The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how PAR Technology (NYSE: PAR) and the rest of the specialized technology stocks fared in Q4.

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

The 8 specialized technology stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.2% since the latest earnings results.

Best Q4: PAR Technology (NYSE: PAR)

Originally founded in 1968 as a defense contractor for the U.S. government, PAR Technology (NYSE: PAR) provides cloud-based software, payment processing, and hardware solutions that help restaurants manage everything from point-of-sale to customer loyalty programs.

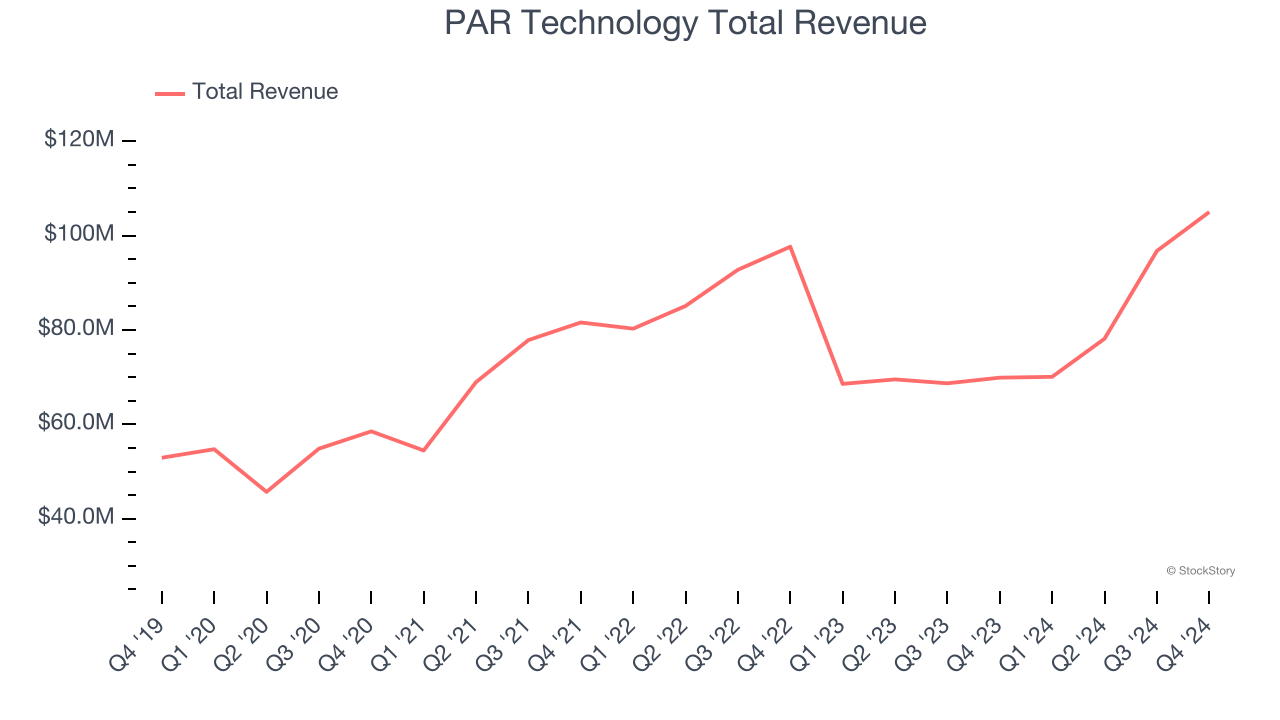

PAR Technology reported revenues of $105 million, up 50.2% year on year. This print exceeded analysts’ expectations by 4.3%. Overall, it was an incredible quarter for the company with an impressive beat of analysts’ ARR and EPS estimates.

PAR Technology achieved the biggest analyst estimates beat and fastest revenue growth of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $60.33.

Is now the time to buy PAR Technology? Access our full analysis of the earnings results here, it’s free.

OSI Systems (NASDAQ: OSIS)

With security scanners deployed at airports and borders worldwide and patient monitors used in hospitals across the globe, OSI Systems (NASDAQ: OSIS) designs and manufactures specialized electronic systems for security screening, patient monitoring, and optoelectronic applications.

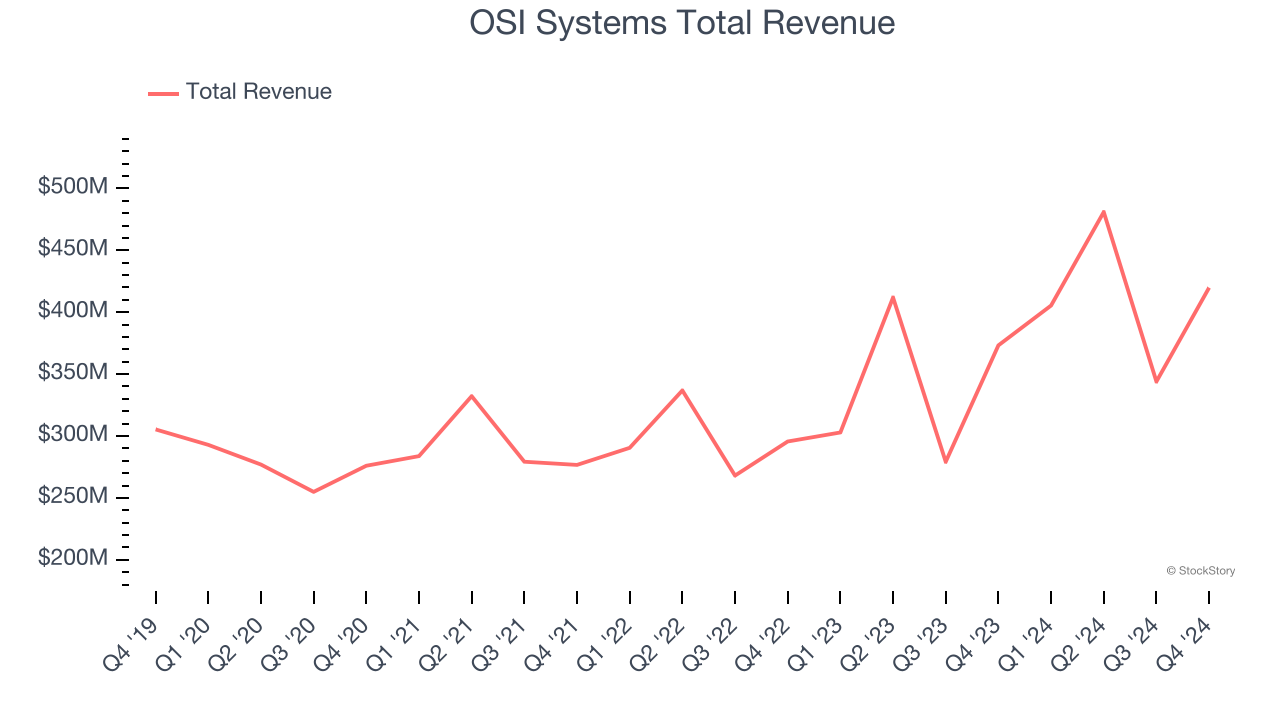

OSI Systems reported revenues of $419.8 million, up 12.5% year on year, outperforming analysts’ expectations by 3.3%. The business had a strong quarter with a decent beat of analysts’ EPS estimates and a narrow beat of analysts’ full-year EPS guidance estimates.

The market seems happy with the results as the stock is up 11.4% since reporting. It currently trades at $188.17.

Is now the time to buy OSI Systems? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Napco (NASDAQ: NSSC)

Protecting everything from schools to government facilities since 1969, Napco Security Technologies (NASDAQ: NSSC) manufactures electronic security devices, access control systems, and communication services for intrusion and fire alarm systems.

Napco reported revenues of $42.93 million, down 9.7% year on year, falling short of analysts’ expectations by 13.9%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Napco delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 31.3% since the results and currently trades at $25.21.

Read our full analysis of Napco’s results here.

Crane NXT (NYSE: CXT)

Born from a corporate transformation completed in 2023, Crane NXT (NYSE: CXT) provides specialized technology solutions for payment processing, banknote security, and authentication systems for financial institutions and businesses.

Crane NXT reported revenues of $399.1 million, up 11.8% year on year. This number came in 2.7% below analysts' expectations. It was a slower quarter as it also produced a miss of analysts’ organic revenue estimates and EPS in line with analysts’ estimates.

The stock is down 6.5% since reporting and currently trades at $54.76.

Read our full, actionable report on Crane NXT here, it’s free.

Arlo Technologies (NYSE: ARLO)

Originally spun off from networking equipment maker Netgear in 2018, Arlo Technologies (NYSE: ARLO) provides cloud-based smart security devices and subscription services that help consumers and businesses monitor and protect their homes, properties, and loved ones.

Arlo Technologies reported revenues of $121.6 million, down 10% year on year. This print was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS guidance for next quarter estimates.

Arlo Technologies had the slowest revenue growth among its peers. The stock is down 8% since reporting and currently trades at $10.98.

Read our full, actionable report on Arlo Technologies here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.