Looking back on HR software stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Asure (NASDAQ: ASUR) and its peers.

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

The 6 HR software stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was 4% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

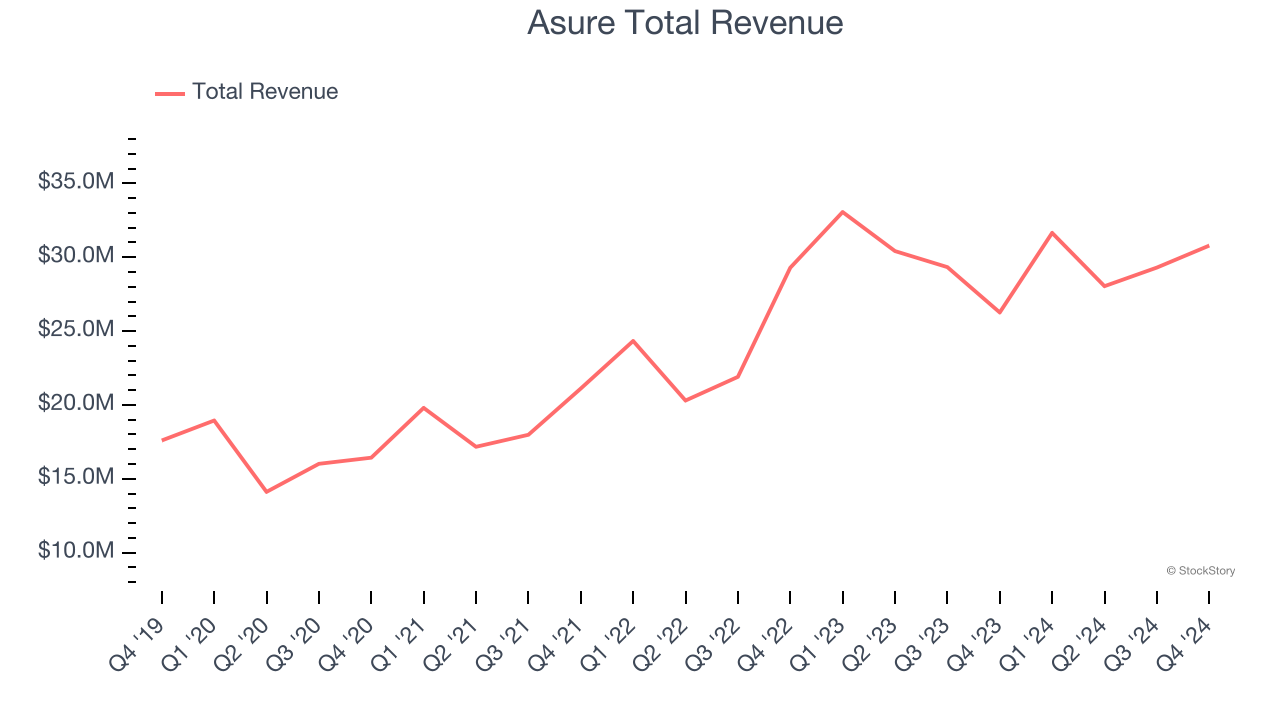

Asure (NASDAQ: ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ: ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $30.79 million, up 17.2% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with EBITDA guidance for next quarter missing analysts’ expectations.

“We are pleased to report strong results for 2024, demonstrating the continued momentum of our business. Excluding the one-time impact of ERTC revenue, our fourth-quarter revenue grew 22% year-over-year, reaching $30.8 million—an impressive finish to the year. For the full year, total revenue increased modestly to $119.8 million, but when adjusted to exclude ERTC, our revenue growth was 17% year-over-year, underscoring the strength of our core business. Recurring revenue, the backbone of our model, grew 15% year-over-year and now represents 96% of total revenue, up from 84% in 2023. Additionally, our contracted revenue backlog continued to expand, providing further visibility into future growth,” said Asure Chairman and CEO Pat Goepel.

Asure pulled off the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. The stock is up 12.9% since reporting and currently trades at $10.94.

Read our full report on Asure here, it’s free.

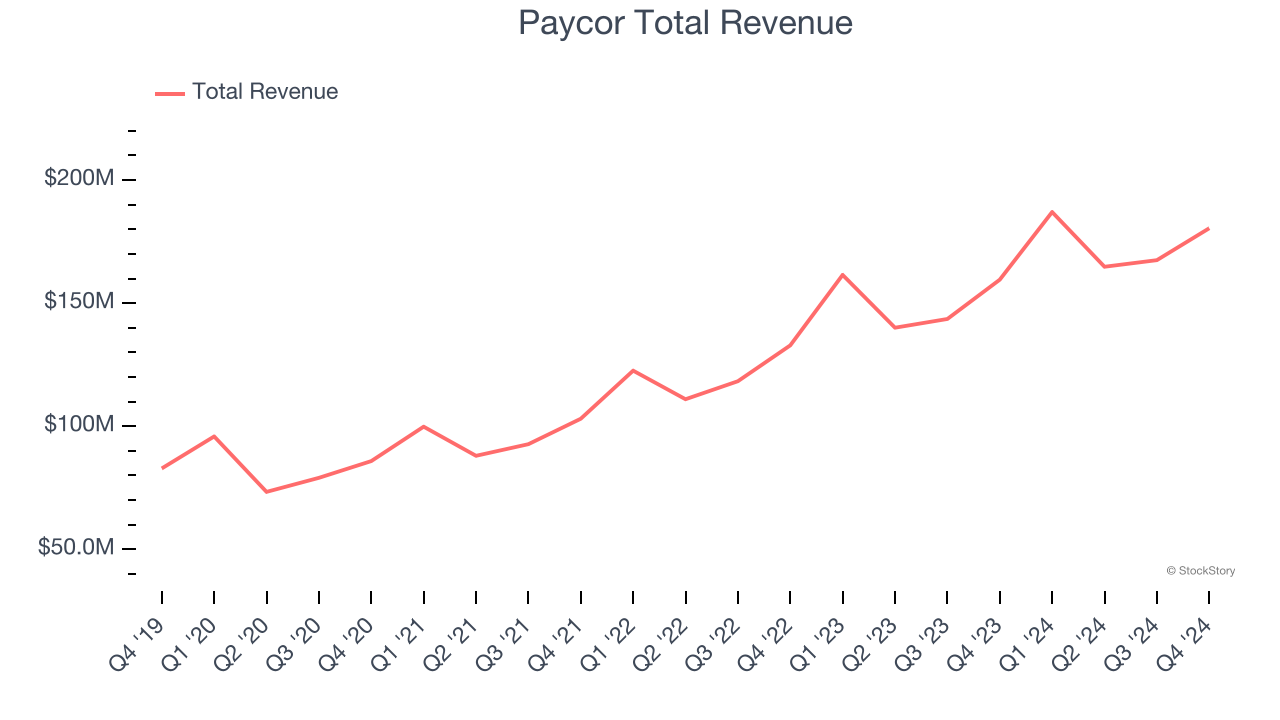

Best Q4: Paycor (NASDAQ: PYCR)

Founded in 1990 in Cincinnati, Ohio, Paycor (NASDAQ: PYCR) provides software for small businesses to manage their payroll and HR needs in one place.

Paycor reported revenues of $180.4 million, up 13.1% year on year, outperforming analysts’ expectations by 1.9%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ billings estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $22.29.

Is now the time to buy Paycor? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Dayforce (NYSE: DAY)

Founded in 1992 as Ceridian, an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Dayforce (NYSE: DAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Dayforce reported revenues of $465.2 million, up 16.4% year on year, exceeding analysts’ expectations by 2%. Still, it was a slower quarter as it posted full-year guidance of slowing revenue growth and revenue guidance for next quarter missing analysts’ expectations.

Dayforce delivered the weakest full-year guidance update in the group. As expected, the stock is down 23.1% since the results and currently trades at $55.18.

Read our full analysis of Dayforce’s results here.

Paylocity (NASDAQ: PCTY)

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ: PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

Paylocity reported revenues of $377 million, up 15.5% year on year. This result surpassed analysts’ expectations by 2.7%. It was a strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates.

Paylocity achieved the biggest analyst estimates beat and highest full-year guidance raise among its peers. The stock is down 8.3% since reporting and currently trades at $194.11.

Read our full, actionable report on Paylocity here, it’s free.

Paychex (NASDAQ: PAYX)

One of the oldest service providers in the industry, Paychex (NASDAQ: PAYX) offers its customers payroll and HR software solutions.

Paychex reported revenues of $1.32 billion, up 4.7% year on year. This print met analysts’ expectations. However, it was a mixed quarter as it underperformed in some other aspects of the business.

Paychex had the slowest revenue growth among its peers. The stock is up 12.1% since reporting and currently trades at $152.50.

Read our full, actionable report on Paychex here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.