As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the branded pharmaceuticals industry, including Corcept (NASDAQ: CORT) and its peers.

The branded pharmaceutical industry relies on a high-cost, high-reward business model, driven by substantial investments in research and development to create innovative, patent-protected drugs. Successful products can generate significant revenue streams over their patent life, and the larger a roster of drugs, the stronger a moat a company enjoys. However, the business model is inherently risky, with high failure rates during clinical trials, lengthy regulatory approval processes, and intense competition from generic and biosimilar manufacturers once patents expire. These challenges, combined with scrutiny over drug pricing, create a complex operating environment. Looking ahead, the industry is positioned for tailwinds from advancements in precision medicine, increasing adoption of AI to enhance drug development efficiency, and growing global demand for treatments addressing chronic and rare diseases. However, headwinds include heightened regulatory scrutiny, pricing pressures from governments and insurers, and the looming patent cliffs for key blockbuster drugs. Patent cliffs bring about competition from generics, forcing branded pharmaceutical companies back to the drawing board to find the next big thing.

The 11 branded pharmaceuticals stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.3%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

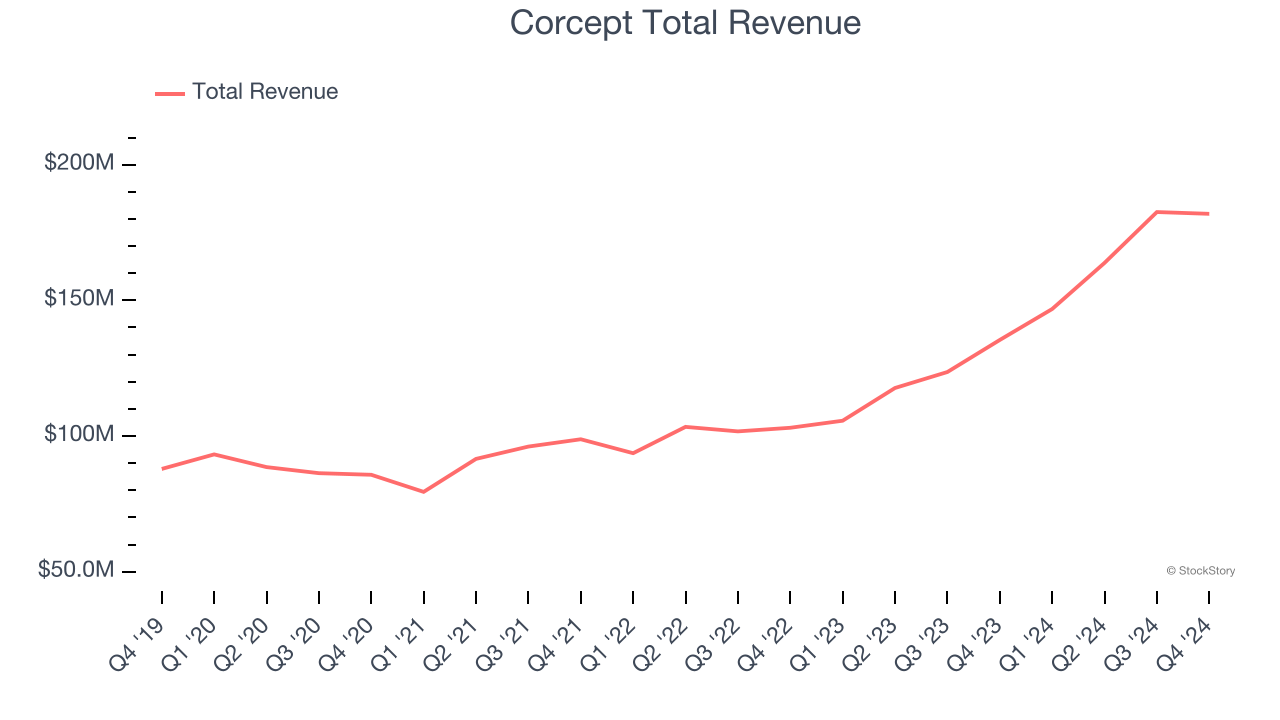

Corcept (NASDAQ: CORT)

Founded in 1998, Corcept Therapeutics (NASDAQ: CORT) develops and commercializes medications for the treatment of severe metabolic, oncologic, and psychiatric disorders associated with cortisol dysregulation.

Corcept reported revenues of $181.9 million, up 34.3% year on year. This print fell short of analysts’ expectations by 8.5%. Overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates.

Corcept achieved the highest full-year guidance raise but had the weakest performance against analyst estimates of the whole group. Still, the market seems discontent with the results. The stock is down 14.5% since reporting and currently trades at $61.46.

Read our full report on Corcept here, it’s free.

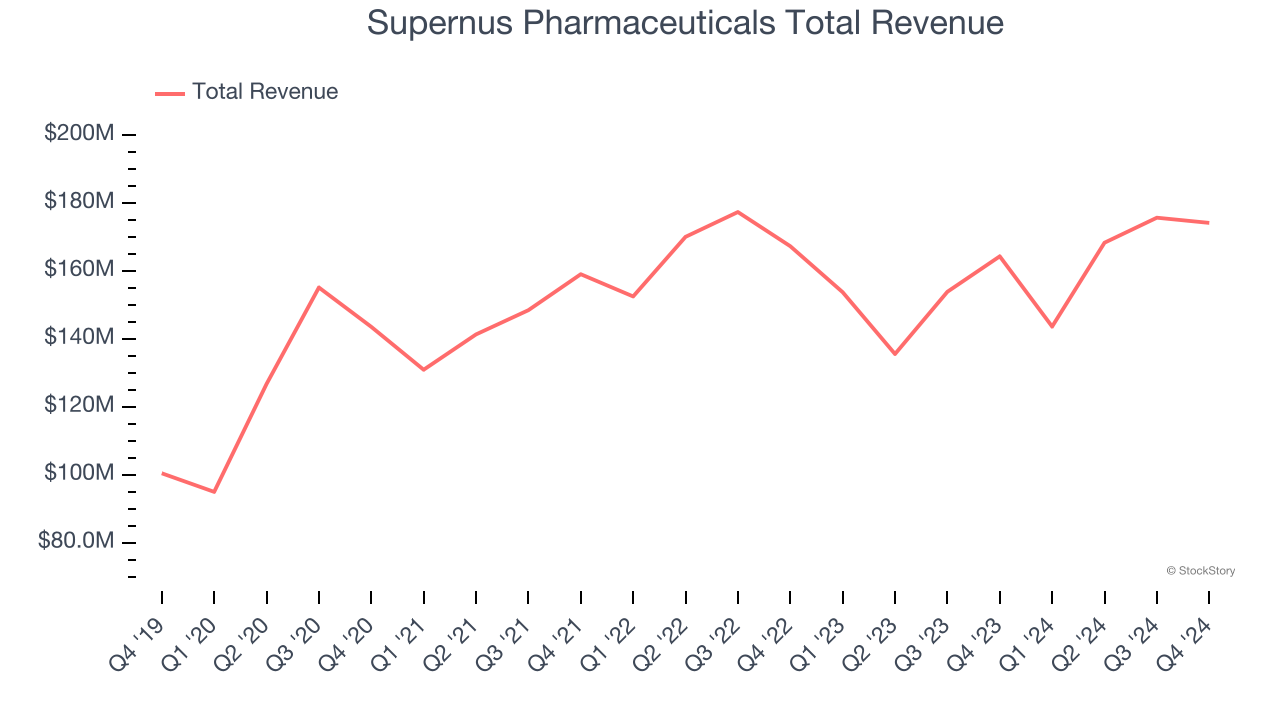

Best Q4: Supernus Pharmaceuticals (NASDAQ: SUPN)

Founded in 2005, Supernus Pharmaceuticals (NASDAQ: SUPN) develops and commercializes treatments for central nervous system (CNS) disorders, focusing on epilepsy, ADHD, and Parkinson’s disease.

Supernus Pharmaceuticals reported revenues of $174.2 million, up 6% year on year, outperforming analysts’ expectations by 12.2%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and full-year operating income guidance topping analysts’ expectations.

Supernus Pharmaceuticals pulled off the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 14.5% since reporting. It currently trades at $28.08.

Is now the time to buy Supernus Pharmaceuticals? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Zoetis (NYSE: ZTS)

Originally a subsidiary of Pfizer, Zoetis (NYSE: ZTS) is an animal health company that develops and distributes medicines, vaccines, and diagnostic products for livestock and pets.

Zoetis reported revenues of $2.32 billion, up 4.7% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a significant miss of analysts’ full-year EPS guidance estimates.

As expected, the stock is down 2.8% since the results and currently trades at $169.01.

Read our full analysis of Zoetis’s results here.

Royalty Pharma (NASDAQ: RPRX)

Founded in 1996, Royalty Pharma (NASDAQ: RPRX) acquires pharmaceutical royalties and funds late-stage clinical trials, offering a unique revenue model centered on financing innovative drug development.

Royalty Pharma reported revenues of $594 million, flat year on year. This number lagged analysts' expectations by 1.9%. All in all, it was a slower quarter for the company.

The stock is up 6.7% since reporting and currently trades at $33.87.

Read our full, actionable report on Royalty Pharma here, it’s free.

Organon (NYSE: OGN)

Founded in 2020, Organon (NYSE: OGN) offers healthcare products focused on women's health.

Organon reported revenues of $1.59 billion, flat year on year. This print beat analysts’ expectations by 0.9%. However, it was a slower quarter as it recorded full-year revenue guidance missing analysts’ expectations.

Organon had the slowest revenue growth among its peers. The stock is down 1.8% since reporting and currently trades at $14.43.

Read our full, actionable report on Organon here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.