Topgolf Callaway has gotten torched over the last six months - since September 2024, its stock price has dropped 38.9% to $6.48 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Topgolf Callaway, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Even with the cheaper entry price, we're cautious about Topgolf Callaway. Here are three reasons why there are better opportunities than MODG and a stock we'd rather own.

Why Do We Think Topgolf Callaway Will Underperform?

Formed between the merger of Callaway and Topgolf, Topgolf Callaway (NYSE: MODG) sells golf equipment and operates technology-driven golf entertainment venues.

1. Declining Constant Currency Revenue, Demand Takes a Hit

We can better understand Leisure Facilities companies by analyzing their constant currency revenue. This metric excludes currency movements, which are outside of Topgolf Callaway’s control and are not indicative of underlying demand.

Over the last two years, Topgolf Callaway’s constant currency revenue averaged 1.9% year-on-year declines. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Topgolf Callaway might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

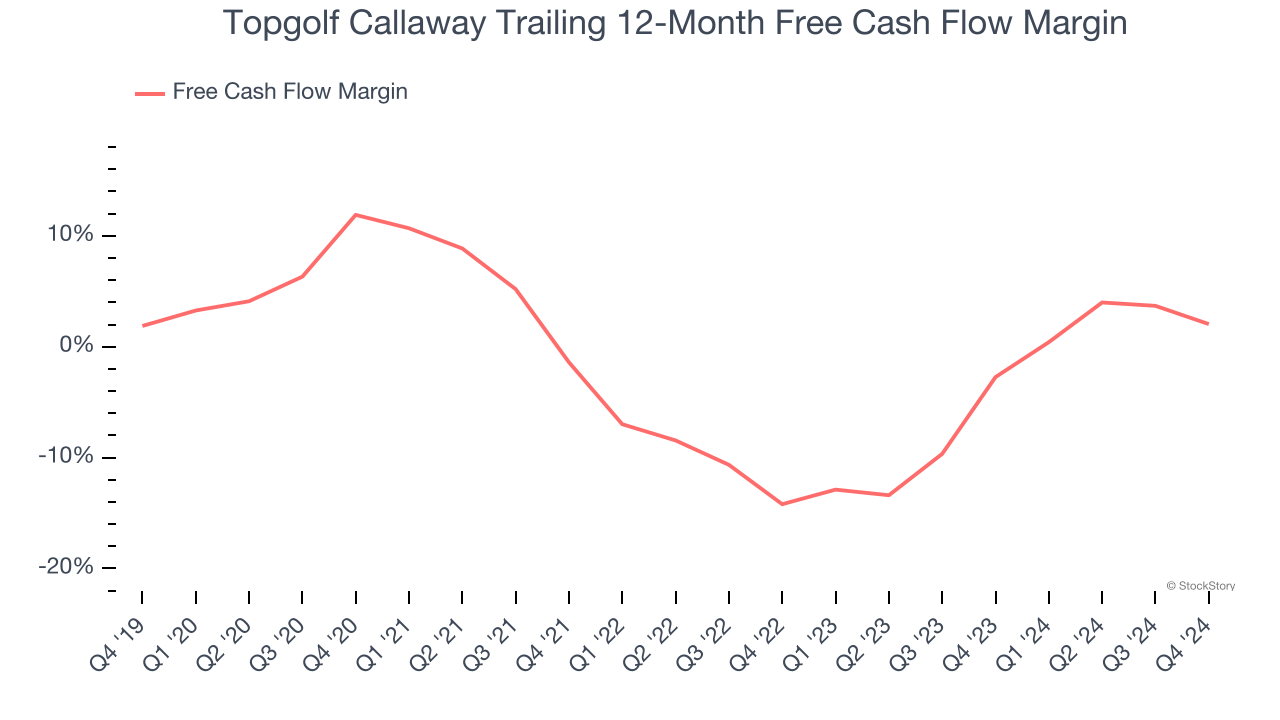

2. Breakeven Free Cash Flow Limits Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Topgolf Callaway broke even from a free cash flow perspective over the last two years, giving the company limited opportunities to return capital to shareholders.

3. New Investments Fail to Bear Fruit as ROIC Declines

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Topgolf Callaway’s ROIC has unfortunately decreased. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Topgolf Callaway, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 371.7× forward price-to-earnings (or $6.48 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

Stocks We Would Buy Instead of Topgolf Callaway

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.