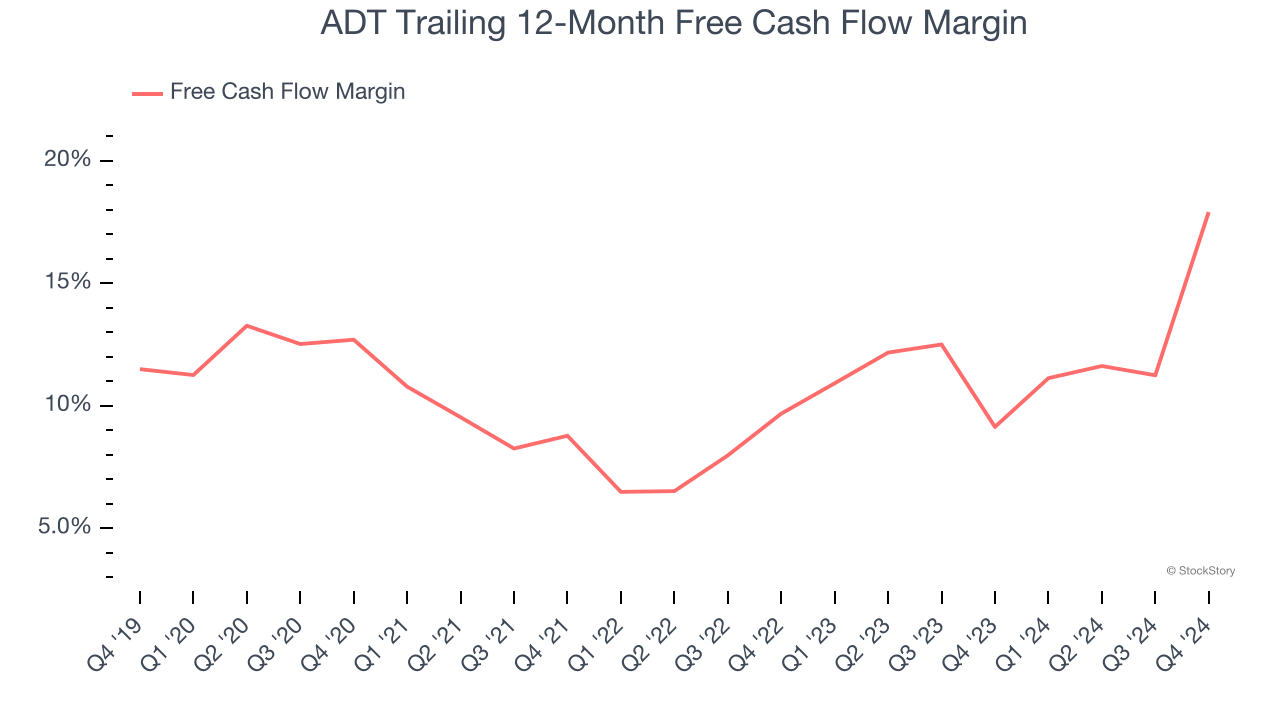

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

ADT has shown impressive cash profitability, giving it the option to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.6% over the last two years, better than the broader consumer discretionary sector.

ADT’s free cash flow clocked in at $426 million in Q4, equivalent to a 33.8% margin. This result was good as its margin was 26.1 percentage points higher than in the same quarter last year, but we wouldn’t read too much into the short term because investment needs can be seasonal, causing temporary swings. Long-term trends carry greater meaning.

Over the next year, analysts predict ADT’s cash conversion will fall. Their consensus estimates imply its free cash flow margin of 17.9% for the last 12 months will decrease to 15.2%.

Key Takeaways from ADT’s Q4 Results

It was encouraging to see ADT beat analysts’ revenue and EPS expectations this quarter. Looking ahead, full-year revenue guidance was also ahead while full-year EPS guidance was just in line. Overall, this quarter wasn't perfect but it was decent. The stock remained flat at $7.54 immediately following the results.

So should you invest in ADT right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.