Wrapping up Q4 earnings, we look at the numbers and key takeaways for the semiconductor manufacturing stocks, including Amtech (NASDAQ: ASYS) and its peers.

The semiconductor industry is driven by demand for advanced electronic products like smartphones, PCs, servers, and data storage. The need for technologies like artificial intelligence, 5G networks, and smart cars is also creating the next wave of growth for the industry. Keeping up with this dynamism requires new tools that can design, fabricate, and test chips at ever smaller sizes and more complex architectures, creating a dire need for semiconductor capital manufacturing equipment.

The 14 semiconductor manufacturing stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was 1.8% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 16.6% since the latest earnings results.

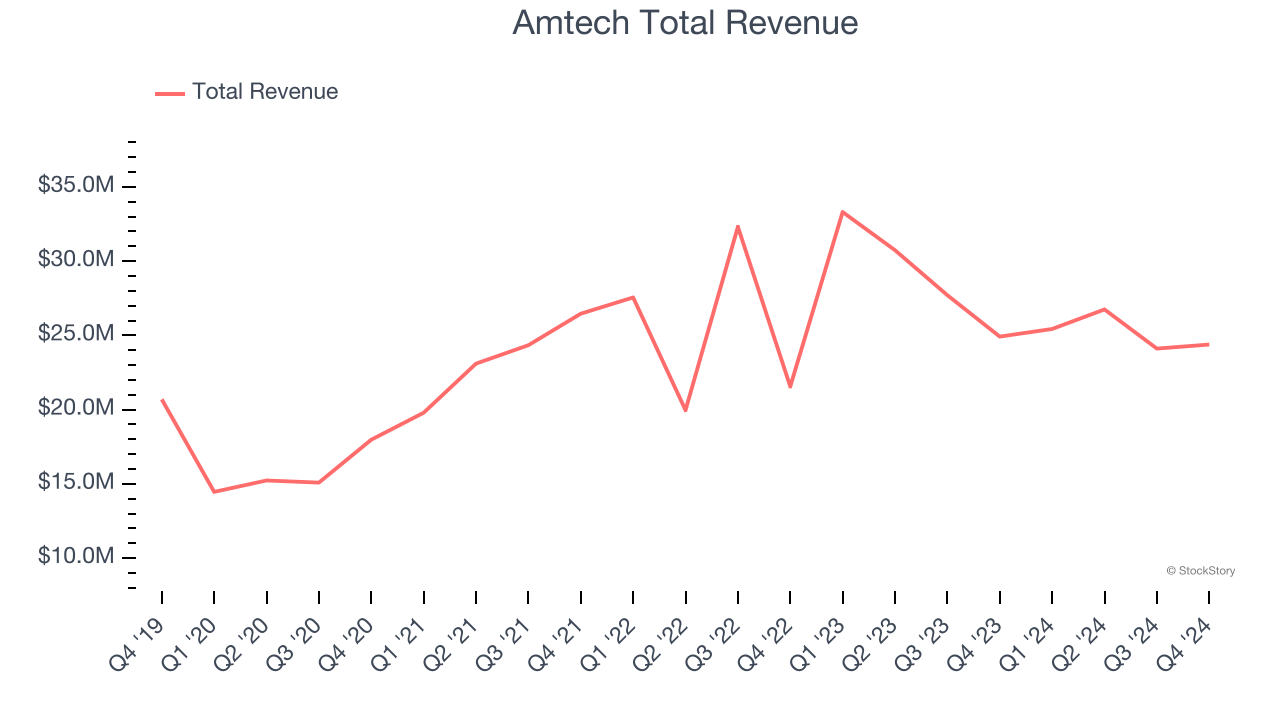

Amtech (NASDAQ: ASYS)

Focusing on the silicon carbide and power semiconductor sectors, Amtech Systems (NASDAQ: ASYS) produces the machinery and related chemicals needed for manufacturing semiconductors.

Amtech reported revenues of $24.39 million, down 2.1% year on year. This print exceeded analysts’ expectations by 4.9%. Despite the top-line beat, it was still a mixed quarter for the company with a significant improvement in its inventory levels but revenue guidance for next quarter missing analysts’ expectations.

“I'm pleased to report a strong first quarter that exceeded the high end of our guidance, with $24.4 million in revenue and $1.9 million in adjusted EBITDA. While industry softness remains a headwind, we continue to make progress on our operational excellence and cost optimization initiatives, evidenced by the $1.8 million year-over-year increase in adjusted EBITDA. With strong long-term growth drivers that include AI infrastructure investments and our initiatives to grow our consumables, parts and services revenue, we are well positioned to deliver profitable growth that should result in meaningful value creation for shareholders,” commented Mr. Bob Daigle, Chief Executive Officer of Amtech.

Amtech pulled off the biggest analyst estimates beat of the whole group. The results were likely priced in, however, and the stock is flat since reporting. It currently trades at $5.23.

Is now the time to buy Amtech? Access our full analysis of the earnings results here, it’s free.

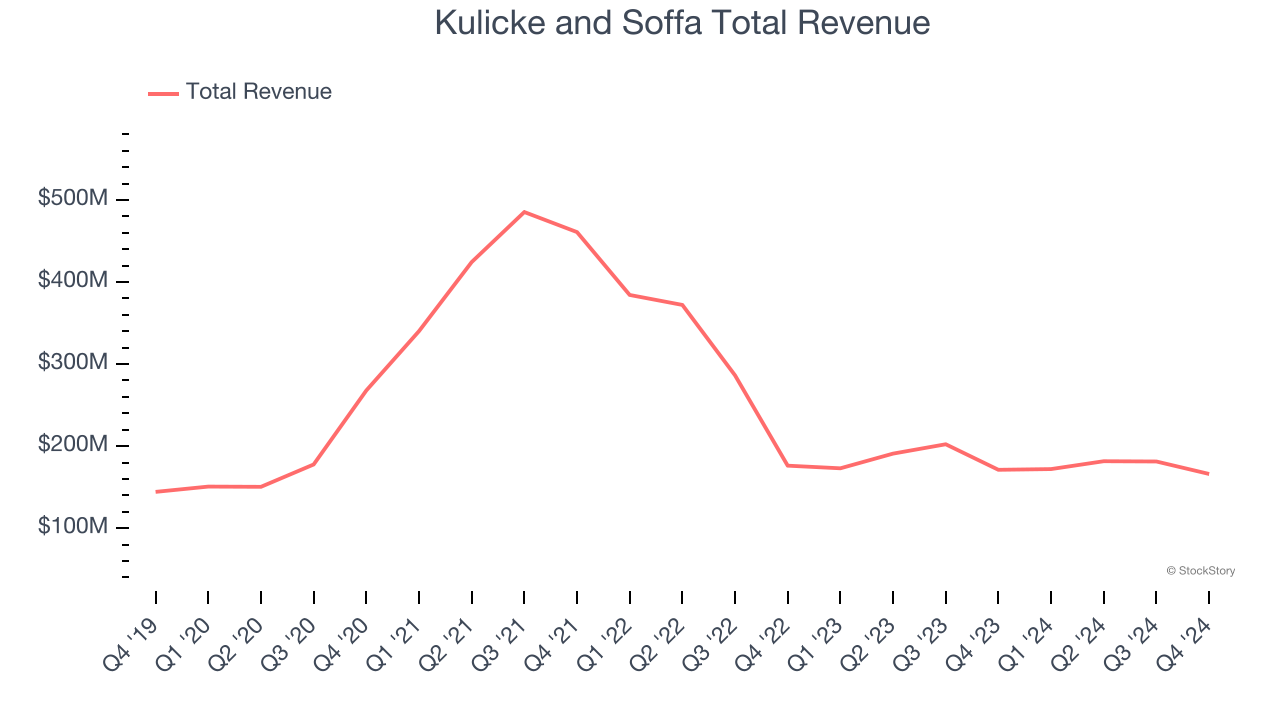

Best Q4: Kulicke and Soffa (NASDAQ: KLIC)

Headquartered in Singapore, Kulicke & Soffa (NASDAQ: KLIC) is a provider of production equipment and tools used to assemble semiconductor devices

Kulicke and Soffa reported revenues of $166.1 million, down 3% year on year, outperforming analysts’ expectations by 0.7%. The business had a very strong quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 24.2% since reporting. It currently trades at $32.89.

Is now the time to buy Kulicke and Soffa? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: FormFactor (NASDAQ: FORM)

With customers across the foundry and fabless markets, FormFactor (NASDAQ: FORM) is a US-based provider of test and measurement technologies for semiconductors.

FormFactor reported revenues of $189.5 million, up 12.7% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

As expected, the stock is down 31.8% since the results and currently trades at $28.07.

Read our full analysis of FormFactor’s results here.

Marvell Technology (NASDAQ: MRVL)

Moving away from a low margin storage device management chips in one of the biggest semiconductor business model pivots of the past decade, Marvell Technology (NASDAQ: MRVL) is a fabless designer of special purpose data processing and networking chips used by data centers, communications carriers, enterprises, and autos.

Marvell Technology reported revenues of $1.82 billion, up 27.4% year on year. This print topped analysts’ expectations by 1.2%. Zooming out, it was a slower quarter as it produced revenue guidance for next quarter slightly missing analysts’ expectations and an increase in its inventory levels.

The stock is down 33.7% since reporting and currently trades at $59.80.

Read our full, actionable report on Marvell Technology here, it’s free.

Applied Materials (NASDAQ: AMAT)

Founded in 1967 as the first company to develop tools for other businesses in the semiconductor industry, Applied Materials (NASDAQ: AMAT) is the largest provider of semiconductor wafer fabrication equipment.

Applied Materials reported revenues of $7.17 billion, up 6.8% year on year. This result was in line with analysts’ expectations. Taking a step back, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS estimates but revenue guidance for next quarter meeting analysts’ expectations.

The stock is down 22.5% since reporting and currently trades at $142.77.

Read our full, actionable report on Applied Materials here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.