Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Lindblad Expeditions (NASDAQ: LIND) and the best and worst performers in the travel and vacation providers industry.

Airlines, hotels, resorts, and cruise line companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted from buying "things" (wasteful) to buying "experiences" (memorable). In addition, the internet has introduced new ways of approaching leisure and lodging such as booking homes and longer-term accommodations. Traditional airlines, hotel, resorts, and cruise line companies must innovate to stay relevant in a market rife with innovation.

The 19 travel and vacation providers stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 2.2% while next quarter’s revenue guidance was 6.9% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.3% since the latest earnings results.

Lindblad Expeditions (NASDAQ: LIND)

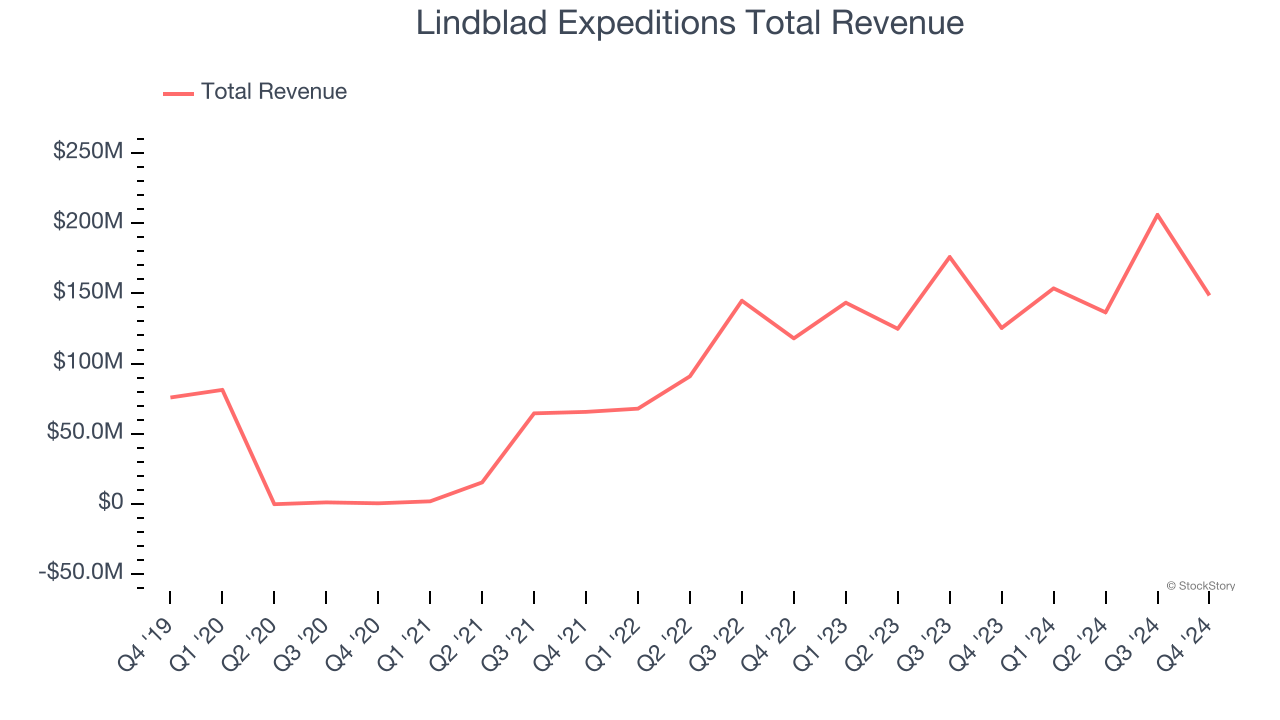

Founded by explorer Sven-Olof Lindblad in 1979, Lindblad Expeditions (NASDAQ: LIND) offers cruising experiences to remote destinations in partnership with National Geographic.

Lindblad Expeditions reported revenues of $148.6 million, up 18.5% year on year. This print exceeded analysts’ expectations by 10.2%. Despite the top-line beat, it was still a mixed quarter for the company with full-year revenue guidance exceeding analysts’ expectations but a significant miss of analysts’ adjusted operating income estimates.

Natalya Leahy, Chief Executive Officer, commented, "Experiencing our ships firsthand, I was both humbled and inspired by the truly unmatched adventures we offer, from the most agile and immersive expeditions to the warmth and intimacy of the atmosphere onboard. Lindblad Expeditions pioneered and perfected exploration in the world's most awe-inspiring destinations. 2024 was not only a record year, it was also a foundational one for future growth. With a strengthened Disney/National Geographic relationship, expanded capacity in core markets, and the increased scale of our six-brand portfolio, we are entering 2025 with strong tailwinds. This year, we are focused on driving demand, innovating smartly on costs, and unlocking new portfolio opportunities to further expand our reach and impact."

Lindblad Expeditions pulled off the biggest analyst estimates beat and highest full-year guidance raise of the whole group. Still, the market seems discontent with the results. The stock is down 6% since reporting and currently trades at $9.51.

Is now the time to buy Lindblad Expeditions? Access our full analysis of the earnings results here, it’s free.

Best Q4: Pursuit (NYSE: PRSU)

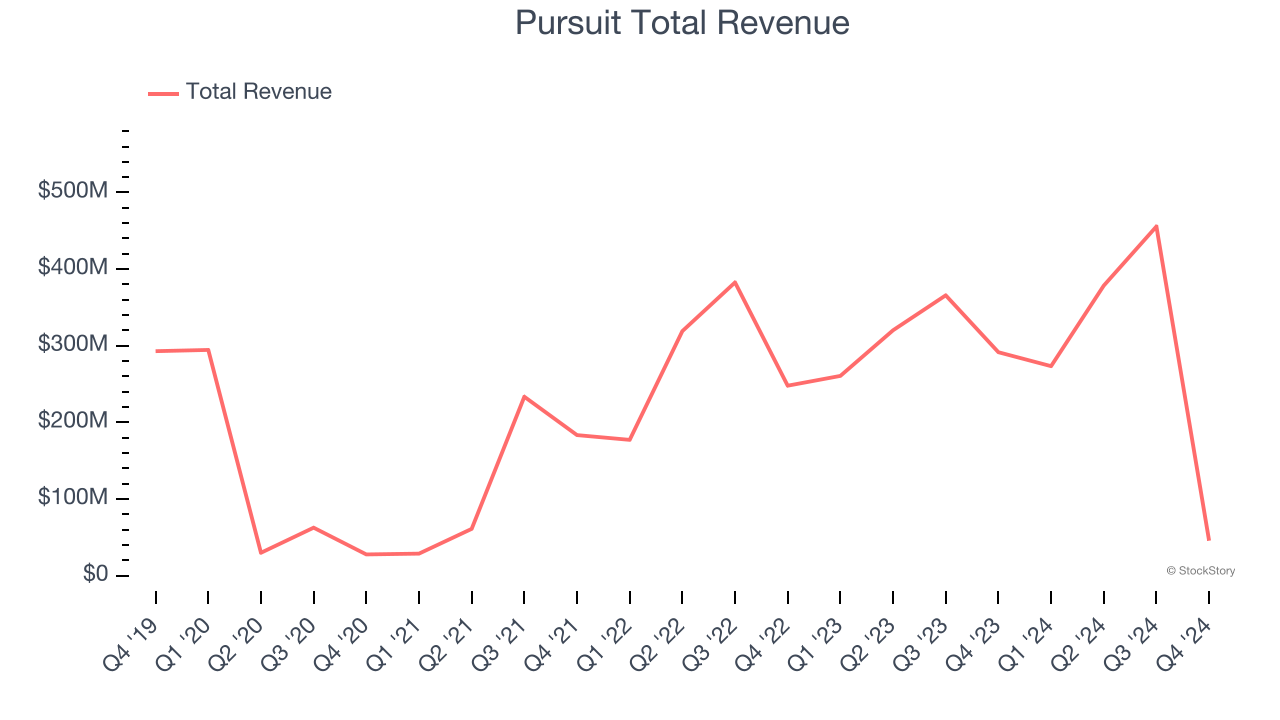

With attractions ranging from glacier tours in the Canadian Rockies to an oceanfront geothermal lagoon in Iceland, Pursuit Attractions and Hospitality (NYSE: PRSU) operates iconic travel experiences, experiential marketing services, and exhibition management across North America and Europe.

Pursuit reported revenues of $45.8 million, down 84.3% year on year, outperforming analysts’ expectations by 8.8%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6% since reporting. It currently trades at $34.91.

Is now the time to buy Pursuit? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Hyatt Hotels (NYSE: H)

Founded in 1957, Hyatt Hotels (NYSE: H) is a global hospitality company with a portfolio of 20 premier brands and over 950 properties across 65 countries.

Hyatt Hotels reported revenues of $1.60 billion, down 3.5% year on year, falling short of analysts’ expectations by 3.1%. It was a softer quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

Hyatt Hotels delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 25.5% since the results and currently trades at $120.86.

Read our full analysis of Hyatt Hotels’s results here.

Playa Hotels & Resorts (NASDAQ: PLYA)

Sporting a roster of beachfront properties, Playa Hotels & Resorts (NASDAQ: PLYA) is an owner, operator, and developer of all-inclusive resorts in prime vacation destinations.

Playa Hotels & Resorts reported revenues of $218.9 million, down 9.7% year on year. This number surpassed analysts’ expectations by 1.3%. Overall, it was a strong quarter as it also logged an impressive beat of analysts’ EPS estimates and a decent beat of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $13.34.

Read our full, actionable report on Playa Hotels & Resorts here, it’s free.

Carnival (NYSE: CCL)

Boasting outrageous amenities like a planetarium on board its ships, Carnival (NYSE: CCL) is one of the world's largest leisure travel companies and a prominent player in the cruise industry.

Carnival reported revenues of $5.81 billion, up 7.5% year on year. This result topped analysts’ expectations by 0.9%. It was a strong quarter as it also put up a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 9.2% since reporting and currently trades at $19.25.

Read our full, actionable report on Carnival here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.