Over the past six months, FTAI Aviation’s shares (currently trading at $113.84) have posted a disappointing 12.5% loss while the S&P 500 was flat. This may have investors wondering how to approach the situation.

Given the weaker price action, is now the time to buy FTAI? Find out in our full research report, it’s free.

Why Are We Positive On FTAI?

With a focus on the CFM56 engine that powers Boeing and Airbus’s planes, FTAI Aviation (NASDAQ: FTAI) sells, leases, maintains, and repairs aircraft engines.

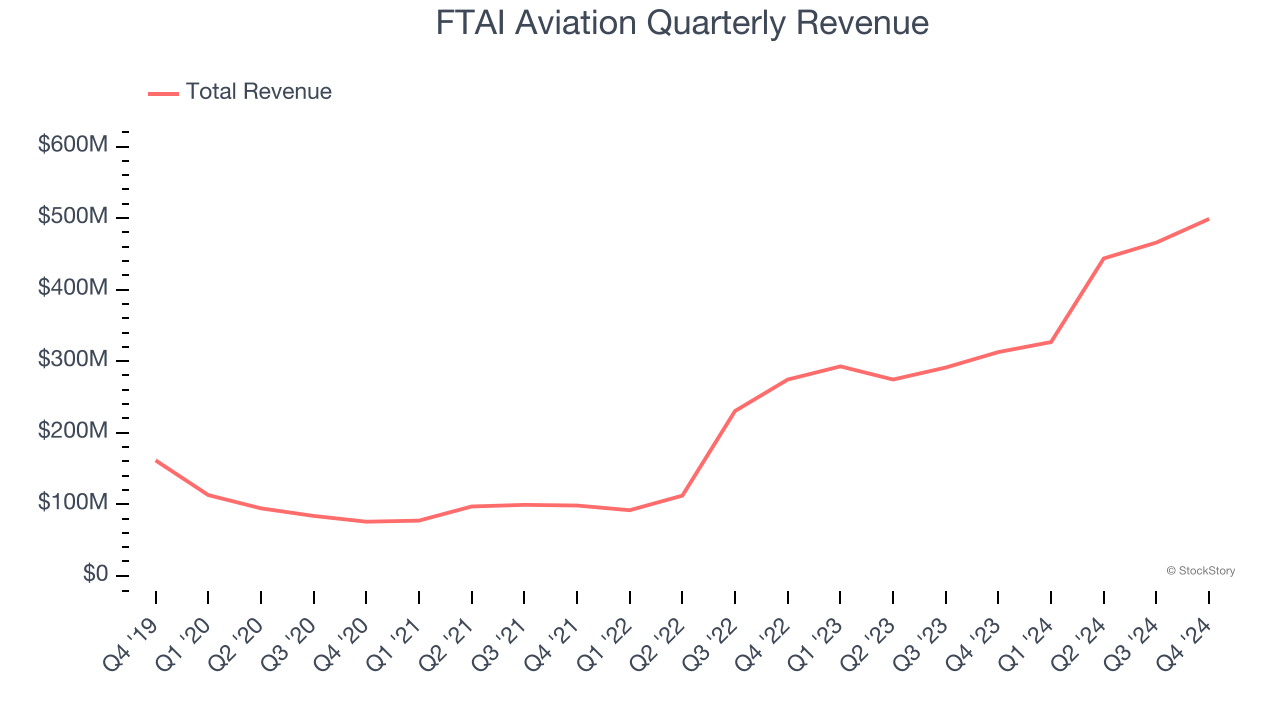

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, FTAI Aviation’s 24.6% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

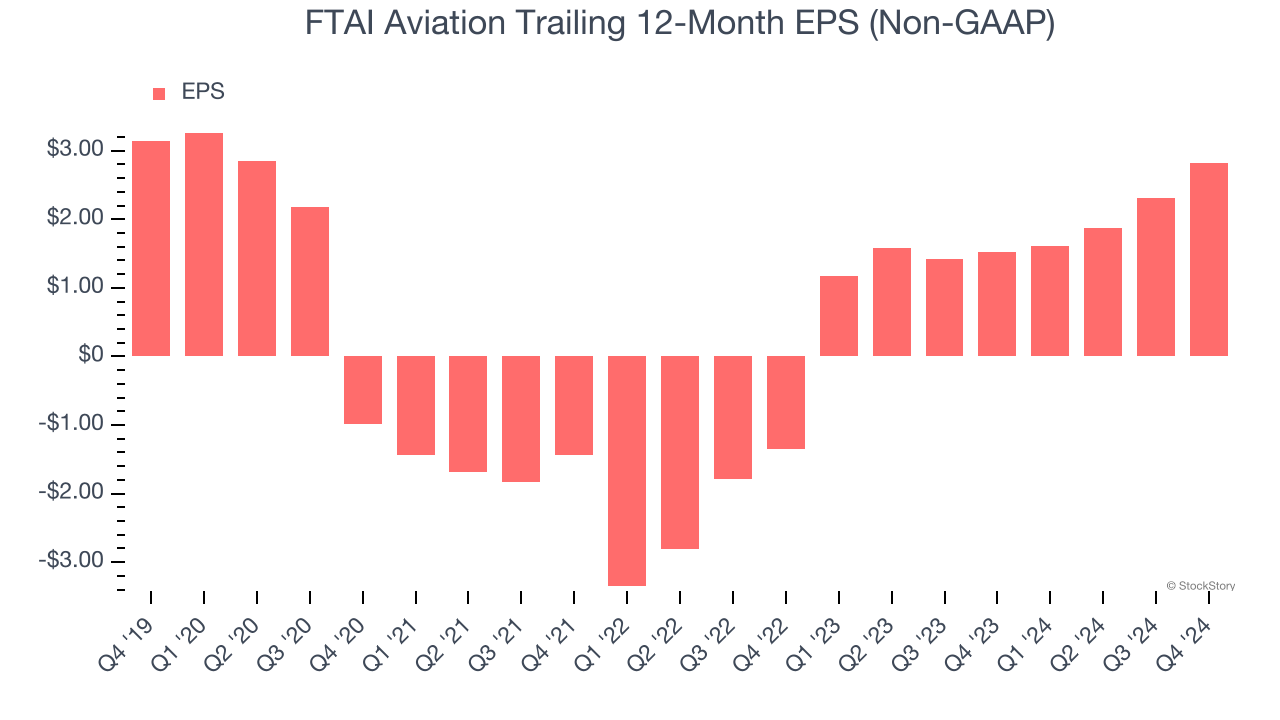

2. EPS Surges Higher Over the Last Two Years

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

For FTAI Aviation, its two-year annual EPS growth of 102% was higher than its five-year trend. This acceleration made it one of the faster-growing industrials companies in recent history.

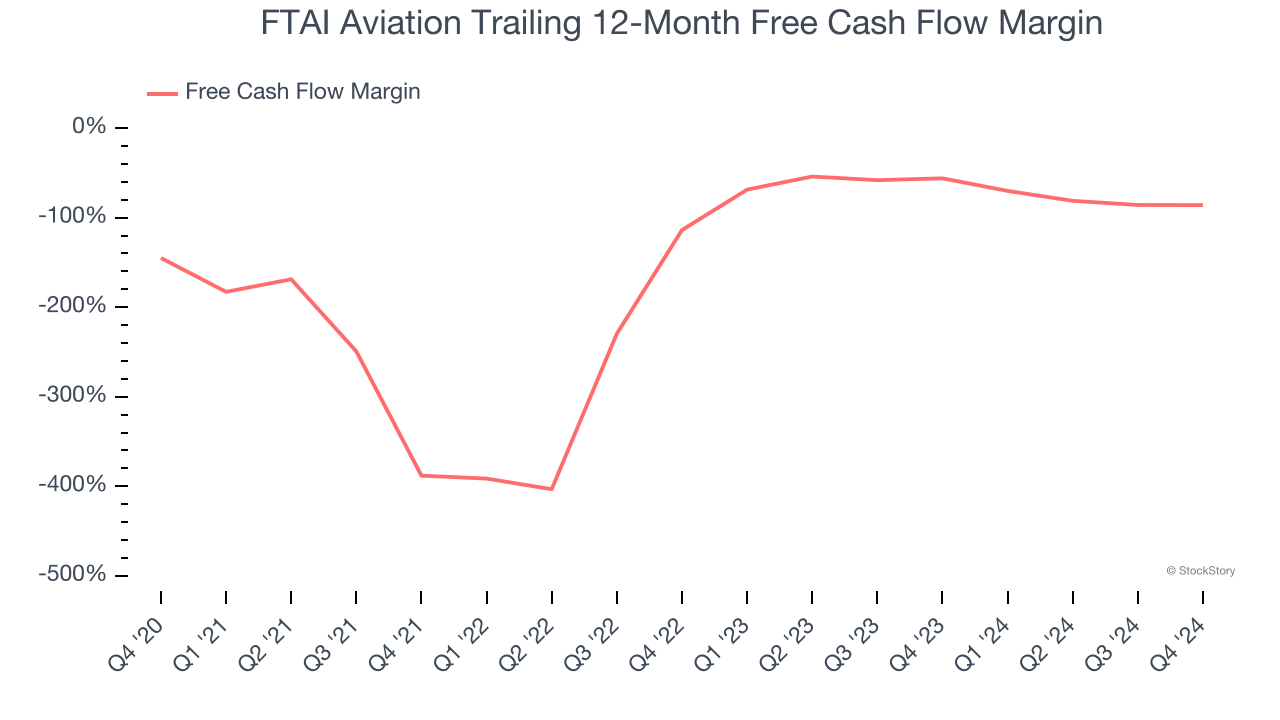

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, FTAI Aviation’s margin expanded by 59.1 percentage points over the last five years. FTAI Aviation’s free cash flow margin for the trailing 12 months was negative 86%, and continued increases could help it achieve long-term cash profitability.

Final Judgment

These are just a few reasons why we think FTAI Aviation is a great business. After the recent drawdown, the stock trades at 25.7× forward price-to-earnings (or $113.84 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than FTAI Aviation

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.