As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the leisure products industry, including MasterCraft (NASDAQ: MCFT) and its peers.

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 13 leisure products stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 1.9% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.4% since the latest earnings results.

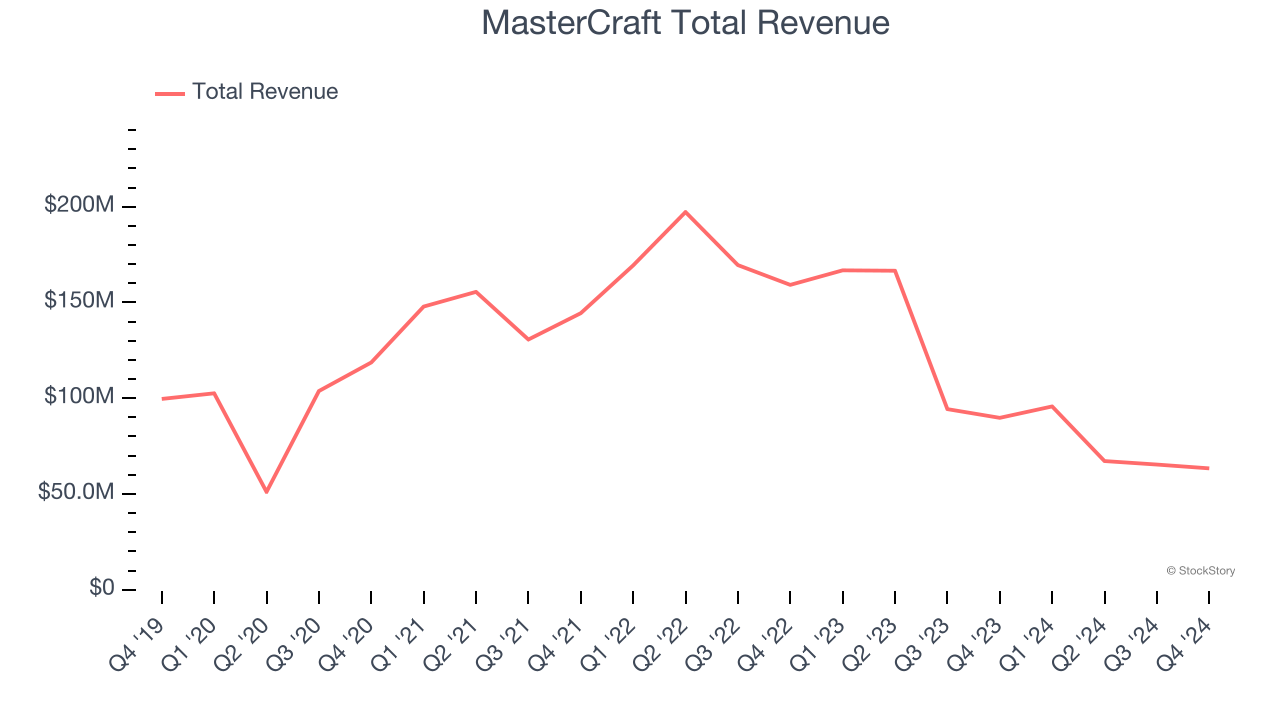

MasterCraft (NASDAQ: MCFT)

Started by a waterskiing instructor, MasterCraft (NASDAQ: MCFT) specializes in designing, manufacturing, and selling sport boats.

MasterCraft reported revenues of $63.37 million, down 29.4% year on year. This print exceeded analysts’ expectations by 4.4%. Despite the top-line beat, it was still a mixed quarter for the company with an impressive beat of analysts’ EPS estimates but EBITDA guidance for next quarter missing analysts’ expectations.

Brad Nelson, Chief Executive Officer, commented, “Our business executed well during our fiscal second quarter by delivering results above expectations despite macroeconomic and retail environment headwinds. Early boat show season results have been encouraging, especially with strong demand for our new ultra-premium XStar lineup which has provided positive momentum as we near the summer selling season.”

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $18.09.

Is now the time to buy MasterCraft? Access our full analysis of the earnings results here, it’s free.

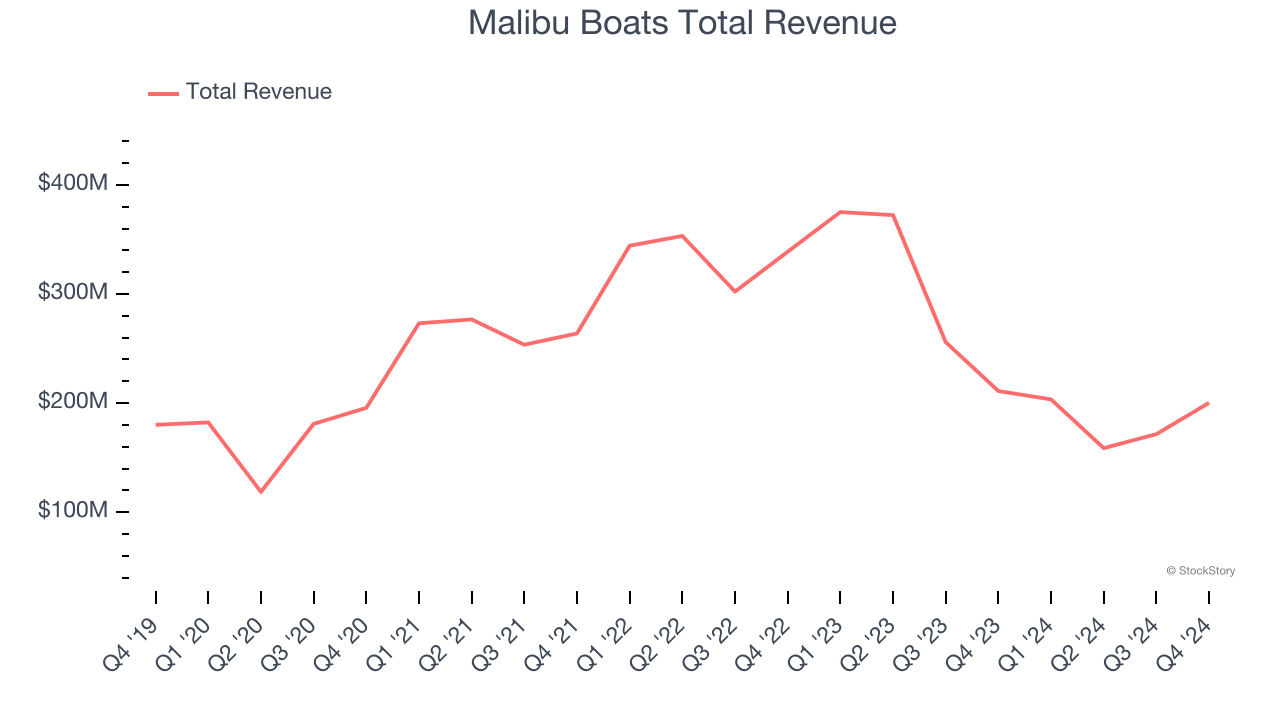

Best Q4: Malibu Boats (NASDAQ: MBUU)

Founded in California in 1982, Malibu Boats (NASDAQ: MBUU) is a manufacturer of high-performance sports boats and luxury watercrafts.

Malibu Boats reported revenues of $200.3 million, down 5.1% year on year, outperforming analysts’ expectations by 4.8%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 21.1% since reporting. It currently trades at $30.29.

Is now the time to buy Malibu Boats? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Harley-Davidson (NYSE: HOG)

Founded in 1903, Harley-Davidson (NYSE: HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson reported revenues of $687.6 million, down 34.7% year on year, falling short of analysts’ expectations by 3.8%. It was a disappointing quarter as it posted a miss of analysts’ motorcycles sold estimates and a significant miss of analysts’ adjusted operating income estimates.

Harley-Davidson delivered the slowest revenue growth in the group. As expected, the stock is down 8.9% since the results and currently trades at $24.44.

Read our full analysis of Harley-Davidson’s results here.

Ruger (NYSE: RGR)

Founded in 1949, Ruger (NYSE: RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger reported revenues of $145.8 million, up 11.6% year on year. This result beat analysts’ expectations by 5.8%. Zooming out, it was a mixed quarter as it recorded a significant miss of analysts’ EBITDA estimates.

Ruger achieved the fastest revenue growth among its peers. The stock is up 11.7% since reporting and currently trades at $39.63.

Read our full, actionable report on Ruger here, it’s free.

Latham (NASDAQ: SWIM)

Started as a family business, Latham (NASDAQ: SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $87.27 million, down 4% year on year. This print surpassed analysts’ expectations by 1.6%. It was a strong quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates and full-year revenue guidance exceeding analysts’ expectations.

Latham pulled off the highest full-year guidance raise among its peers. The stock is up 24.7% since reporting and currently trades at $6.81.

Read our full, actionable report on Latham here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.