The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how ESAB (NYSE: ESAB) and the rest of the professional tools and equipment stocks fared in Q4.

Automation that increases efficiency and connected equipment that collects analyzable data have been trending, creating new demand. Some professional tools and equipment companies also provide software to accompany measurement or automated machinery, adding a stream of recurring revenues to their businesses. On the other hand, professional tools and equipment companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 10 professional tools and equipment stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was in line.

While some professional tools and equipment stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.6% since the latest earnings results.

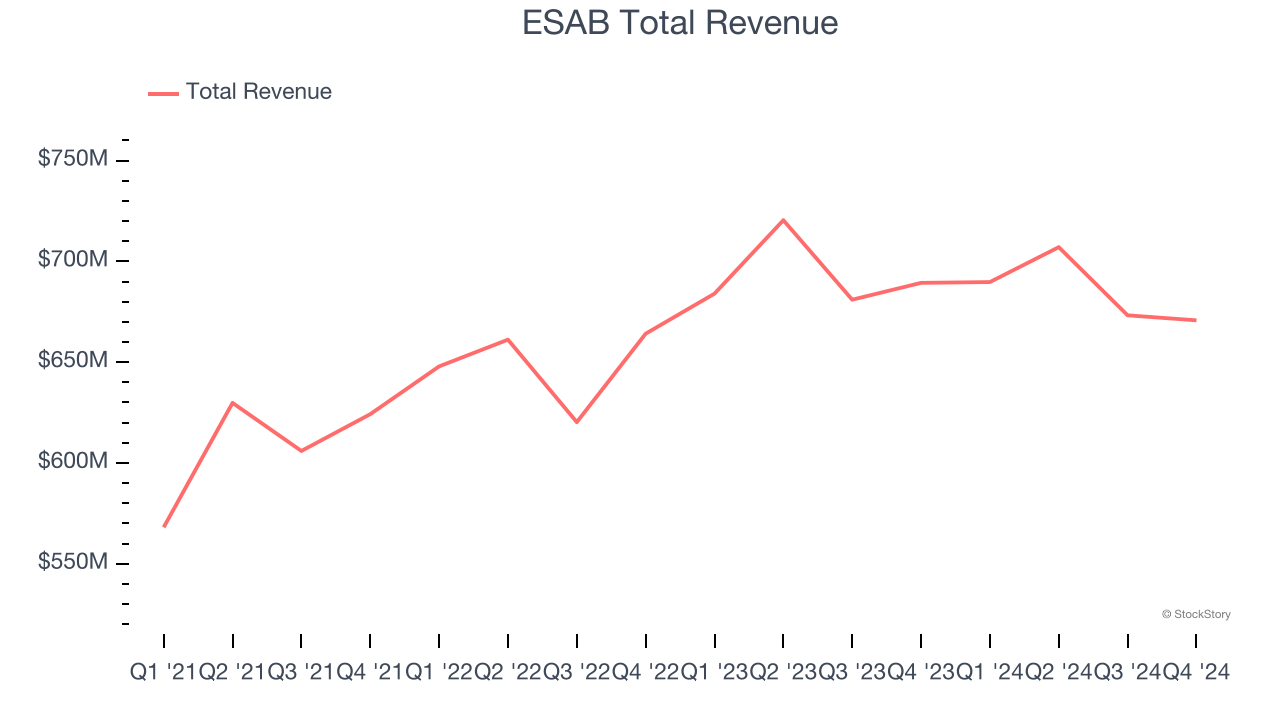

Weakest Q4: ESAB (NYSE: ESAB)

Having played a significant role in the construction of the iconic Sydney Opera House, ESAB (NYSE: ESAB) manufactures and sells welding and cutting equipment for numerous industries.

ESAB reported revenues of $670.8 million, down 2.7% year on year. This print fell short of analysts’ expectations by 0.8%, but it was still a satisfactory quarter for the company with an impressive beat of analysts’ adjusted operating income estimates.

“Our teams delivered another strong quarter, closing another year of exceptional performance. ESAB continues to innovate, introducing products and solutions that fueled growth in welding equipment this quarter. Our relentless focus on efficiency is evident in our record-breaking margin performance," said Shyam P. Kambeyanda, President and CEO of ESAB.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $124.13.

Is now the time to buy ESAB? Access our full analysis of the earnings results here, it’s free.

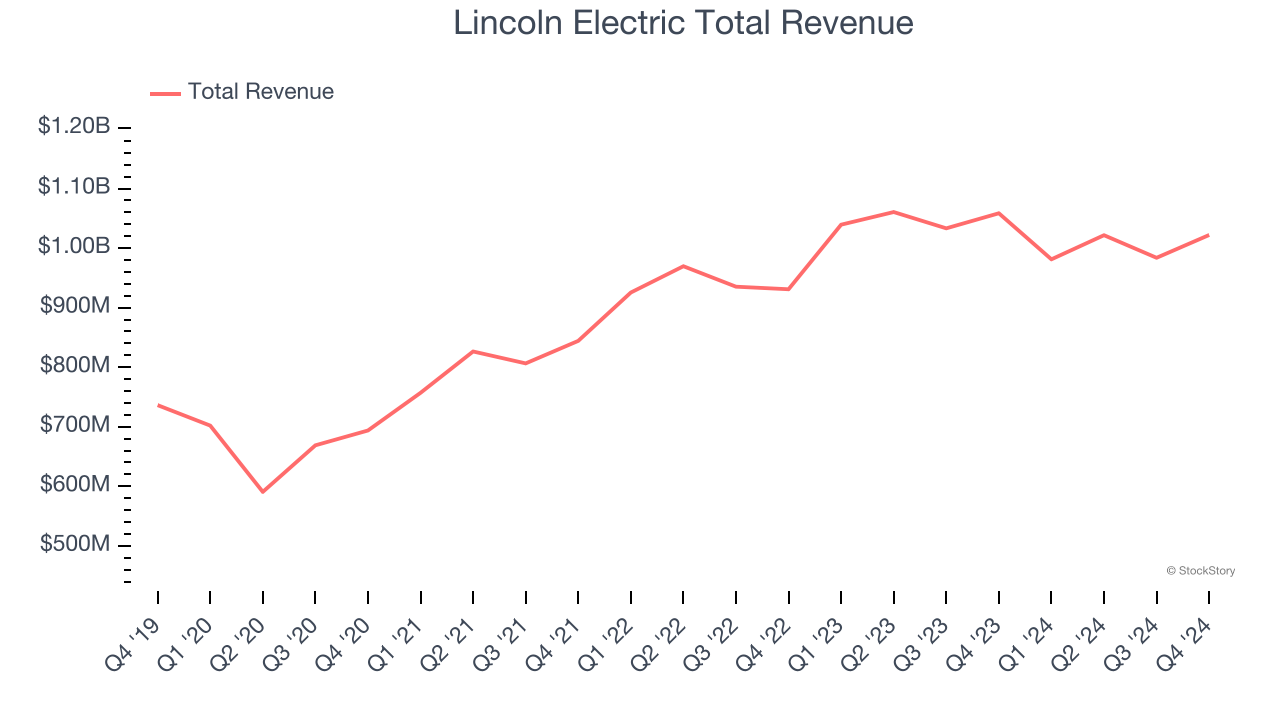

Best Q4: Lincoln Electric (NASDAQ: LECO)

Headquartered in Ohio, Lincoln Electric (NASDAQ: LECO) manufactures and sells welding equipment for various industries.

Lincoln Electric reported revenues of $1.02 billion, down 3.4% year on year, outperforming analysts’ expectations by 2.5%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 5.7% since reporting. It currently trades at $205.28.

Is now the time to buy Lincoln Electric? Access our full analysis of the earnings results here, it’s free.

Hyster-Yale Materials Handling (NYSE: HY)

Playing a significant role in the development of the hydraulic lift truck, Hyster-Yale (NYSE: HY) designs, manufactures, and sells materials handling equipment to various sectors.

Hyster-Yale Materials Handling reported revenues of $1.07 billion, up 3.9% year on year, exceeding analysts’ expectations by 4.4%. It may have had the worst quarter among its peers, but its results were still good as it also locked in a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

Interestingly, the stock is up 3.8% since the results and currently trades at $53.79.

Read our full analysis of Hyster-Yale Materials Handling’s results here.

Hillman (NASDAQ: HLMN)

Established when Max Hillman purchased a franchise operation, Hillman (NASDAQ: HLMN) designs, manufactures, and sells industrial equipment and systems for various sectors.

Hillman reported revenues of $349.6 million, flat year on year. This result came in 0.6% below analysts' expectations. Aside from that, it was a mixed quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

Hillman pulled off the highest full-year guidance raise among its peers. The stock is down 5.1% since reporting and currently trades at $9.85.

Read our full, actionable report on Hillman here, it’s free.

Fortive (NYSE: FTV)

Taking its name from the Latin root of "strong", Fortive (NYSE: FTV) manufactures products and develops industrial software for numerous industries.

Fortive reported revenues of $1.62 billion, up 2.3% year on year. This number lagged analysts' expectations by 0.5%. It was a slower quarter as it also produced EPS guidance for next quarter missing analysts’ expectations.

Fortive had the weakest full-year guidance update among its peers. The stock is flat since reporting and currently trades at $79.28.

Read our full, actionable report on Fortive here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.