What a fantastic six months it’s been for Zevia. Shares of the company have skyrocketed 95.3%, hitting $2.09. This run-up might have investors contemplating their next move.

Is there a buying opportunity in Zevia, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We’re happy investors have made money, but we're cautious about Zevia. Here are three reasons why there are better opportunities than ZVIA and a stock we'd rather own.

Why Is Zevia Not Exciting?

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE: ZVIA) is a better-for-you beverage company.

1. Long-Term Revenue Growth Disappoints

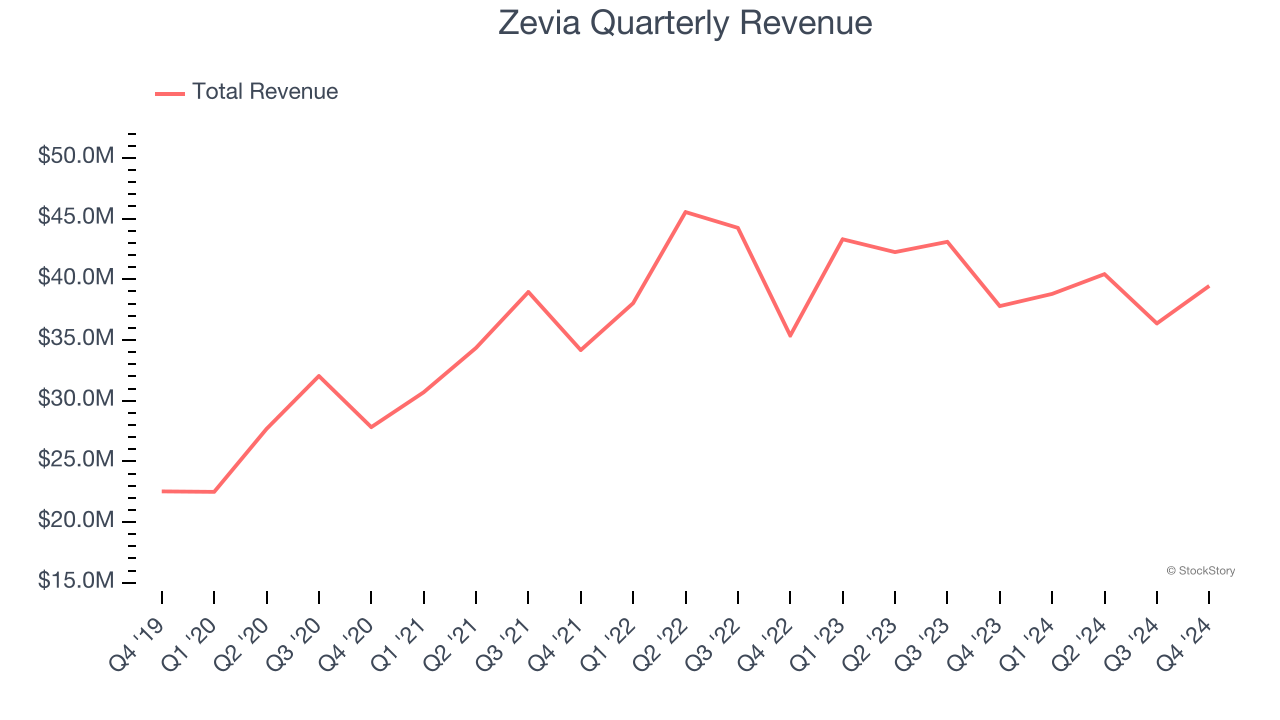

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Zevia grew its sales at a sluggish 3.9% compounded annual growth rate. This was below our standard for the consumer staples sector.

2. Fewer Distribution Channels Limit its Ceiling

With $155 million in revenue over the past 12 months, Zevia is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. Operating Losses Sound the Alarms

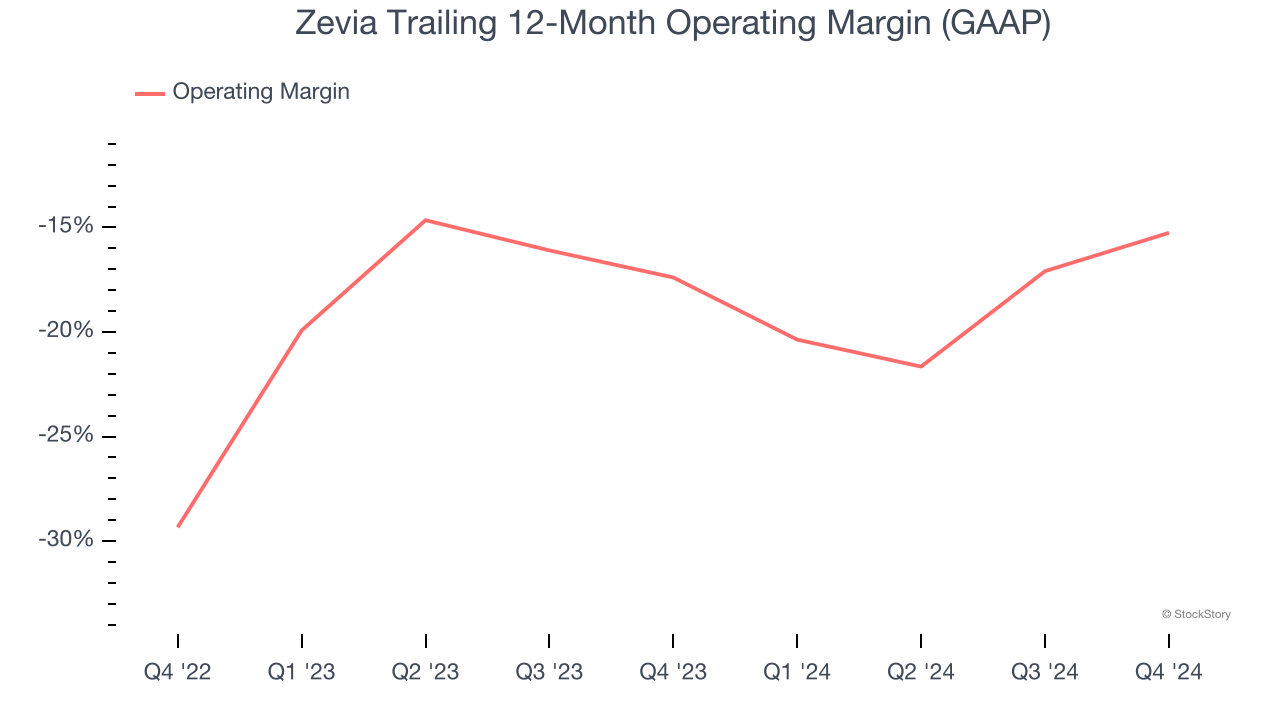

Operating margin is a key profitability metric because it accounts for all expenses enabling a business to operate smoothly, including marketing and advertising, IT systems, wages, and other administrative costs.

Unprofitable public companies are rare in the defensive consumer staples industry. Unfortunately, Zevia was one of them over the last two years as its high expenses contributed to an average operating margin of negative 16.4%.

Final Judgment

Zevia’s business quality ultimately falls short of our standards. After the recent surge, the stock trades at $2.09 per share (or 0.8× forward price-to-sales). The market typically values companies like Zevia based on their anticipated profits for the next 12 months, but it expects the business to lose money. We also think the upside isn’t great compared to the potential downside here - there are more exciting stocks to buy. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Zevia

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.