What a brutal six months it’s been for Scholastic. The stock has dropped 40.1% and now trades at a new 52-week low of $16.01, rattling many shareholders. This may have investors wondering how to approach the situation.

Is now the time to buy Scholastic, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even though the stock has become cheaper, we're cautious about Scholastic. Here are three reasons why SCHL doesn't excite us and a stock we'd rather own.

Why Is Scholastic Not Exciting?

Creator of the legendary Scholastic Book Fair, Scholastic (NASDAQ: SCHL) is an international company specializing in children's publishing, education, and media services.

1. Long-Term Revenue Growth Flatter Than a Pancake

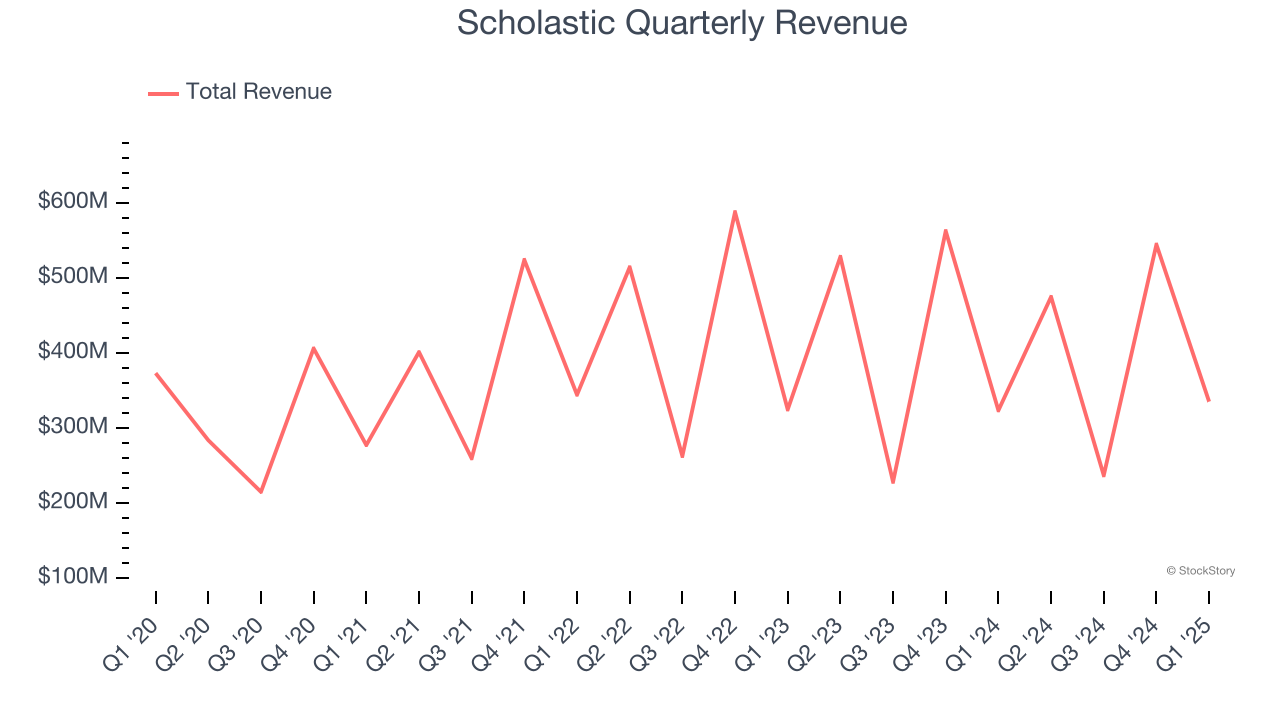

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Scholastic struggled to consistently increase demand as its $1.59 billion of sales for the trailing 12 months was close to its revenue five years ago. This was below our standards and signals it’s a lower quality business.

2. Weak Operating Margin Could Cause Trouble

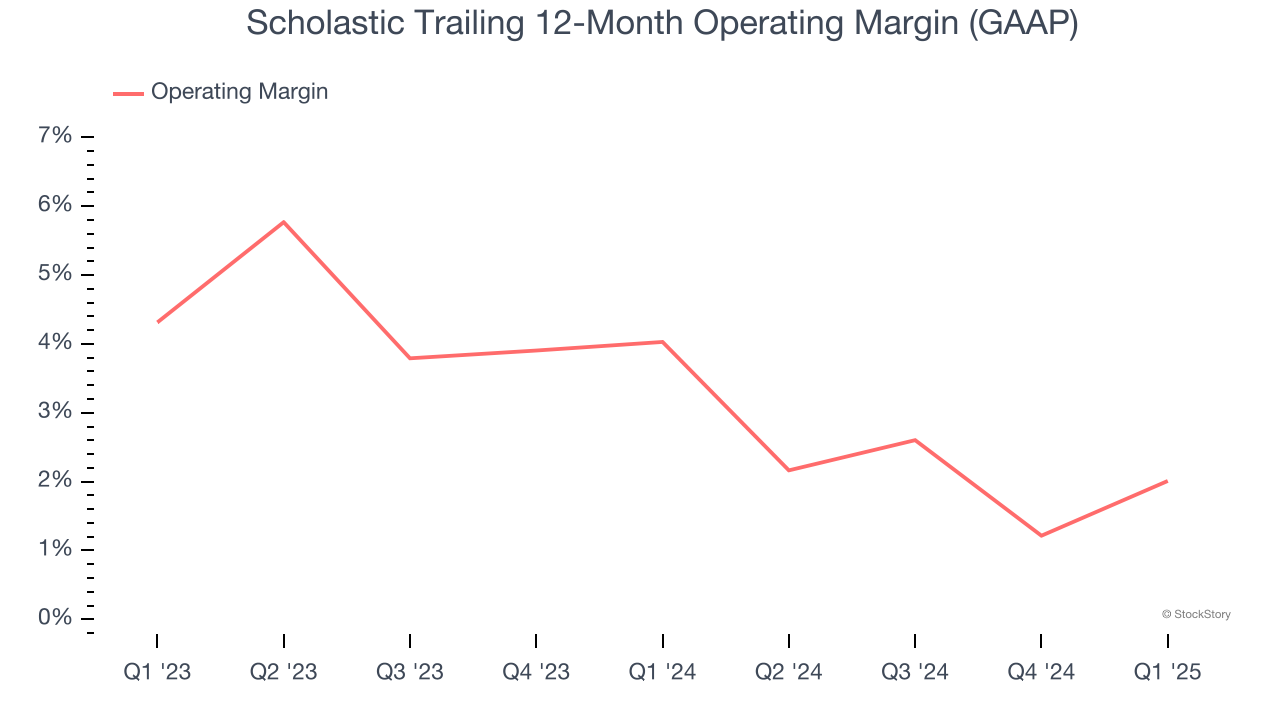

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Scholastic’s operating margin has shrunk over the last 12 months and averaged 3% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

3. Previous Growth Initiatives Haven’t Impressed

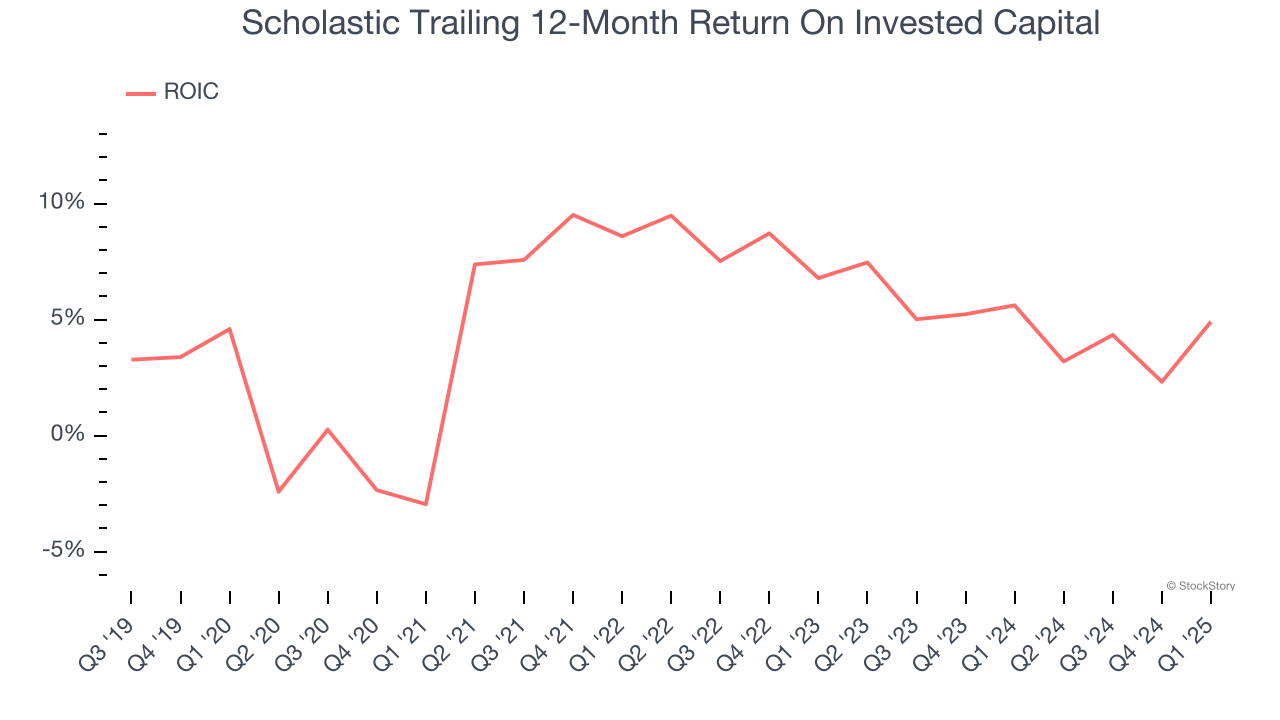

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Scholastic historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.6%, lower than the typical cost of capital (how much it costs to raise money) for consumer discretionary companies.

Final Judgment

Scholastic’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 9.5× forward price-to-earnings (or $16.01 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than Scholastic

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.