Wrapping up Q4 earnings, we look at the numbers and key takeaways for the healthcare technology for providers stocks, including Phreesia (NYSE: PHR) and its peers.

The healthcare technology industry focuses on delivering software, data analytics, and workflow solutions to hospitals, clinics, and other care facilities. These companies enable providers to streamline operations, optimize patient outcomes, and transition to value-based care models. They boast subscription-based revenues or long-term contracts, providing financial stability and growth potential. However, they face challenges such as lengthy sales cycles, significant upfront investment in technology development, and reliance on providers’ adoption of new tools, which can be hindered by budget constraints or resistance to change. Over the next few years, the sector is poised for growth as providers increasingly prioritize digital transformation and efficiency in response to rising healthcare costs and patient demand for seamless care. Tailwinds include the growing adoption of AI-driven tools for patient engagement and operational improvements, government incentives for digitization, and the expansion of telehealth and remote patient monitoring. However, headwinds such as tightening hospital budgets, cybersecurity threats, and the fragmented nature of healthcare systems could slow adoption.

The 6 healthcare technology for providers stocks we track reported a slower Q4. As a group, revenues beat analysts’ consensus estimates by 3.1% while next quarter’s revenue guidance was 0.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.4% since the latest earnings results.

Best Q4: Phreesia (NYSE: PHR)

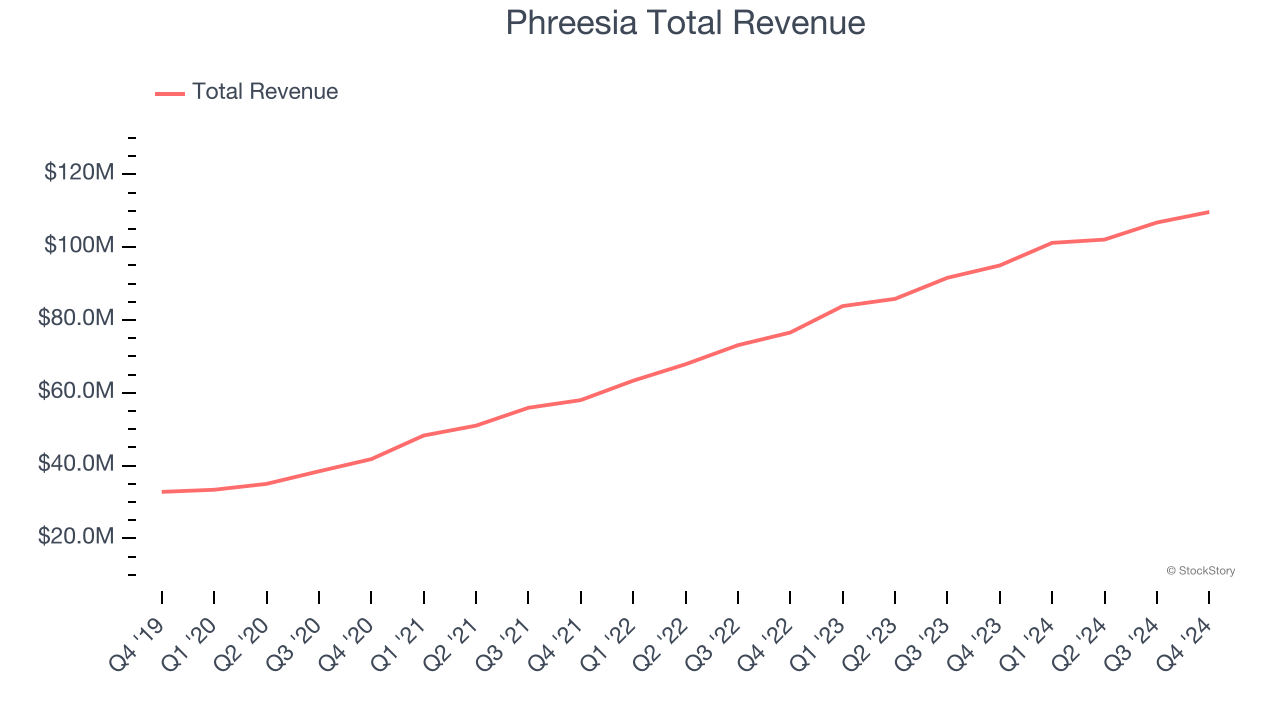

Founded in 2005, Phreesia (NYSE: PHR) is a healthcare technology company that offers a cloud-based platform for patient intake management, enabling providers to streamline administrative tasks.

Phreesia reported revenues of $109.7 million, up 15.4% year on year. This print exceeded analysts’ expectations by 0.7%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and full-year EBITDA guidance topping analysts’ expectations.

"We are pleased with our solid finish to fiscal 2025 and I am excited about the new products we have introduced over the past several quarters that improve medication adherence and the overall patient and provider experience," said CEO and Co-Founder Chaim Indig.

The stock is up 4.1% since reporting and currently trades at $24.85.

Is now the time to buy Phreesia? Access our full analysis of the earnings results here, it’s free.

Privia Health (NASDAQ: PRVA)

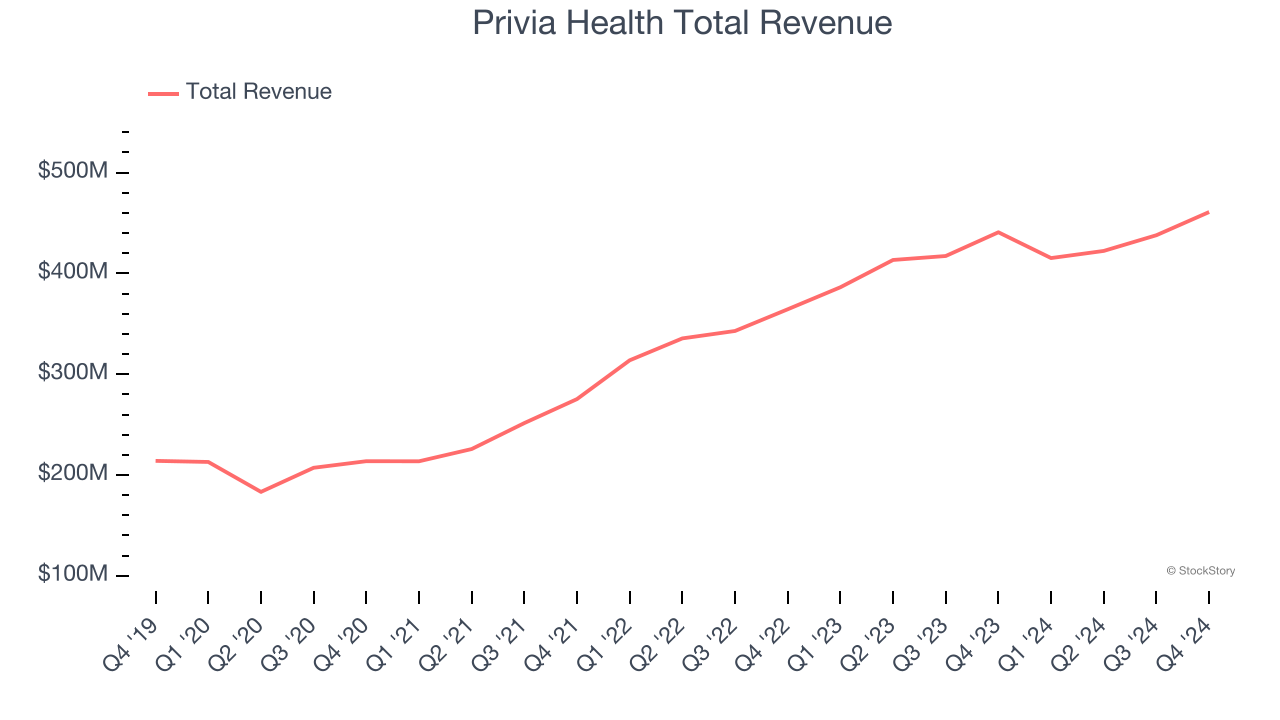

Founded in 2016, Privia Health Group (NASDAQ: PRVA) partners with physicians to establish technology-driven medical practices, aiming to improve healthcare delivery efficiency and patient experience.

Privia Health reported revenues of $460.9 million, up 4.6% year on year, outperforming analysts’ expectations by 9.4%. The business had a satisfactory quarter with a solid beat of analysts’ sales volume estimates but full-year revenue guidance missing analysts’ expectations.

Privia Health achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 2.3% since reporting. It currently trades at $23.49.

Is now the time to buy Privia Health? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Evolent Health (NYSE: EVH)

Founded in 2011, Evolent Health (NYSE: EVH) provides services to health systems (e.g. hospitals) and payers (e.g. insurance companies, government programs such as Medicare) focusing on improving care delivery and cost efficiency.

Evolent Health reported revenues of $646.5 million, up 16.3% year on year, falling short of analysts’ expectations by 0.7%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates and EBITDA guidance for next quarter missing analysts’ expectations.

Evolent Health delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 12.2% since the results and currently trades at $9.42.

Read our full analysis of Evolent Health’s results here.

Astrana Health (NASDAQ: ASTH)

Founded in 2013, Astrana Health provides care management and coordination services designed to improve health outcomes for complex and chronically ill patients, focusing on personalized healthcare and value-based care delivery.

Astrana Health reported revenues of $665.2 million, up 88.4% year on year. This result beat analysts’ expectations by 6.9%. Zooming out, it was a mixed quarter as it also produced full-year revenue guidance beating analysts’ expectations.

Astrana Health achieved the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 16.9% since reporting and currently trades at $28.83.

Read our full, actionable report on Astrana Health here, it’s free.

Premier (NASDAQ: PINC)

Founded in 1968, Premier (NASDAQ: PINC) offers tech-forward products for healthcare organizations focused on cost management, quality improvement, and supply chain optimization.

Premier reported revenues of $240.3 million, down 14.2% year on year. This number was in line with analysts’ expectations. Taking a step back, it was a slower quarter as it logged a significant miss of analysts’ EPS estimates and full-year revenue guidance missing analysts’ expectations.

Premier had the slowest revenue growth among its peers. The stock is down 13.5% since reporting and currently trades at $19.39.

Read our full, actionable report on Premier here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.