Medical device company Zimmer Biomet (NYSE: ZBH) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 4.3% year on year to $2.02 billion. Its non-GAAP profit of $2.31 per share was 0.8% above analysts’ consensus estimates.

Is now the time to buy Zimmer Biomet? Find out by accessing our full research report, it’s free.

Zimmer Biomet (ZBH) Q4 CY2024 Highlights:

- Revenue: $2.02 billion vs analyst estimates of $2.01 billion (4.3% year-on-year growth, in line)

- Adjusted EPS: $2.31 vs analyst estimates of $2.29 (0.8% beat)

- Adjusted EBITDA: $673.7 million vs analyst estimates of $722.5 million (33.3% margin, 6.8% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $8.25 at the midpoint, missing analyst estimates by 3.6%

- Operating Margin: 19.2%, in line with the same quarter last year

- Free Cash Flow Margin: 25%, up from 23% in the same quarter last year

- Constant Currency Revenue rose 4.9% year on year (6.1% in the same quarter last year)

- Market Capitalization: $21.55 billion

Company Overview

Founded in 1927 as a manufacturer of aluminum splints, Zimmer Biomet (NYSE) designs and manufactures orthopedic implants, surgical instruments, and related medical technology solutions for joint replacement, spine, and dental applications.

Surgical Equipment & Consumables - Diversified

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

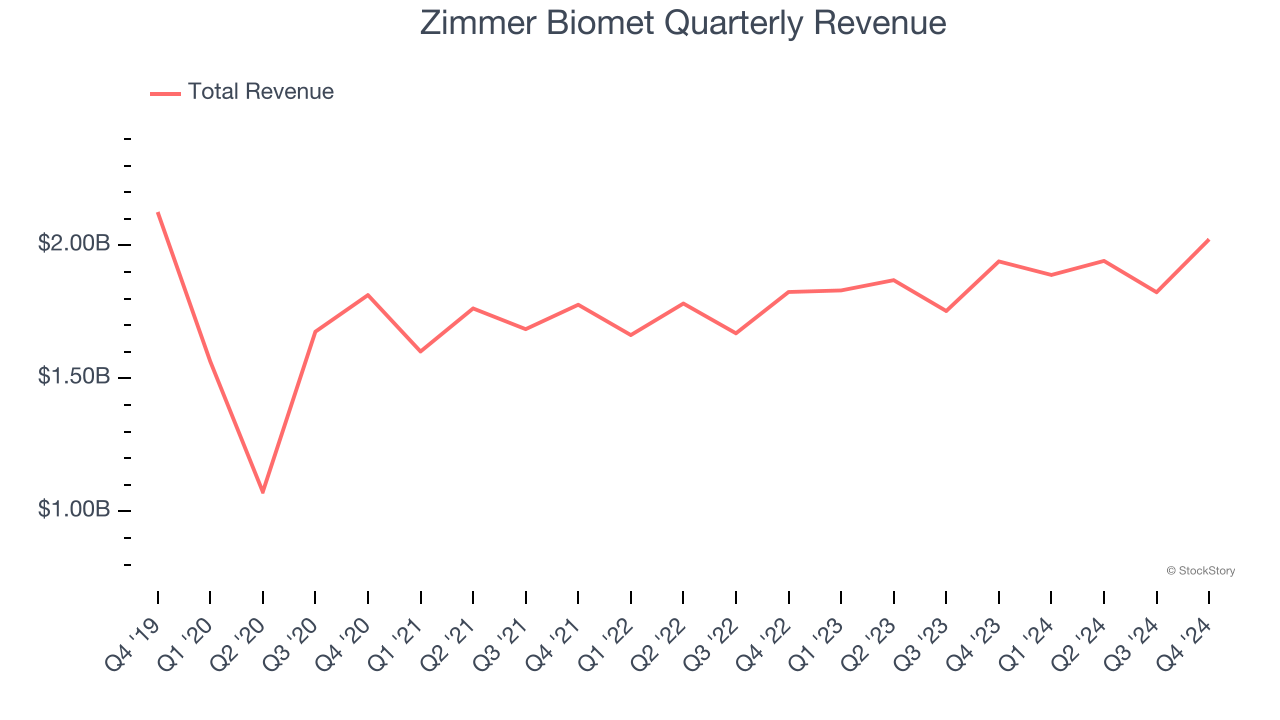

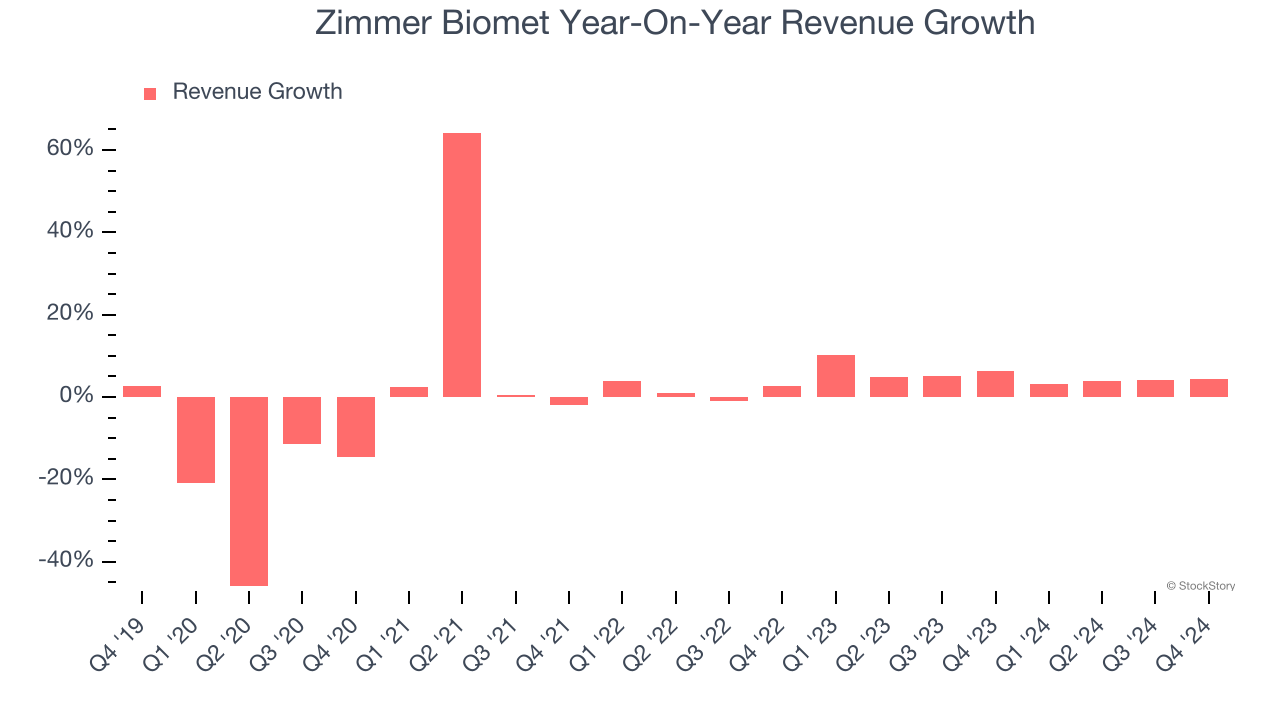

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Zimmer Biomet struggled to consistently increase demand as its $7.68 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of lacking business quality.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Zimmer Biomet’s annualized revenue growth of 5.2% over the last two years is above its five-year trend, but we were still disappointed by the results.

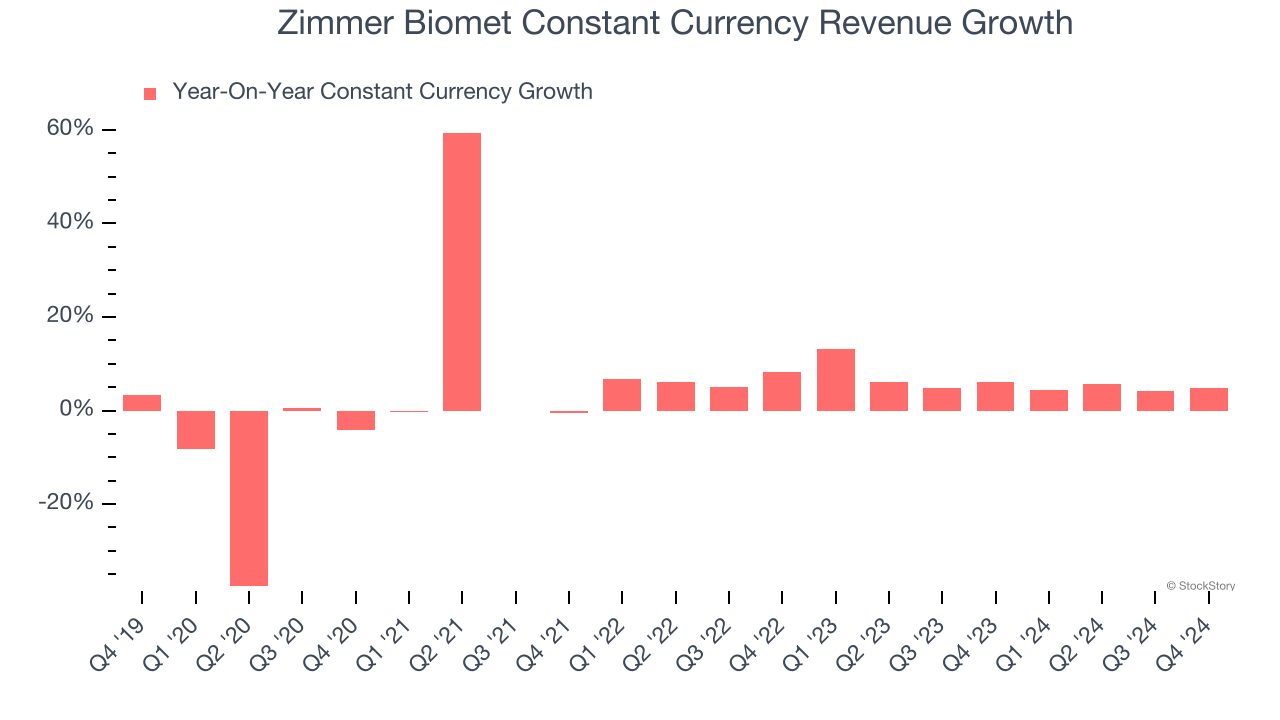

We can dig further into the company’s sales dynamics by analyzing its constant currency revenue, which excludes currency movements that are outside their control and not indicative of demand. Over the last two years, its constant currency sales averaged 6.1% year-on-year growth. Because this number aligns with its normal revenue growth, we can see Zimmer Biomet’s foreign exchange rates have been steady.

This quarter, Zimmer Biomet grew its revenue by 4.3% year on year, and its $2.02 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 4.4% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not lead to better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

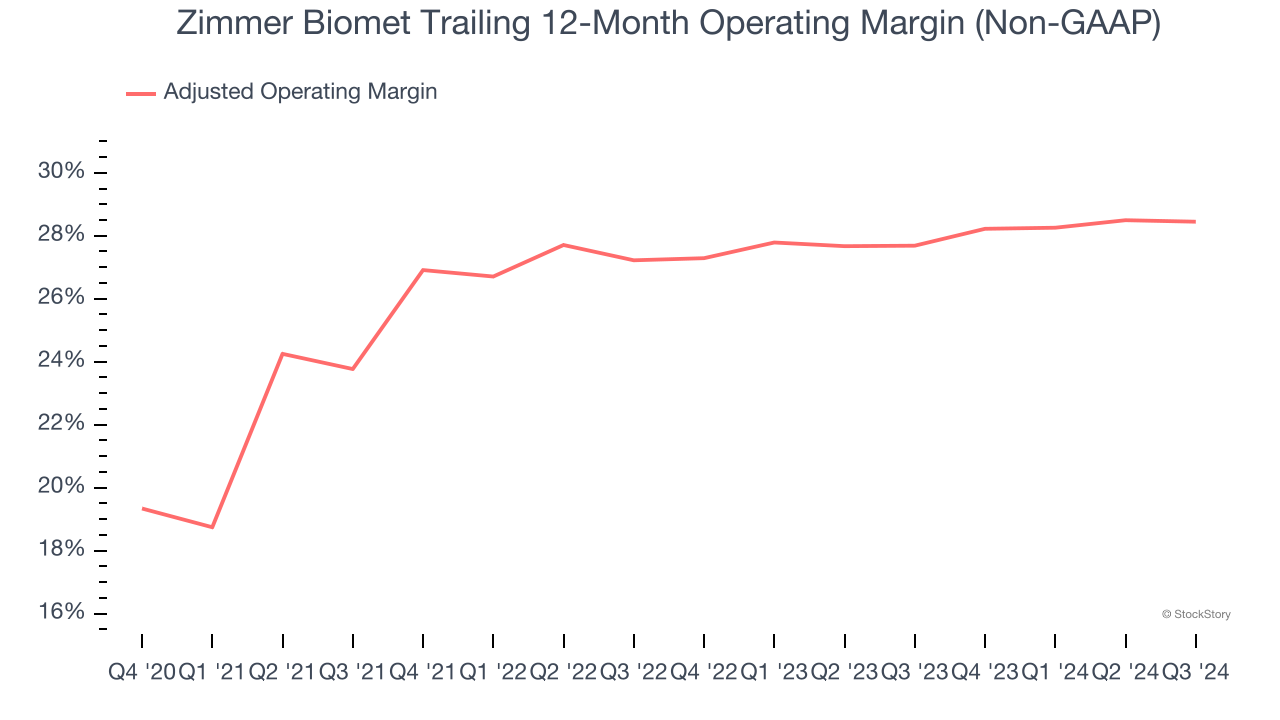

Adjusted Operating Margin

Zimmer Biomet has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average adjusted operating margin of 26%.

Looking at the trend in its profitability, Zimmer Biomet’s adjusted operating margin rose by 7.1 percentage points over the last five years. This performance was mostly driven by its past improvements as the company’s margin was relatively unchanged on two-year basis.

In Q4, Zimmer Biomet generated an adjusted operating profit margin of 33.3%, up 3 percentage points year on year. This increase was a welcome development and shows it was recently more efficient because its expenses grew slower than its revenue.

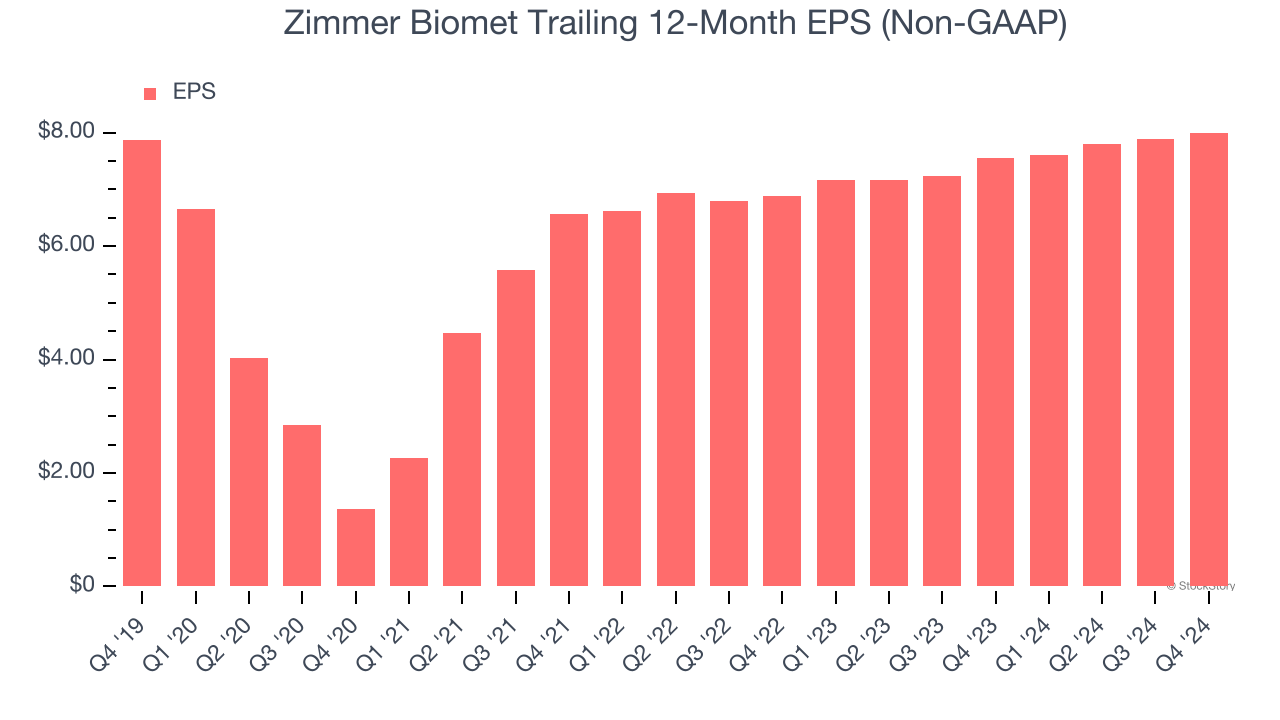

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Zimmer Biomet’s EPS was flat over the last five years, just like its revenue. This performance was underwhelming across the board.

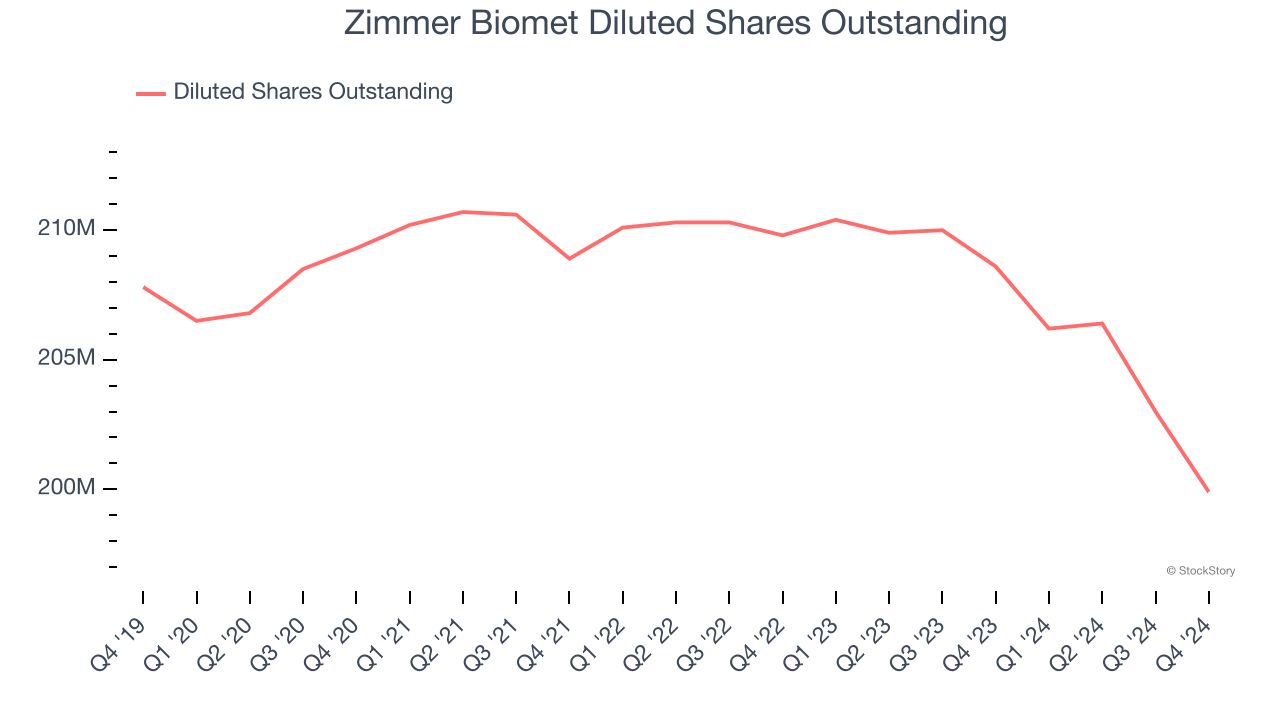

Diving into the nuances of Zimmer Biomet’s earnings can give us a better understanding of its performance. As we mentioned earlier, Zimmer Biomet’s adjusted operating margin expanded by 7.1 percentage points over the last five years. On top of that, its share count shrank by 3.8%. These are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

In Q4, Zimmer Biomet reported EPS at $2.31, up from $2.20 in the same quarter last year. This print was close to analysts’ estimates. Over the next 12 months, Wall Street expects Zimmer Biomet’s full-year EPS of $8 to grow 7%.

Key Takeaways from Zimmer Biomet’s Q4 Results

It was good to see Zimmer Biomet narrowly top analysts’ constant currency revenue expectations this quarter. On the other hand, its full-year EPS guidance and EBITDA missed. Overall, this quarter could have been better. The stock traded down 2.9% to $105.02 immediately following the results.

Zimmer Biomet’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.