Even during a down period for the markets, Clover Health has gone against the grain, climbing to $3.82. Its shares have yielded a 26.1% return over the last six months, beating the S&P 500 by 27.7%. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy Clover Health, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Despite the momentum, we're sitting this one out for now. Here are three reasons why CLOV doesn't excite us and a stock we'd rather own.

Why Is Clover Health Not Exciting?

Founded in 2014 to improve healthcare for America's seniors through technology, Clover Health (NASDAQ: CLOV) provides Medicare Advantage plans for seniors with a focus on affordable care and uses its proprietary Clover Assistant software to help physicians manage patient care.

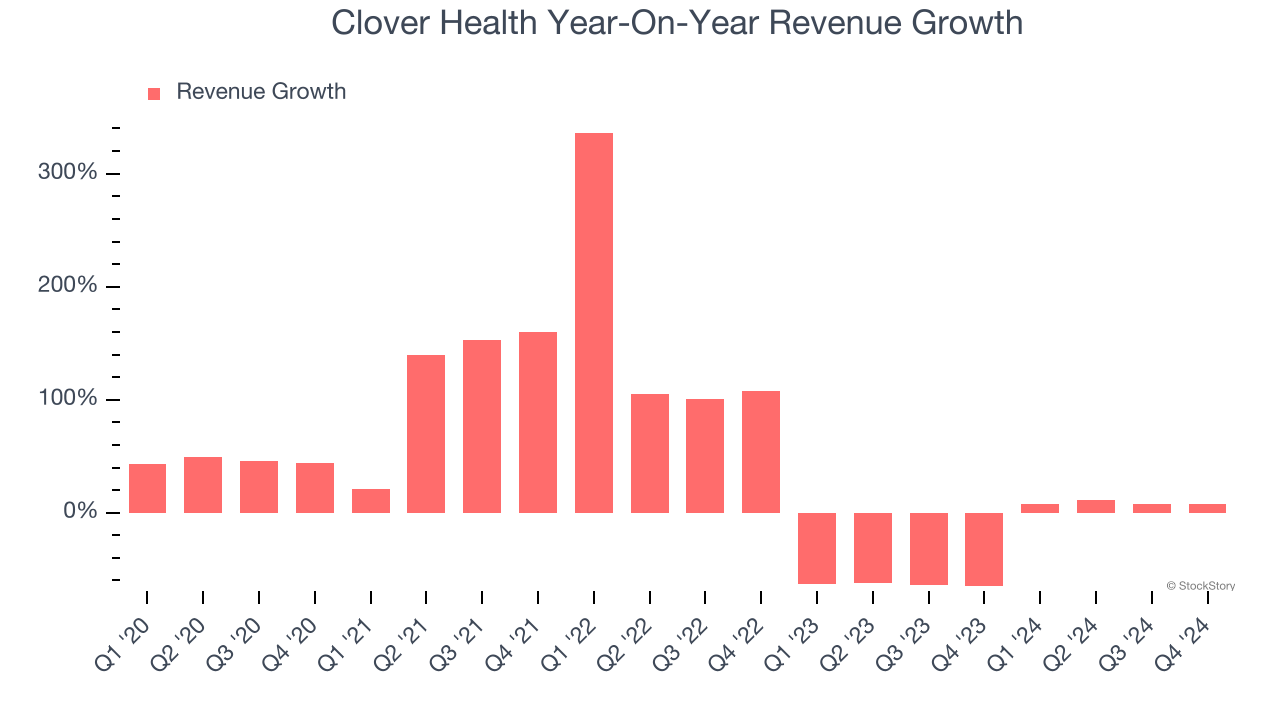

1. Revenue Tumbling Downwards

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. Clover Health’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 37.2% over the last two years.

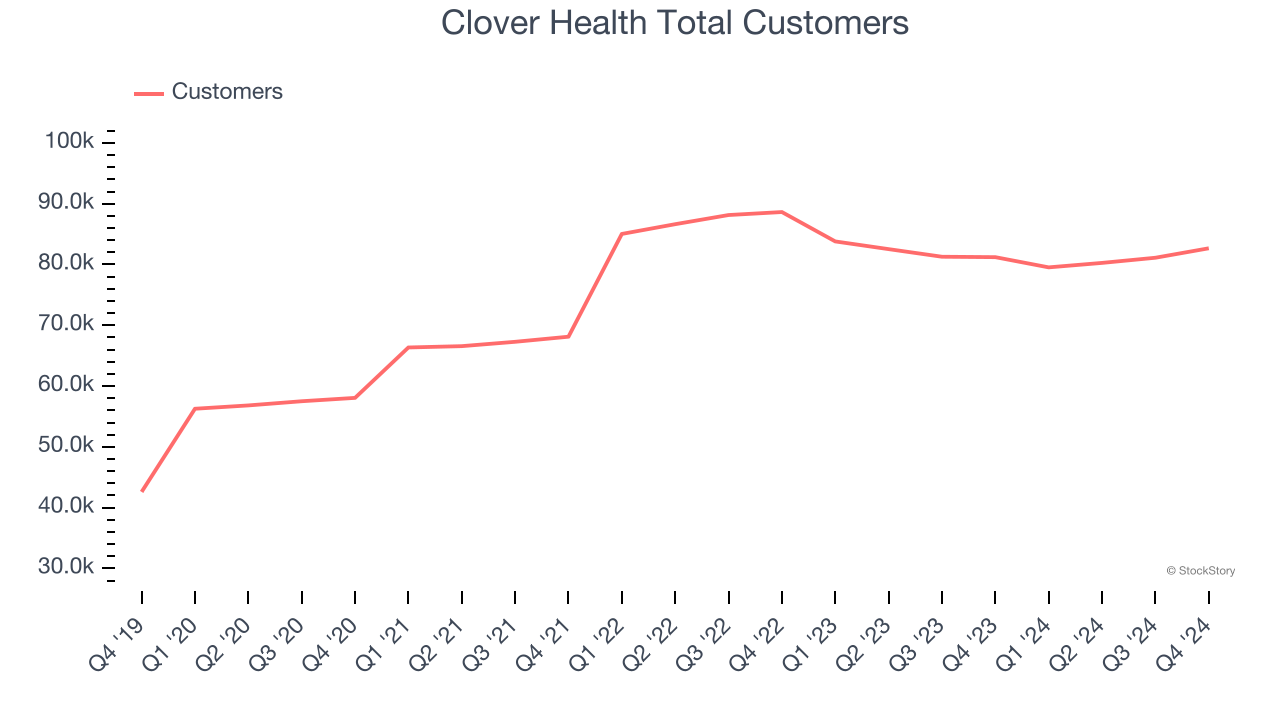

2. Declining Customer Base Reflects Product and Sales Weakness

Revenue growth can be broken down into the number of customers and the average spend per customer. Both are important because an increasing customer base leads to more upselling opportunities while the revenue per customer shows how successful a company was in executing its upselling strategy.

Clover Health’s total customers came in at 82,664 in the latest quarter, and over the last two years, their count averaged 3.6% year-on-year declines. This performance was underwhelming and shows the company lost deals and renewals. It also suggests there may be increasing competition or market saturation.

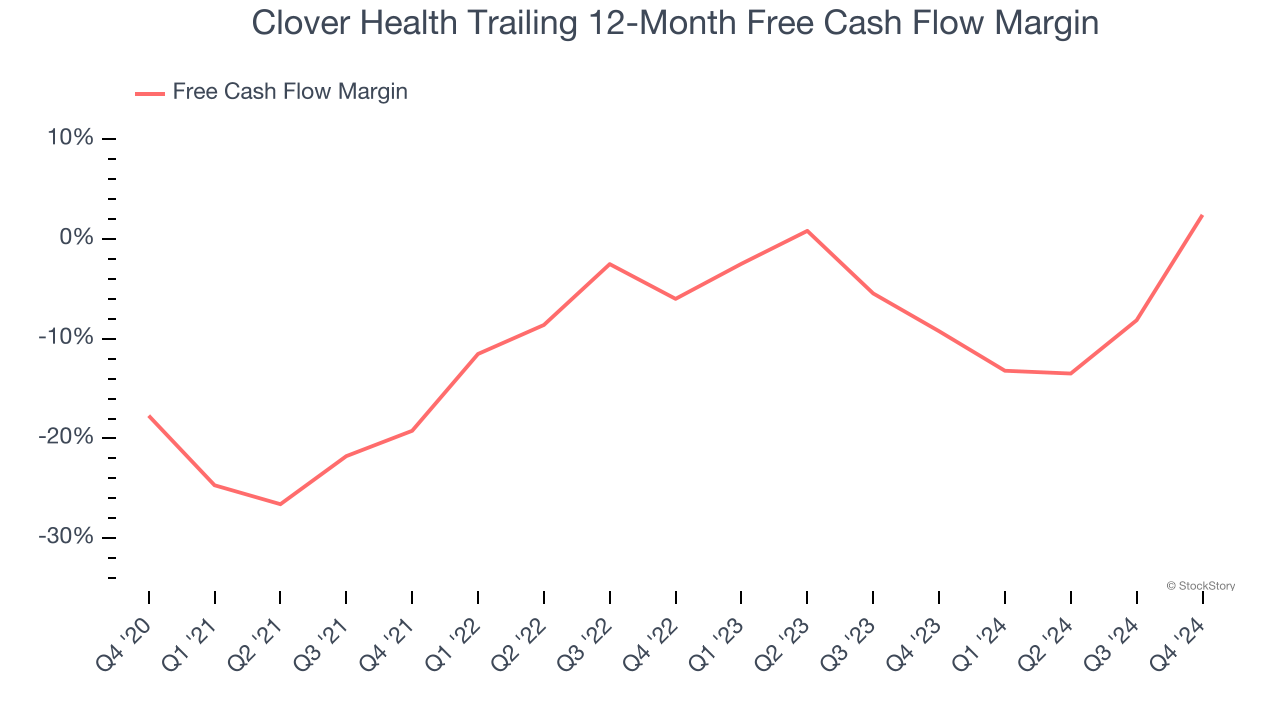

3. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Clover Health’s demanding reinvestments have consumed many resources over the last five years, contributing to an average free cash flow margin of negative 8.4%. This means it lit $8.41 of cash on fire for every $100 in revenue.

Final Judgment

Clover Health’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 42.3× forward EV-to-EBITDA (or $3.82 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of Clover Health

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.