Laureate Education has had an impressive run over the past six months as its shares have beaten the S&P 500 by 19%. The stock now trades at $19.30, marking a 35.8% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Laureate Education, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the momentum, we're cautious about Laureate Education. Here are three reasons why you should be careful with LAUR and a stock we'd rather own.

Why Is Laureate Education Not Exciting?

Founded in 1998 by Douglas L. Becker and based in Miami, Laureate Education (NASDAQ: LAUR) is a global network of higher education institutions.

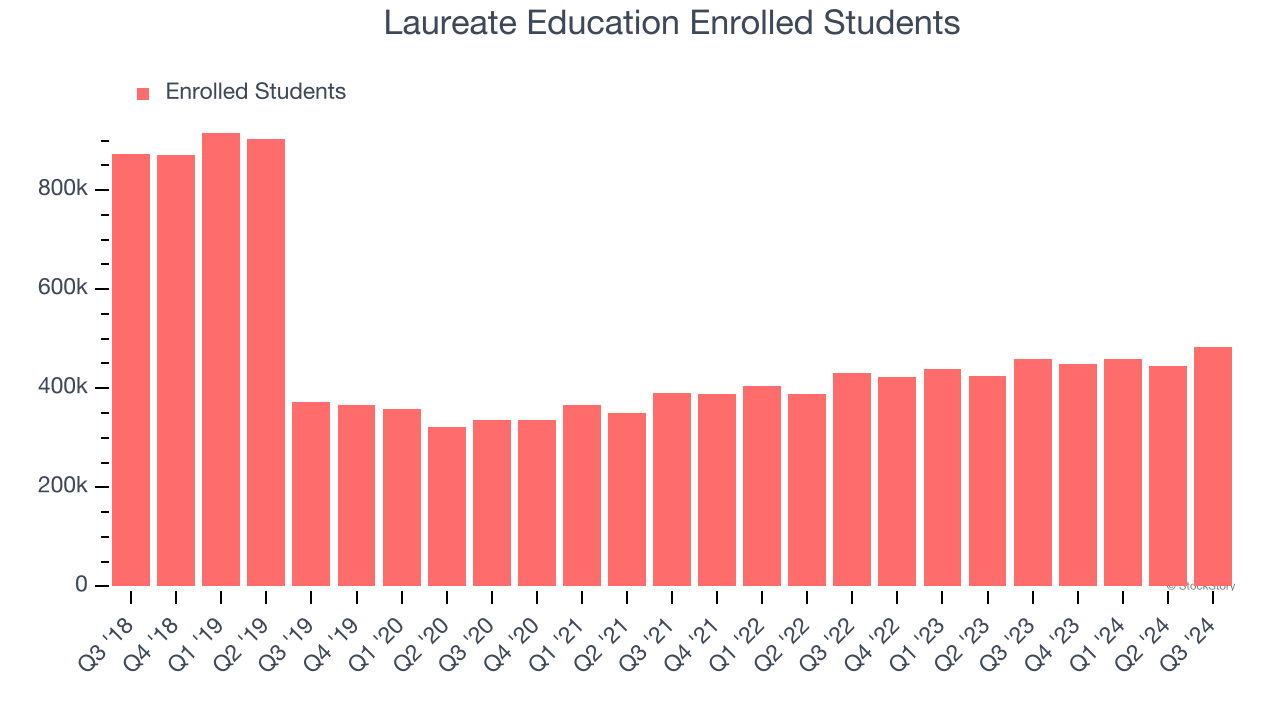

1. Weak Growth in Enrolled Students Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like Laureate Education, our preferred volume metric is enrolled students). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Laureate Education’s enrolled students came in at 483,300 in the latest quarter, and over the last two years, averaged 6.7% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Laureate Education’s revenue to rise by 1.2%, a deceleration versus its 14.1% annualized growth for the past two years. This projection doesn't excite us and implies its products and services will face some demand challenges.

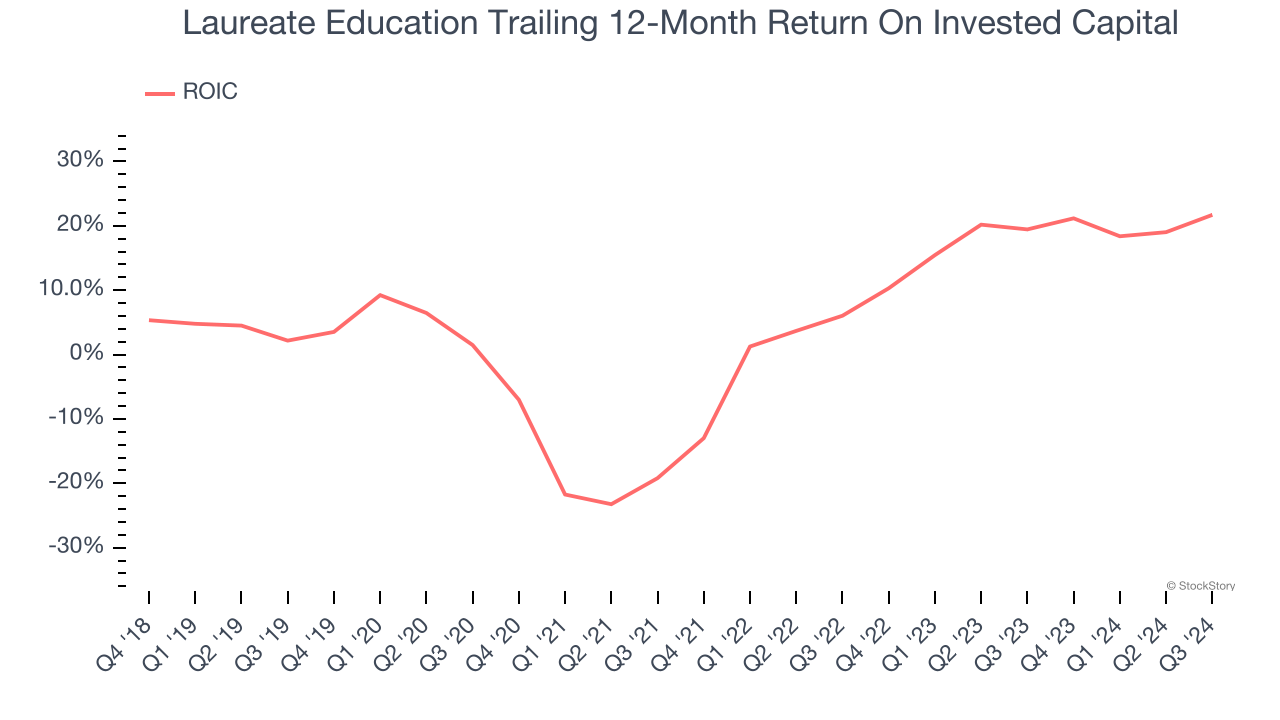

3. Previous Growth Initiatives Haven’t Paid Off Yet

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Laureate Education historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 5.9%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

Laureate Education isn’t a terrible business, but it doesn’t pass our bar. With its shares topping the market in recent months, the stock trades at 13.7× forward price-to-earnings (or $19.30 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Like More Than Laureate Education

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.