Over the last six months, Artivion shares have sunk to $24.36, producing a disappointing 8.5% loss - worse than the S&P 500’s 1.4% drop. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Artivion, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Even though the stock has become cheaper, we're cautious about Artivion. Here are three reasons why we avoid AORT and a stock we'd rather own.

Why Do We Think Artivion Will Underperform?

Formerly known as CryoLife until its 2022 rebranding, Artivion (NYSE: AORT) develops and manufactures medical devices and preserves human tissues used in cardiac and vascular surgical procedures for patients with aortic disease.

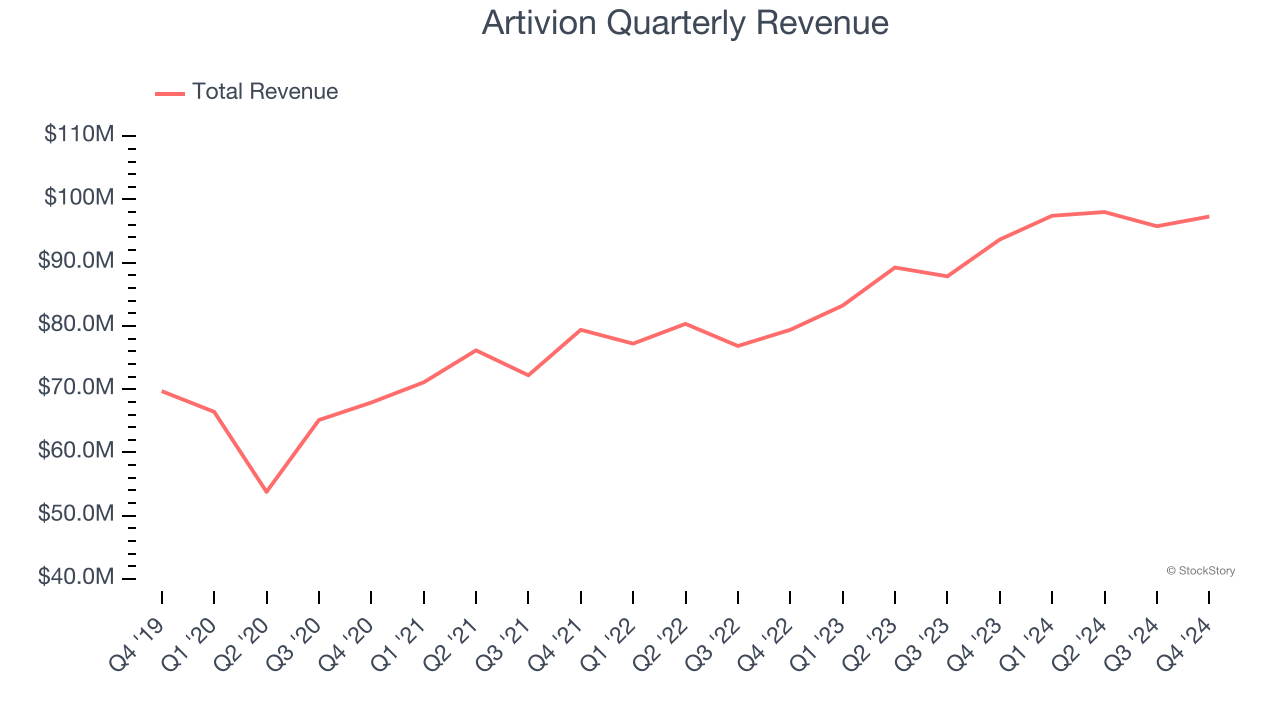

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Regrettably, Artivion’s sales grew at a mediocre 7.1% compounded annual growth rate over the last five years. This was below our standard for the healthcare sector.

2. Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $388.5 million in revenue over the past 12 months, Artivion is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive.

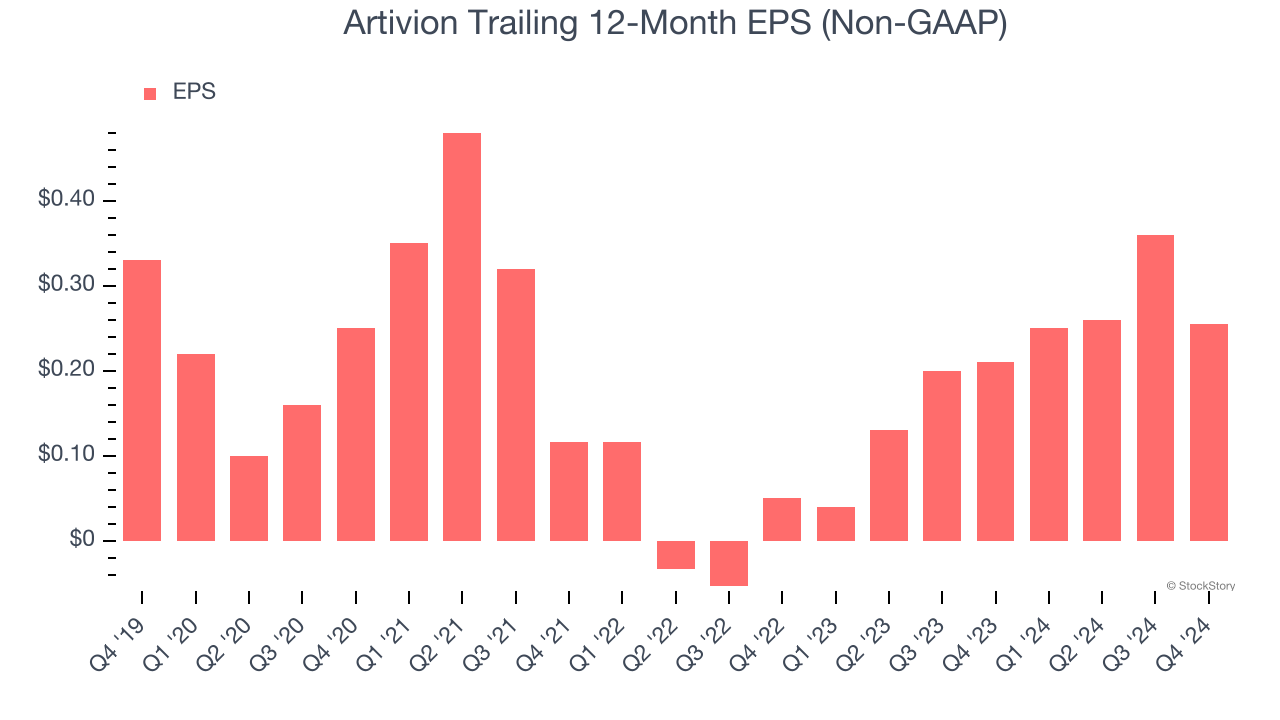

3. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Artivion, its EPS declined by 5.1% annually over the last five years while its revenue grew by 7.1%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Artivion falls short of our quality standards. Following the recent decline, the stock trades at 50× forward price-to-earnings (or $24.36 per share). This multiple tells us a lot of good news is priced in - we think there are better stocks to buy right now. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Like More Than Artivion

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.