Over the last six months, Genco’s shares have sunk to $14.42, producing a disappointing 16.4% loss while the S&P 500 was flat. This might have investors contemplating their next move.

Is there a buying opportunity in Genco, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the more favorable entry price, we're cautious about Genco. Here are three reasons why we avoid GNK and a stock we'd rather own.

Why Is Genco Not Exciting?

Headquartered in NYC, Genco (NYSE: GNK) is a shipping company that transports dry bulk cargo along worldwide maritime routes.

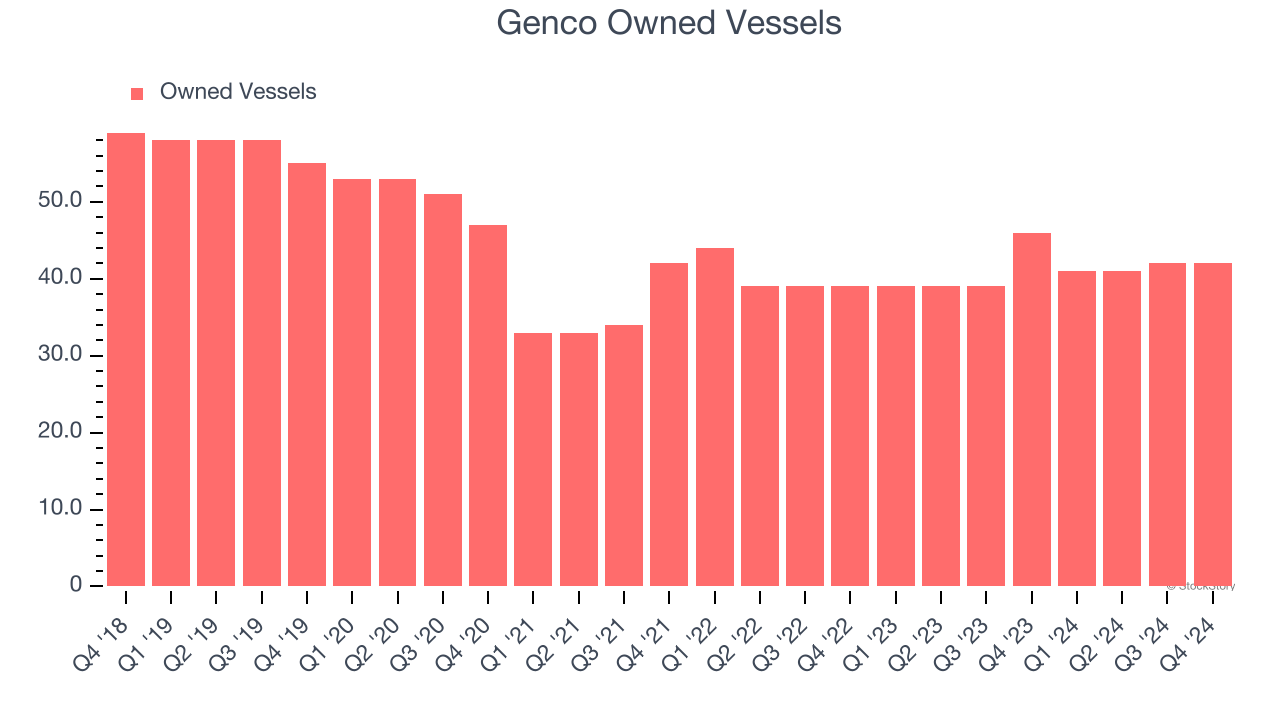

1. Weak Growth in owned vessels Points to Soft Demand

Revenue growth can be broken down into changes in price and volume (for companies like Genco, our preferred volume metric is owned vessels). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Genco’s owned vessels came in at 42 in the latest quarter, and over the last two years, averaged 2% year-on-year growth. This performance was underwhelming and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Genco’s revenue to drop by 14.9%, a decrease from its 11.5% annualized declines for the past two years. This projection doesn't excite us and suggests its products and services will see some demand headwinds.

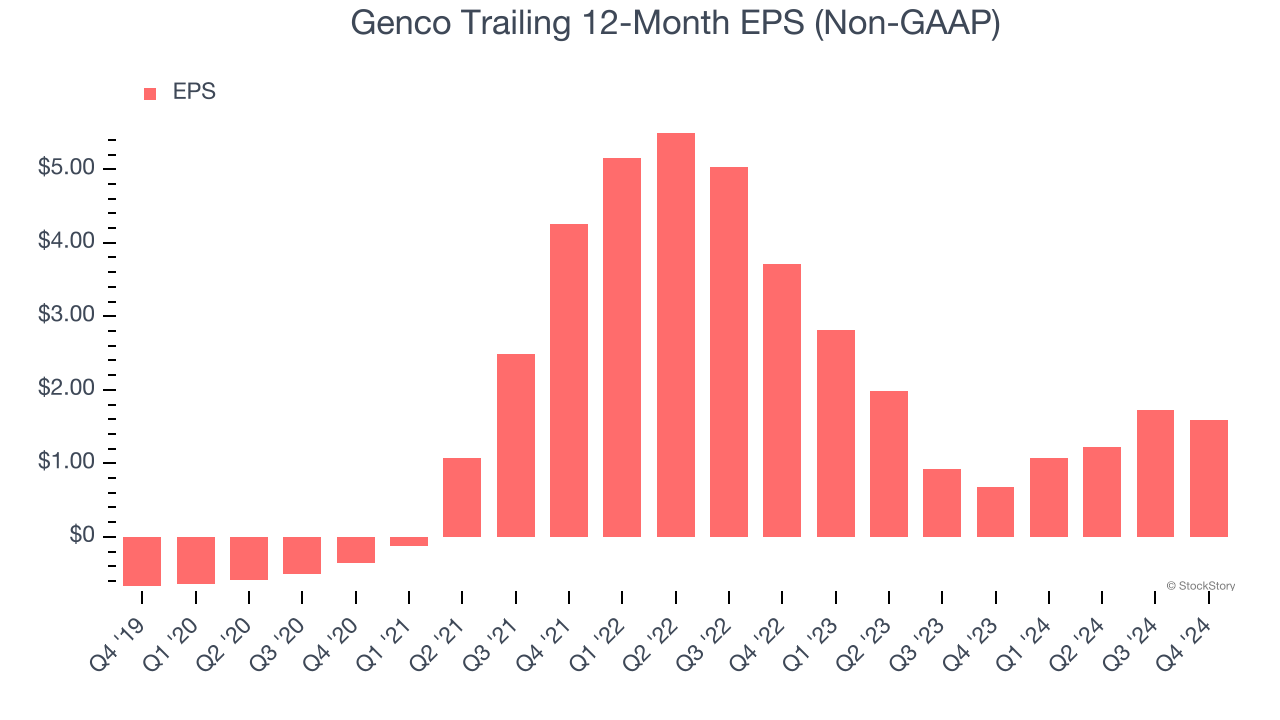

3. EPS Took a Dip Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

Sadly for Genco, its EPS declined by more than its revenue over the last two years, dropping 34.7%. This tells us the company struggled to adjust to shrinking demand.

Final Judgment

Genco isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 19.7× forward price-to-earnings (or $14.42 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better investments elsewhere. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Genco

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.