Online payroll and human resource software provider Paycor (NASDAQ: PYCR) reported Q4 CY2024 results topping the market’s revenue expectations, with sales up 13.1% year on year to $180.4 million. Its non-GAAP profit of $0.14 per share was 21.3% above analysts’ consensus estimates.

Is now the time to buy Paycor? Find out by accessing our full research report, it’s free.

Paycor (PYCR) Q4 CY2024 Highlights:

- On January 7, 2025, we announced that we had entered into a definitive agreement (“Merger Agreement”) to be acquired by Paychex, Inc. (“Paychex”) in an all-cash transaction structured as a merger and valued at approximately $4.1 billion, or $22.50 per share.

- Revenue: $180.4 million vs analyst estimates of $177.2 million (13.1% year-on-year growth, 1.9% beat)

- Adjusted EPS: $0.14 vs analyst estimates of $0.12 (21.3% beat)

- Adjusted Operating Income: $31.79 million vs analyst estimates of $26.61 million (17.6% margin, 19.5% beat)

- Operating Margin: 0.7%, up from -16.4% in the same quarter last year

- Free Cash Flow was $36.64 million, up from -$22.23 million in the previous quarter

- Billings: $181.2 million at quarter end, up 13.4% year on year

- Market Capitalization: $3.99 billion

Company Overview

Founded in 1990 in Cincinnati, Ohio, Paycor (NASDAQ: PYCR) provides software for small businesses to manage their payroll and HR needs in one place.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

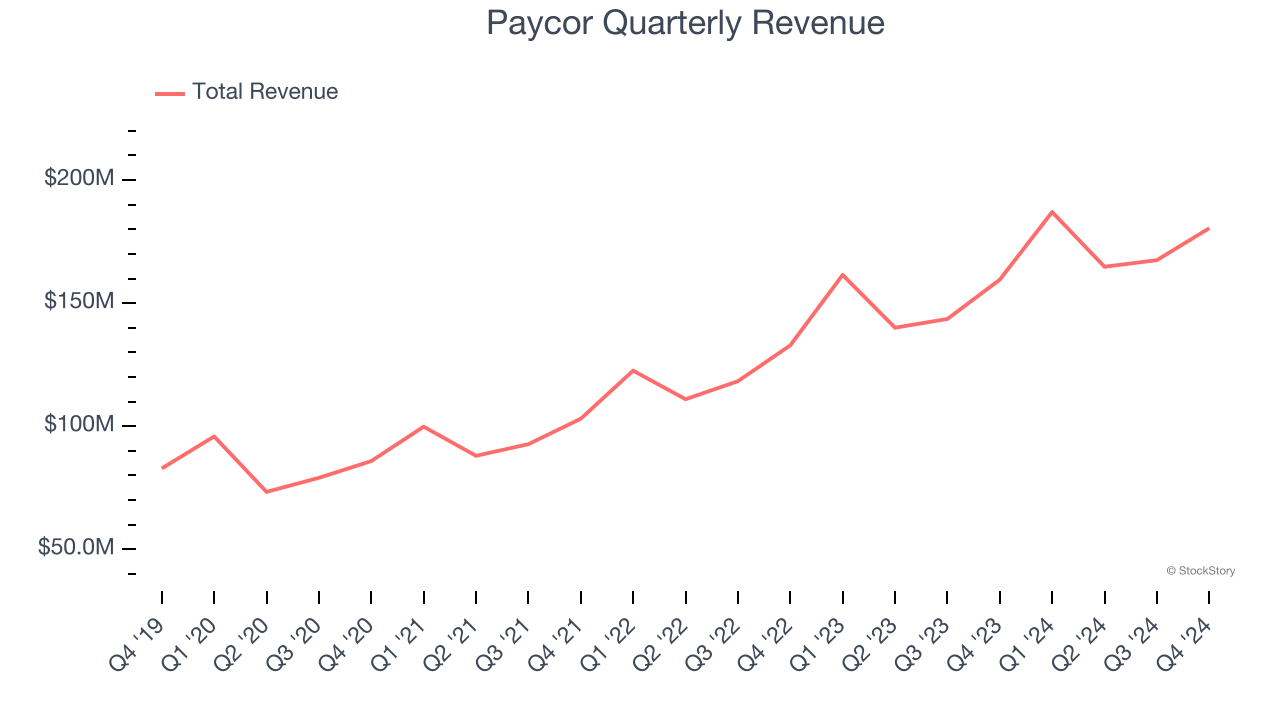

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Paycor’s sales grew at a decent 22.2% compounded annual growth rate over the last three years. Its growth was slightly above the average software company and shows its offerings resonate with customers.

This quarter, Paycor reported year-on-year revenue growth of 13.1%, and its $180.4 million of revenue exceeded Wall Street’s estimates by 1.9%.

Looking ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

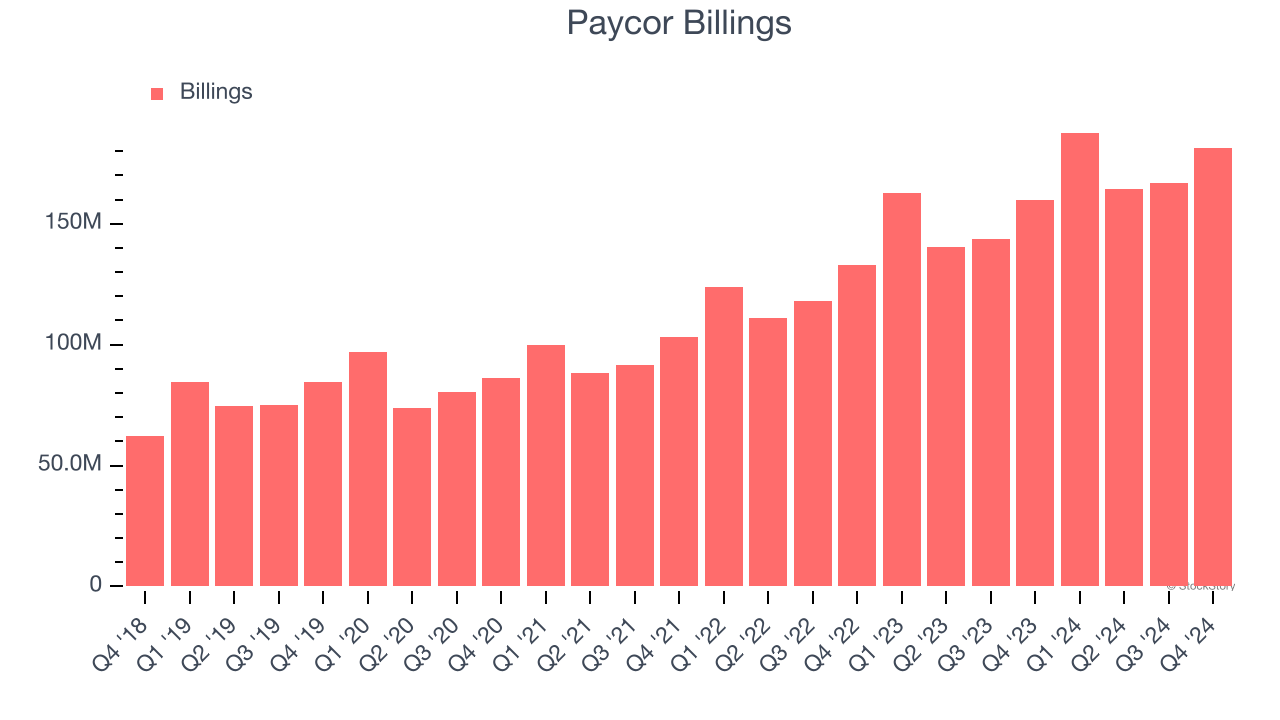

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Paycor’s billings punched in at $181.2 million in Q4, and over the last four quarters, its growth was solid as it averaged 15.5% year-on-year increases. This performance aligned with its total sales growth, indicating robust customer demand. The cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Paycor is very efficient at acquiring new customers, and its CAC payback period checked in at 29 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Paycor more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Paycor’s Q4 Results

It was encouraging to see Paycor beat analysts’ billings expectations this quarter. We were also happy its revenue and EPS outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $22.29 immediately following the results.

We will be discontinuing coverage of the stock. "On January 7, 2025, we announced that we had entered into a definitive agreement (“Merger Agreement”) to be acquired by Paychex, Inc. (“Paychex”) in an all-cash transaction structured as a merger and valued at approximately $4.1 billion, or $22.50 per share."