Looking back on leisure facilities stocks’ Q4 earnings, we examine this quarter’s best and worst performers, including Live Nation (NYSE: LYV) and its peers.

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

The 11 leisure facilities stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was 1.6% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 10.7% since the latest earnings results.

Best Q4: Live Nation (NYSE: LYV)

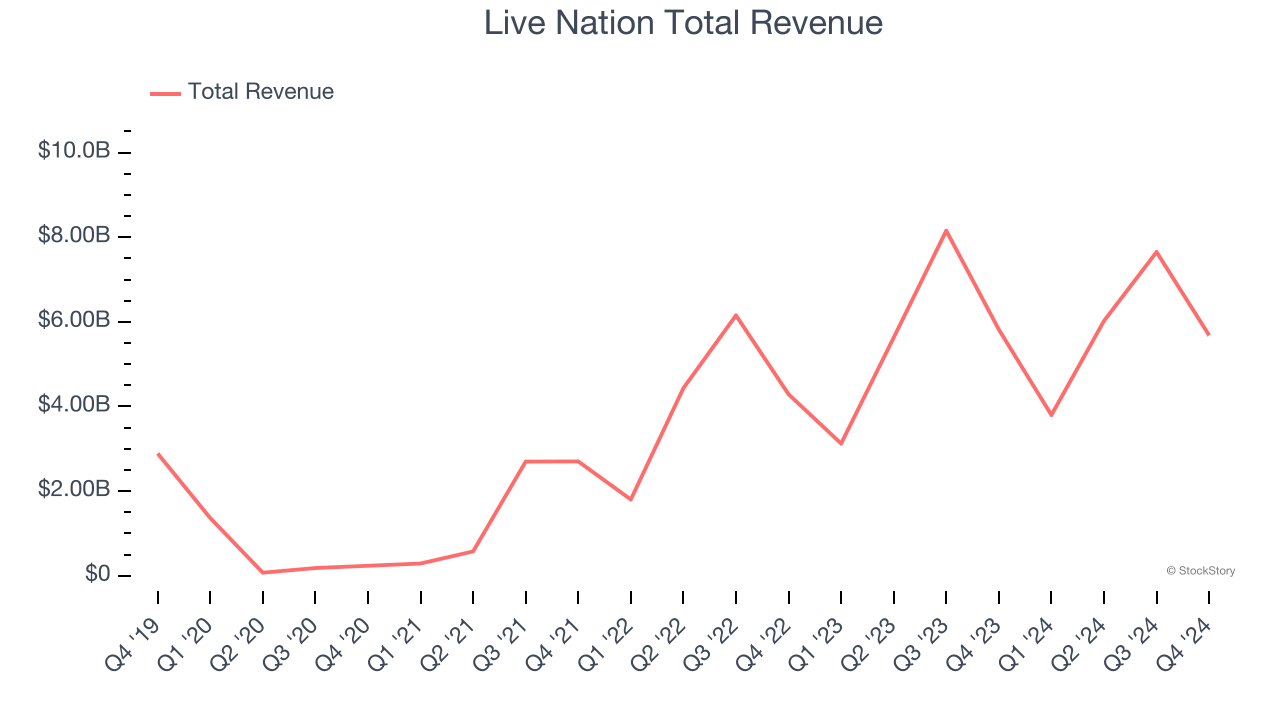

Owner of Ticketmaster and operator of music festival EDC, Live Nation (NYSE: LYV) is a company specializing in live event promotion, venue management, and ticketing services for concerts and shows.

Live Nation reported revenues of $5.68 billion, down 2.4% year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 20.5% since reporting and currently trades at $121.10.

Is now the time to buy Live Nation? Access our full analysis of the earnings results here, it’s free.

Planet Fitness (NYSE: PLNT)

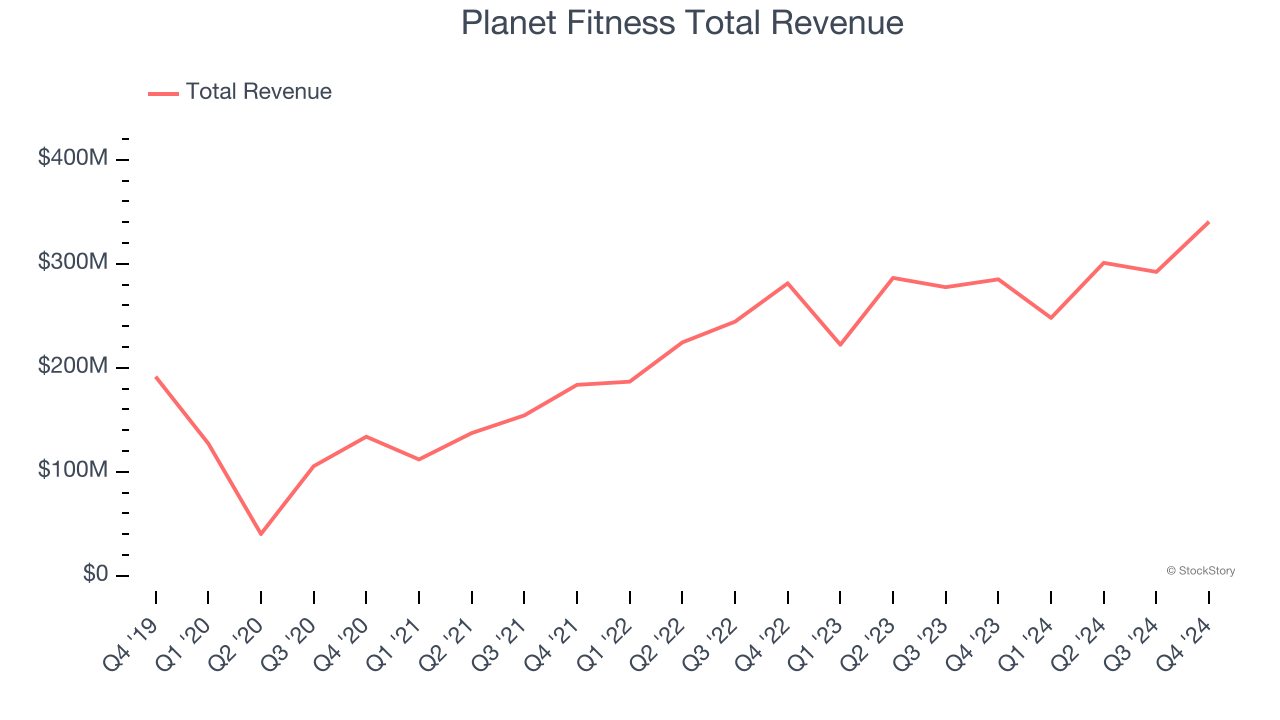

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE: PLNT) is a gym franchise that caters to casual fitness users by providing a friendly and inclusive atmosphere.

Planet Fitness reported revenues of $340.5 million, up 19.4% year on year, outperforming analysts’ expectations by 4.9%. The business had a very strong quarter with an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EPS estimates.

Planet Fitness scored the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 1.1% since reporting. It currently trades at $98.41.

Is now the time to buy Planet Fitness? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Bowlero (NYSE: BOWL)

Operating over 300 locations globally, Bowlero (NYSE: BOWL) is a contemporary bowling company merging classic lanes with entertainment and deluxe food offerings.

Bowlero reported revenues of $300.1 million, down 1.8% year on year, falling short of analysts’ expectations by 4.9%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

The stock is flat since the results and currently trades at $11.80.

Read our full analysis of Bowlero’s results here.

European Wax Center (NASDAQ: EWCZ)

Founded by two siblings, European Wax Center (NASDAQ: EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

European Wax Center reported revenues of $49.74 million, down 11.7% year on year. This result missed analysts’ expectations by 5%. Overall, it was a slower quarter as it also recorded full-year revenue guidance missing analysts’ expectations.

European Wax Center had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 21.5% since reporting and currently trades at $4.02.

Read our full, actionable report on European Wax Center here, it’s free.

Sphere Entertainment (NYSE: SPHR)

Famous for its viral Las Vegas Sphere venue, Sphere Entertainment (NYSE: SPHR) hosts live entertainment events and distributes content across various media platforms.

Sphere Entertainment reported revenues of $308.3 million, down 1.9% year on year. This number surpassed analysts’ expectations by 6.9%. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EPS estimates.

Sphere Entertainment delivered the biggest analyst estimates beat among its peers. The stock is down 28.3% since reporting and currently trades at $31.31.

Read our full, actionable report on Sphere Entertainment here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.