Shareholders of AMN Healthcare Services would probably like to forget the past six months even happened. The stock dropped 45.1% and now trades at $23.39. This may have investors wondering how to approach the situation.

Is there a buying opportunity in AMN Healthcare Services, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we're cautious about AMN Healthcare Services. Here are three reasons why there are better opportunities than AMN and a stock we'd rather own.

Why Do We Think AMN Healthcare Services Will Underperform?

With a network of thousands of healthcare professionals ranging from nurses to physicians to executives, AMN Healthcare (NYSE: AMN) provides healthcare workforce solutions including temporary staffing, permanent placement, and technology platforms for hospitals and healthcare facilities across the United States.

1. Demand Slipping as Sales Volumes Decline

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Specialized Medical & Nursing Services company because there’s a ceiling to what customers will pay.

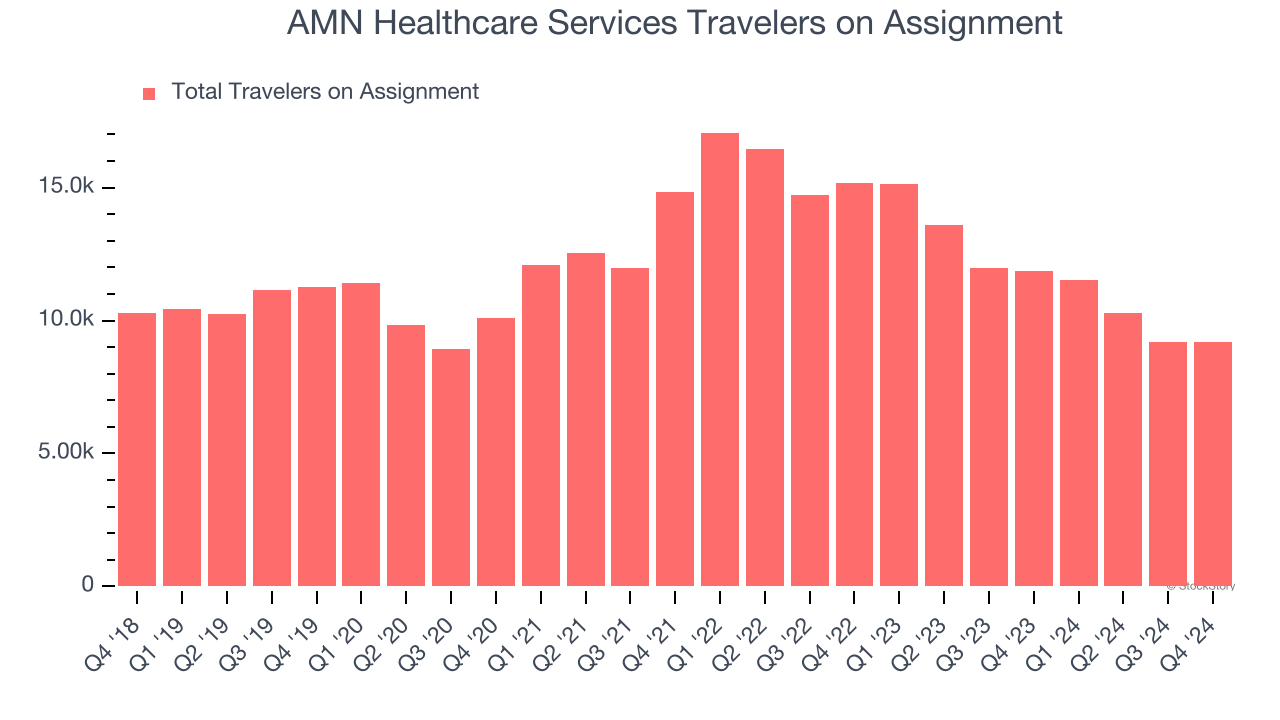

AMN Healthcare Services’s travelers on assignment came in at 9,206 in the latest quarter, and they averaged 20.4% year-on-year declines over the last two years. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests AMN Healthcare Services might have to lower prices or invest in product improvements to grow, factors that can hinder near-term profitability.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect AMN Healthcare Services’s revenue to drop by 11.3%. Although this projection is better than its two-year trend, it's tough to feel optimistic about a company facing demand difficulties.

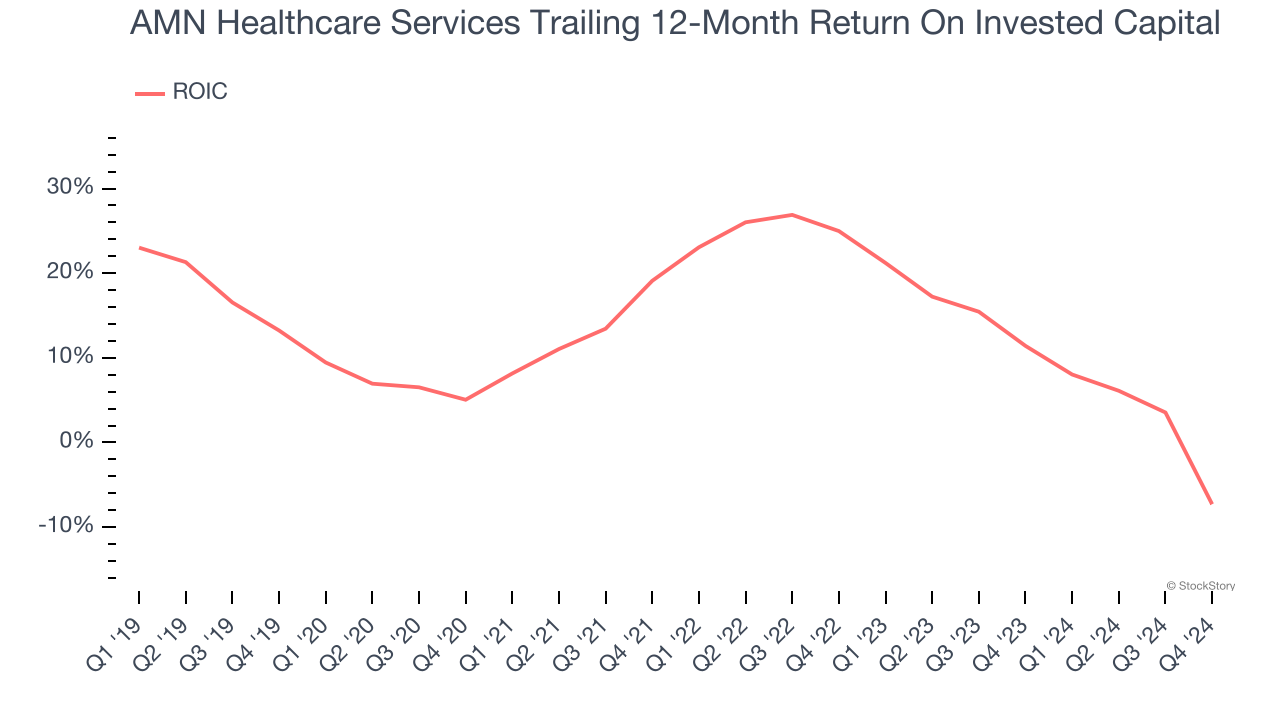

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, AMN Healthcare Services’s ROIC has unfortunately decreased significantly. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of AMN Healthcare Services, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 15.4× forward price-to-earnings (or $23.39 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - you can find better investment opportunities elsewhere. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Like More Than AMN Healthcare Services

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.