Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at IMAX (NYSE: IMAX) and its peers.

The sector faces structural headwinds from declining linear TV viewership, shifts in advertising spend toward digital platforms, and ongoing challenges in monetizing print and broadcast content. However, for companies that invest wisely, tailwinds can include AI, the power of which can result in more personalized content creation and more detailed audience analysis. These can create a flywheel of success where one feeds into the other. Still there are outstanding questions around AI-generated content oversight, and the regulatory framework around this could evolve in unseen ways over the next few years.

The 4 traditional media & publishing stocks we track reported a satisfactory Q4. As a group, revenues missed analysts’ consensus estimates by 2.4% while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady as they are up 2.2% on average since the latest earnings results.

Weakest Q4: IMAX (NYSE: IMAX)

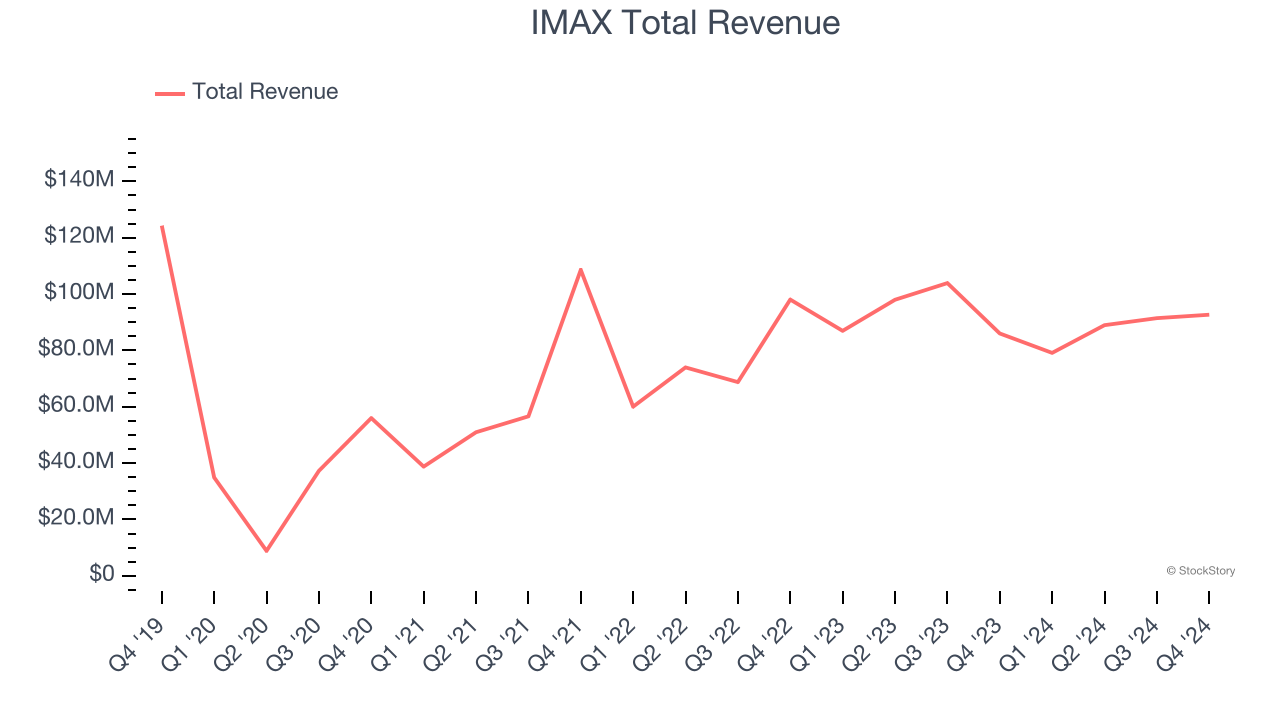

Known for its towering screens and crystal-clear sound that revolutionized the moviegoing experience, IMAX Corporation (NYSE: IMAX) creates immersive cinema experiences through proprietary technology, specialized theater systems, and film remastering for a global network of theaters.

IMAX reported revenues of $92.67 million, up 7.7% year on year. This print fell short of analysts’ expectations by 11.1%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS estimates.

IMAX delivered the weakest performance against analyst estimates of the whole group. The stock is down 7.5% since reporting and currently trades at $25.20.

Read our full report on IMAX here, it’s free.

Best Q4: EchoStar (NASDAQ: SATS)

Following its December 2023 acquisition of DISH Network, EchoStar Corporation (NASDAQGS:SATS) provides satellite communications, pay-TV services, wireless networks, and broadband solutions across consumer and enterprise markets.

EchoStar reported revenues of $3.97 billion, down 4.7% year on year, outperforming analysts’ expectations by 1.1%. The business had an exceptional quarter with an impressive beat of analysts’ EPS estimates.

EchoStar pulled off the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 7.6% since reporting. It currently trades at $26.81.

Is now the time to buy EchoStar? Access our full analysis of the earnings results here, it’s free.

Sinclair (NASDAQ: SBGI)

With a massive footprint of 185 stations broadcasting 640 channels across 86 markets, Sinclair (NASDAQ: SBGI) operates a network of local television stations across the US, producing news content and distributing programming from major networks like FOX, ABC, CBS, and NBC.

Sinclair reported revenues of $1.00 billion, up 21.5% year on year, in line with analysts’ expectations. Still, its results were good as it locked in a solid beat of analysts’ EPS estimates.

The stock is flat since the results and currently trades at $14.34.

Read our full analysis of Sinclair’s results here.

Wiley (NYSE: WLY)

Founded in 1807 as a small printing shop in lower Manhattan, John Wiley & Sons (NYSE: WLY) is a global academic publisher that provides research journals, books, digital courseware, and professional development resources to researchers, students, and professionals.

Wiley reported revenues of $404.6 million, down 12.2% year on year. This result surpassed analysts’ expectations by 0.9%. It was a very strong quarter as it also produced a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

Wiley had the slowest revenue growth among its peers. The stock is up 24.8% since reporting and currently trades at $47.36.

Read our full, actionable report on Wiley here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.