Work management software maker Asana (NYSE: ASAN) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 10% year on year to $188.3 million. On the other hand, the company’s full-year revenue guidance of $786 million at the midpoint came in 2.1% below analysts’ estimates. Its non-GAAP loss of $0 per share was $0.01 above analysts’ consensus estimates.

Is now the time to buy Asana? Find out by accessing our full research report, it’s free.

Asana (ASAN) Q4 CY2024 Highlights:

- Revenue: $188.3 million vs analyst estimates of $188.2 million (10% year-on-year growth, in line)

- Adjusted EPS: $0 vs analyst estimates of -$0.01 ($0.01 beat)

- Adjusted Operating Income: -$1.73 million vs analyst estimates of -$5.95 million (-0.9% margin, beat)

- Management’s revenue guidance for the upcoming quarter is $185.5 million at the midpoint, missing analyst estimates by 2.7%

- Management’s revenue guidance for the upcoming financial year 2026 is $786 million at the midpoint, missing analyst estimates by 2.1% and implying 8.6% growth (vs 11% in FY2025)

- Operating Margin: -33.8%, up from -39.7% in the same quarter last year

- Free Cash Flow was $12.34 million, up from -$18.18 million in the previous quarter

- Market Capitalization: $4.17 billion

Company Overview

Founded in 2008 by Facebook’s co-founder Dustin Moskovitz, Asana (NYSE: ASAN) is a cloud-based project management software, where you can plan and assign tasks to employees and monitor and discuss progress of work.

Project Management Software

The future of work requires teams to collaborate across departments and remote offices. Project management software is both driving this change and benefiting from it. While the trend of collaborative work management has been strong for a while, the Covid pandemic has definitively accelerated the demand for tools that allow work to be done remotely.

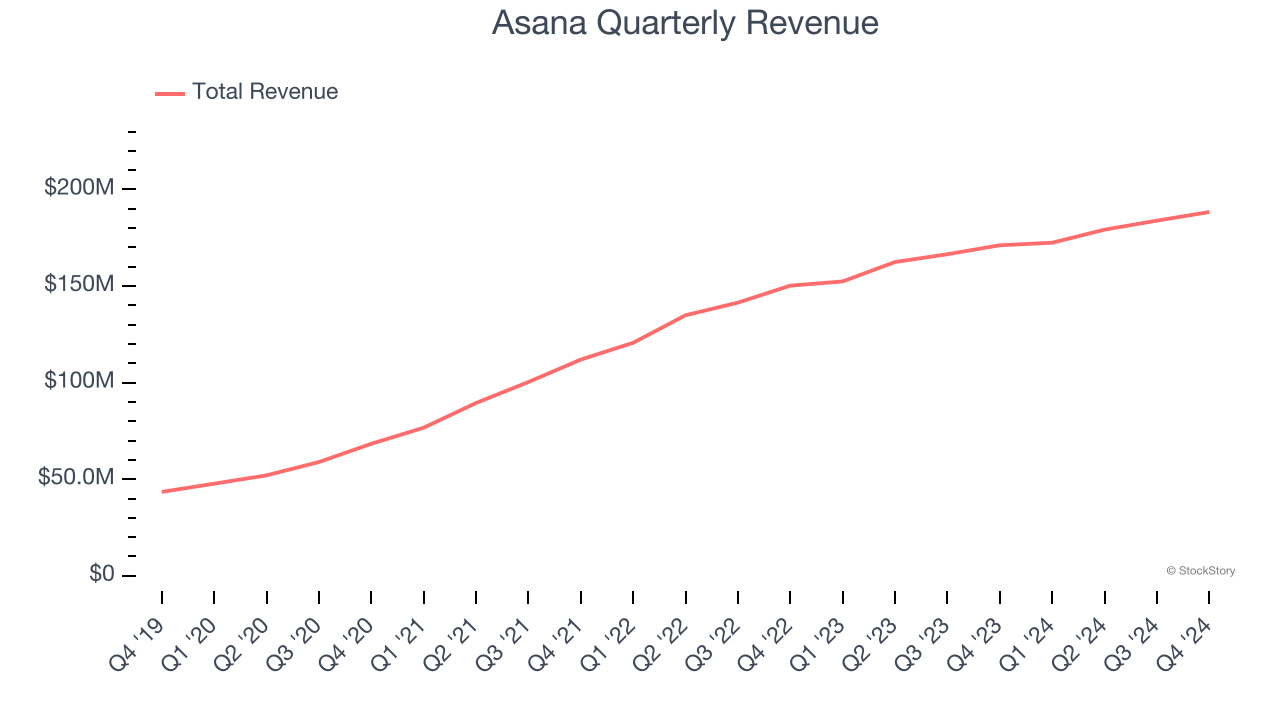

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Asana’s 24.1% annualized revenue growth over the last three years was solid. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Asana’s year-on-year revenue growth was 10%, and its $188.3 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is above the sector average and suggests the market is forecasting some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Asana to acquire new customers as its CAC payback period checked in at 118.5 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Asana’s Q4 Results

Revenue was just in line and revenue guidance for both the upcoming quarter and full year missed. This was an underwhelming quarter, especially as the market continues to rotate out of premium-priced tech. The stock traded down 25.3% to $12.48 immediately after reporting.

Is Asana an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.