As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at asset management & auction services stocks, starting with Liquidity Services (NASDAQ: LQDT).

Like in other industries, the shift to online platforms can lower transaction costs and improve liquidity for sellers. Increasing digitization, AI-driven pricing analytics, and automation in logistics can enhance efficiency for operators who invest in technology and software. On the other hand, challenges include potential regulatory scrutiny on auction transparency, data privacy concerns with AI-driven valuation models, and shifting environmental policies that could impact the resale market for internal combustion vehicles. Additionally, supply chain volatility in new car production may create unpredictable swings in used vehicle supply, impacting auction volumes.

The 4 asset management & auction services stocks we track reported an exceptional Q4. As a group, revenues beat analysts’ consensus estimates by 9.1%.

While some asset management & auction services stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.4% since the latest earnings results.

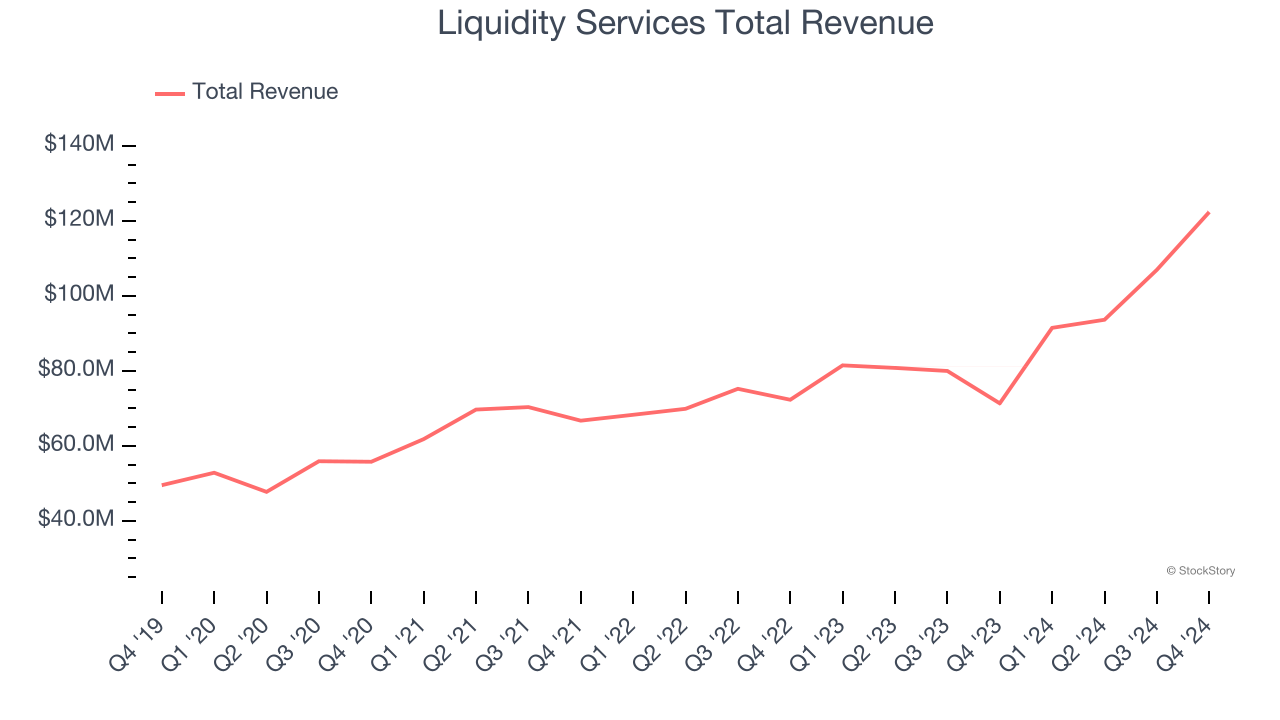

Liquidity Services (NASDAQ: LQDT)

Powering what it calls the "circular economy" with over 5.5 million registered buyers across its platforms, Liquidity Services (NASDAQ: LQDT) operates online marketplaces that connect buyers and sellers of surplus assets, from consumer returns to industrial equipment to government property.

Liquidity Services reported revenues of $122.3 million, up 71.5% year on year. This print exceeded analysts’ expectations by 16.1%. Overall, it was an incredible quarter for the company with an impressive beat of analysts’ EPS estimates.

Liquidity Services scored the biggest analyst estimates beat and fastest revenue growth of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 8.4% since reporting and currently trades at $30.01.

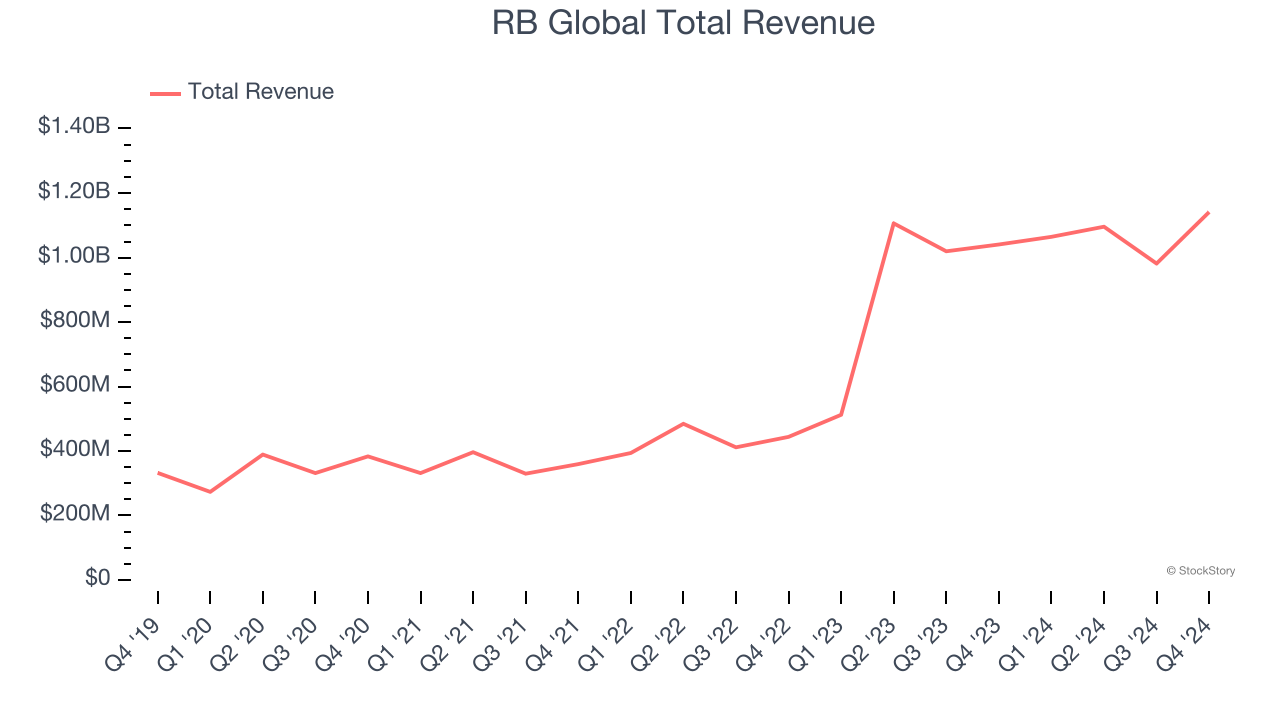

RB Global (NYSE: RBA)

Born from the 1958 founding of Ritchie Bros. Auctioneers and rebranded in 2023, RB Global (NYSE: RBA) operates global marketplaces that connect buyers and sellers of commercial assets, vehicles, and equipment across multiple industries.

RB Global reported revenues of $1.14 billion, up 9.7% year on year, outperforming analysts’ expectations by 7.9%. The business had an incredible quarter with a solid beat of analysts’ EPS estimates.

The market seems content with the results as the stock is up 3.3% since reporting. It currently trades at $99.79.

Is now the time to buy RB Global? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: OPENLANE (NYSE: KAR)

Facilitating the sale of approximately 1.3 million used vehicles in 2023, OPENLANE (NYSE: KAR) operates digital marketplaces that connect sellers and buyers of used vehicles across North America and Europe, facilitating wholesale transactions.

OPENLANE reported revenues of $455 million, up 12% year on year, exceeding analysts’ expectations by 8.2%. It was a satisfactory quarter as it also posted a decent beat of analysts’ EPS estimates but a slight miss of analysts’ full-year EPS guidance estimates.

As expected, the stock is down 4.2% since the results and currently trades at $19.19.

Read our full analysis of OPENLANE’s results here.

Copart (NASDAQ: CPRT)

Starting as a single salvage yard in California in 1982, Copart (NASDAQ: CPRT) operates an online auction platform that connects sellers of damaged and salvage vehicles with buyers ranging from dismantlers and rebuilders to used car dealers and exporters.

Copart reported revenues of $1.16 billion, up 14% year on year. This number topped analysts’ expectations by 4.2%. Overall, it was a very strong quarter as it also put up a decent beat of analysts’ EPS estimates.

Copart had the weakest performance against analyst estimates among its peers. The stock is down 4.5% since reporting and currently trades at $55.55.

Read our full, actionable report on Copart here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.