Planet Labs has been on fire lately. In the past six months alone, the company’s stock price has rocketed 43.2%, reaching $3.25 per share. This run-up might have investors contemplating their next move.

Is it too late to buy PL? Find out in our full research report, it’s free.

Why Are We Positive On PL?

Pioneering the concept of "agile aerospace" with hundreds of small but powerful satellites, Planet Labs (NYSE: PL) operates the world's largest fleet of Earth observation satellites, capturing daily images of our planet to provide insights on deforestation, agriculture, and climate change.

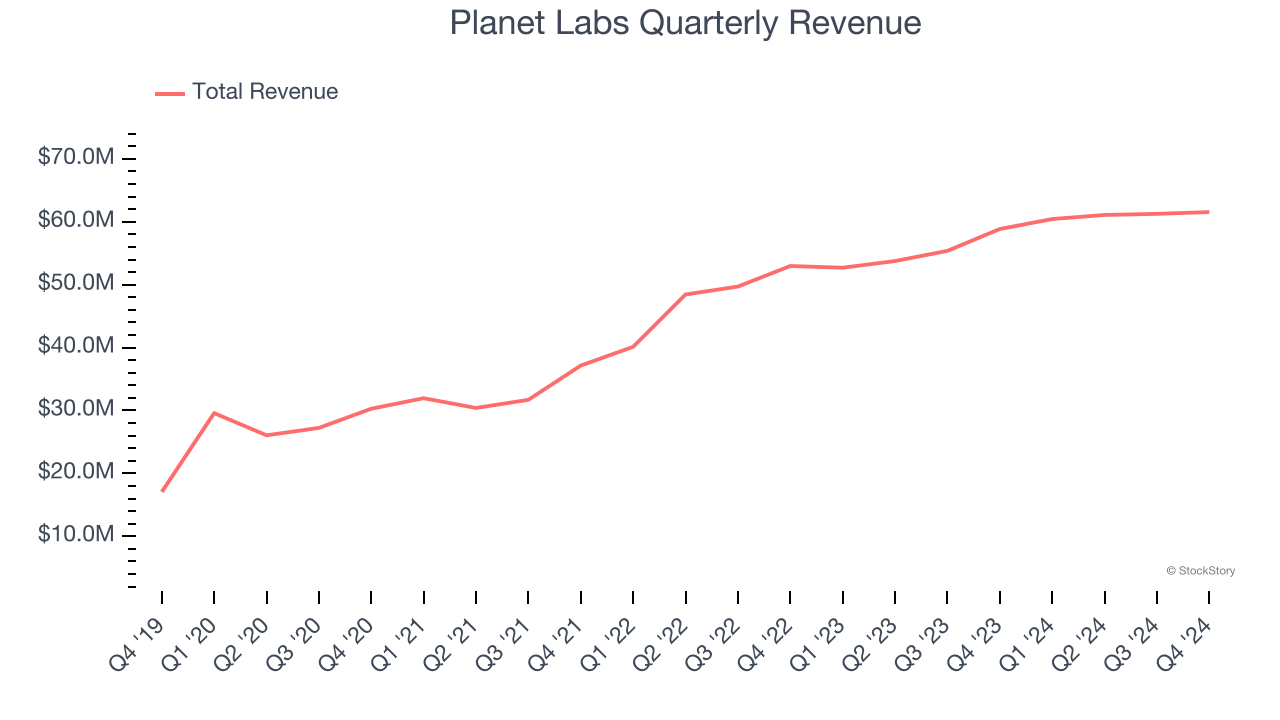

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Luckily, Planet Labs’s sales grew at an incredible 20.6% compounded annual growth rate over the last five years. Its growth beat the average business services company and shows its offerings resonate with customers.

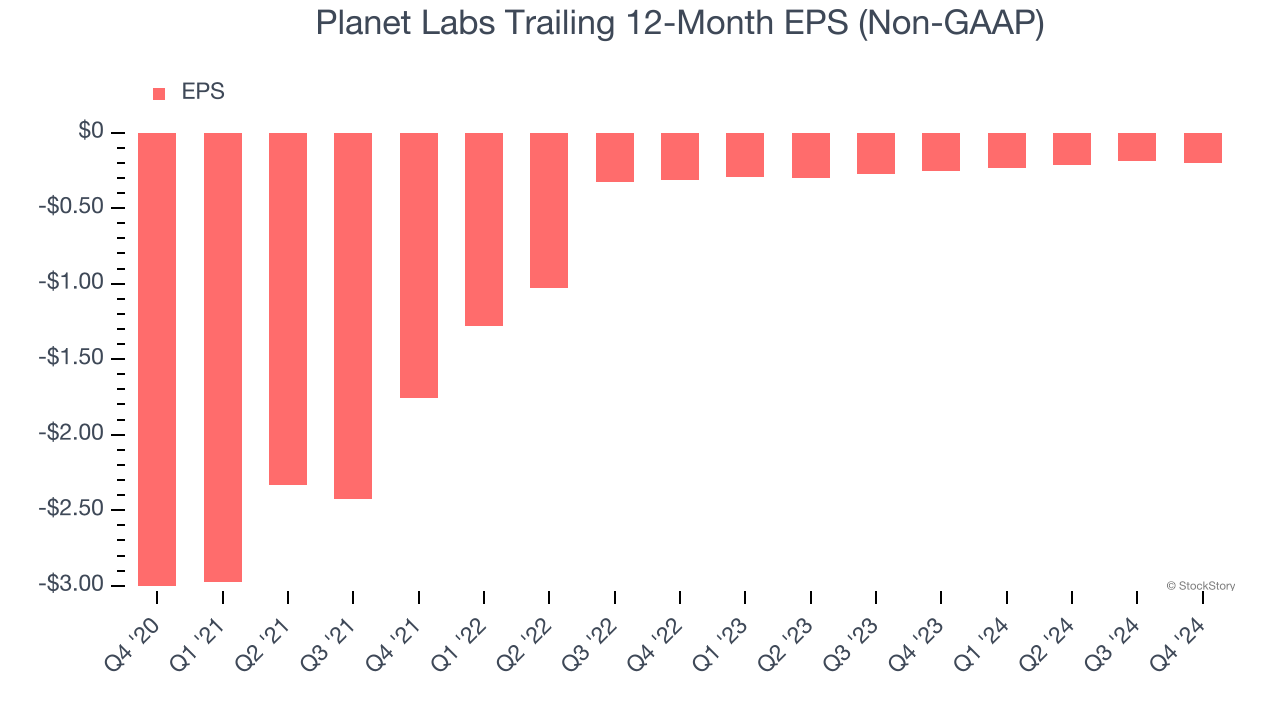

2. EPS Improving Significantly

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Although Planet Labs’s full-year earnings are still negative, it reduced its losses and improved its EPS by 49% annually over the last four years. The next few quarters will be critical for assessing its long-term profitability. An inflection point could be coming soon.

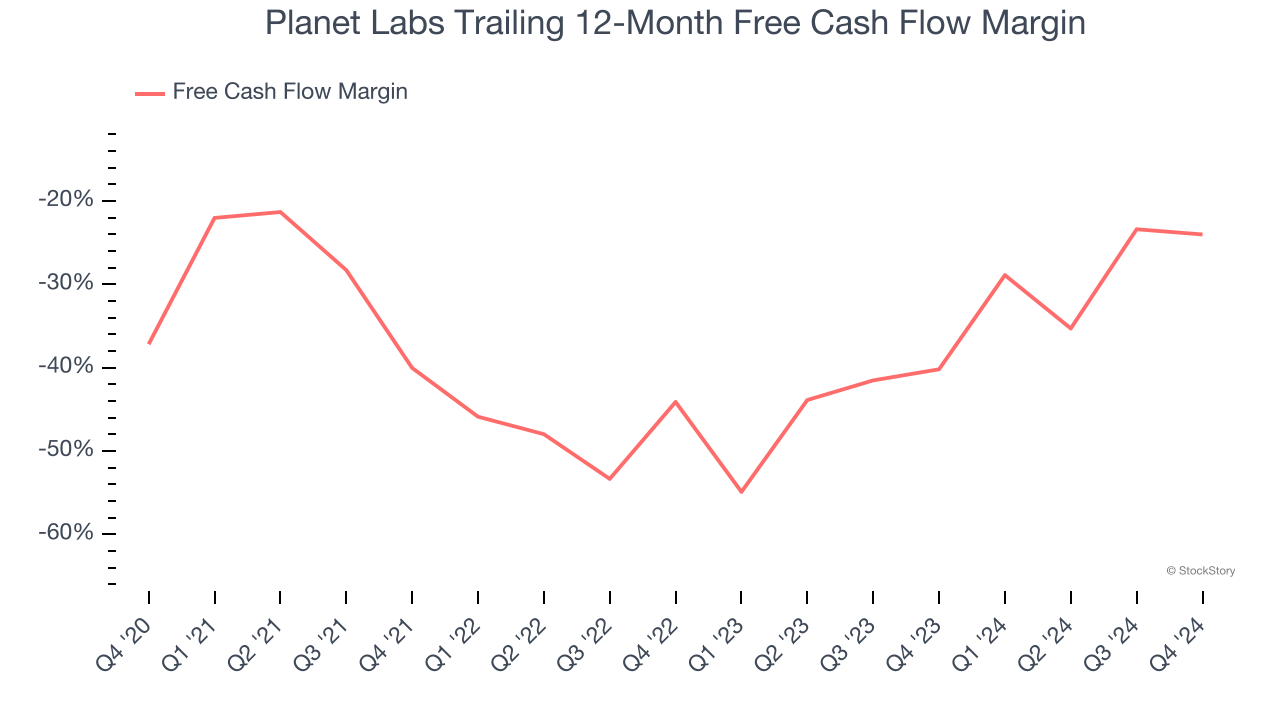

3. Increasing Free Cash Flow Margin Juices Financials

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, Planet Labs’s margin expanded by 13.2 percentage points over the last five years. Planet Labs’s free cash flow margin for the trailing 12 months was negative 24%, and continued increases could help it achieve long-term cash profitability.

Final Judgment

These are just a few reasons why we think Planet Labs is an elite business services company, and with the recent rally, the stock trades at 67.1× forward EV-to-EBITDA (or $3.25 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Planet Labs

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.