What a brutal six months it’s been for ASGN. The stock has dropped 27.3% and now trades at $67.80, rattling many shareholders. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in ASGN, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we don't have much confidence in ASGN. Here are three reasons why ASGN doesn't excite us and a stock we'd rather own.

Why Do We Think ASGN Will Underperform?

Evolving from its roots in IT staffing to become a high-end technology consulting powerhouse, ASGN (NYSE: ASGN) provides specialized IT consulting services and staffing solutions to Fortune 1000 companies and U.S. federal government agencies.

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, ASGN’s sales grew at a tepid 3.7% compounded annual growth rate over the last five years. This was below our standard for the business services sector.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect ASGN’s revenue to stall. While this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

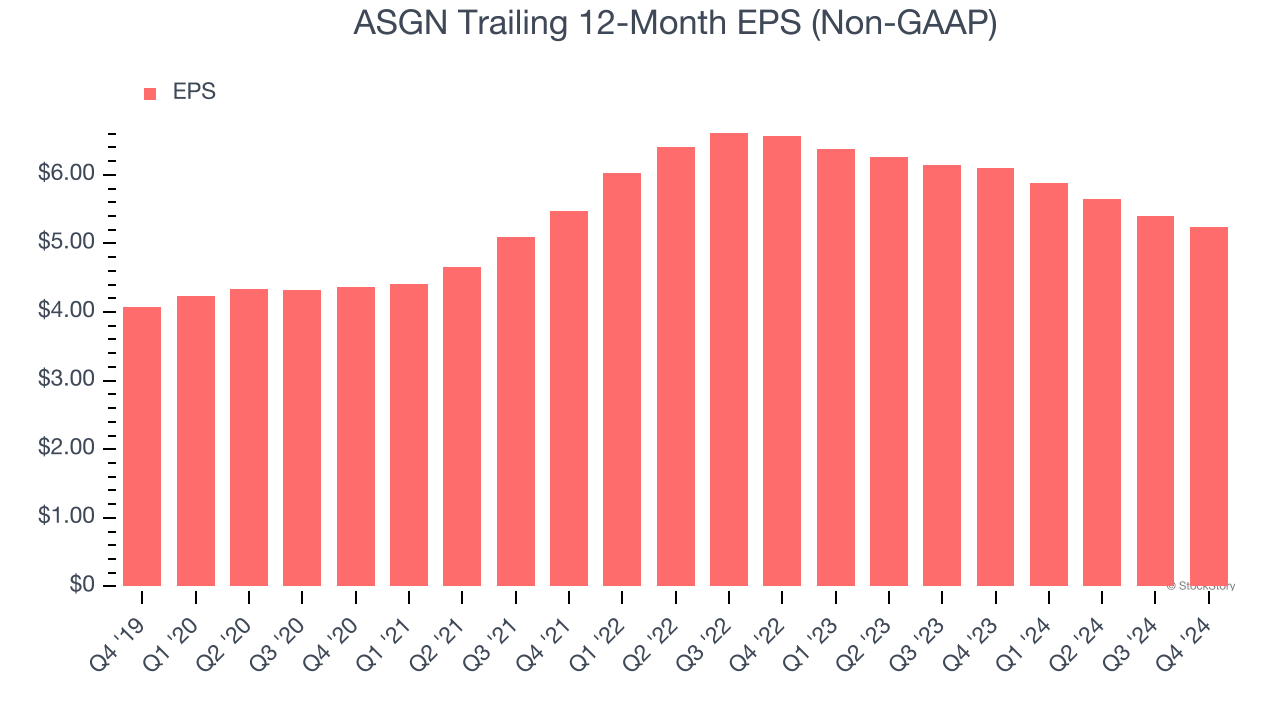

3. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

ASGN’s EPS grew at an unimpressive 5.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.7% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

ASGN falls short of our quality standards. Following the recent decline, the stock trades at 12.2× forward price-to-earnings (or $67.80 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Would Buy Instead of ASGN

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.