Interpublic Group has gotten torched over the last six months - since October 2024, its stock price has dropped 20.5% to $25.03 per share. This was partly driven by its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Interpublic Group, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Even with the cheaper entry price, we're cautious about Interpublic Group. Here are three reasons why we avoid IPG and a stock we'd rather own.

Why Do We Think Interpublic Group Will Underperform?

With a history dating back to 1902 and roots in the McCann-Erickson agency, Interpublic Group (NYSE: IPG) is a marketing and communications holding company that owns agencies specializing in advertising, media buying, public relations, and digital marketing services.

1. Core Business Falling Behind as Demand Plateaus

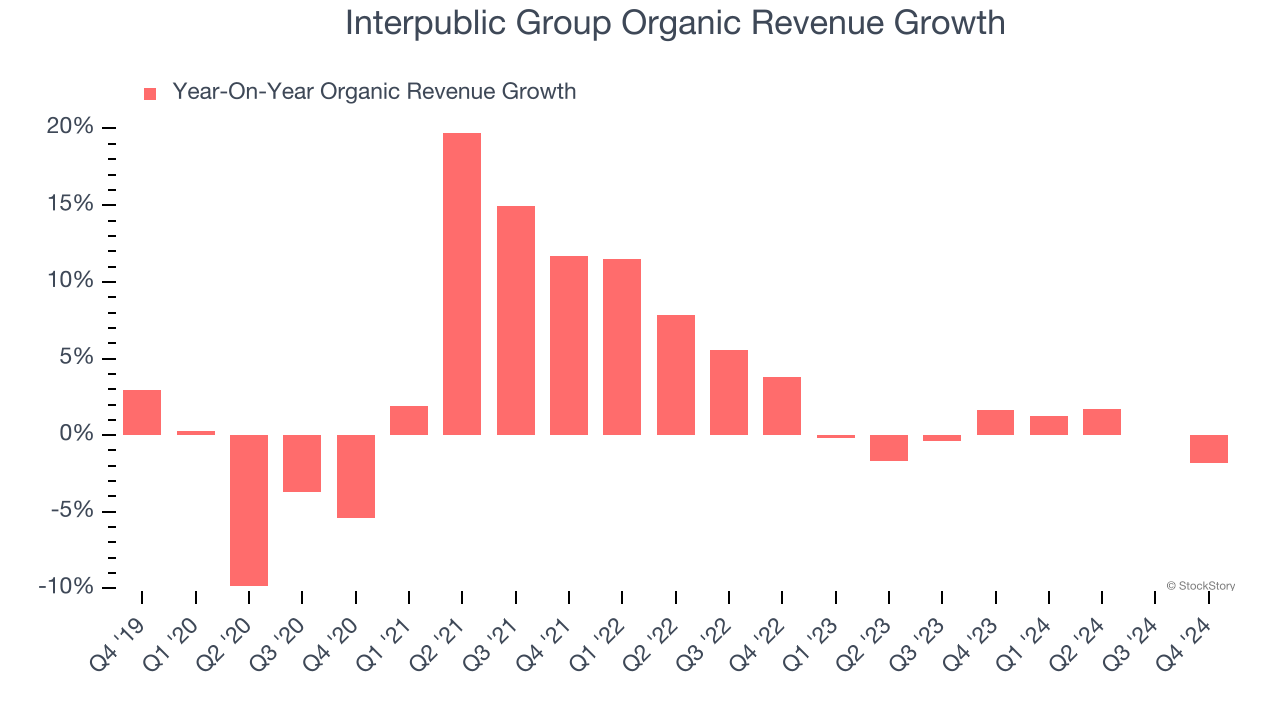

We can better understand Advertising & Marketing Services companies by analyzing their organic revenue. This metric gives visibility into Interpublic Group’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Interpublic Group failed to grow its organic revenue. This performance was underwhelming and implies it may need to improve its products, pricing, or go-to-market strategy. It also suggests Interpublic Group might have to lean into acquisitions to accelerate growth, which isn’t ideal because M&A can be expensive and risky (integrations often disrupt focus).

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Interpublic Group’s revenue to drop by 5.7%, a decrease from its 1.4% annualized declines for the past two years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

3. Free Cash Flow Margin Dropping

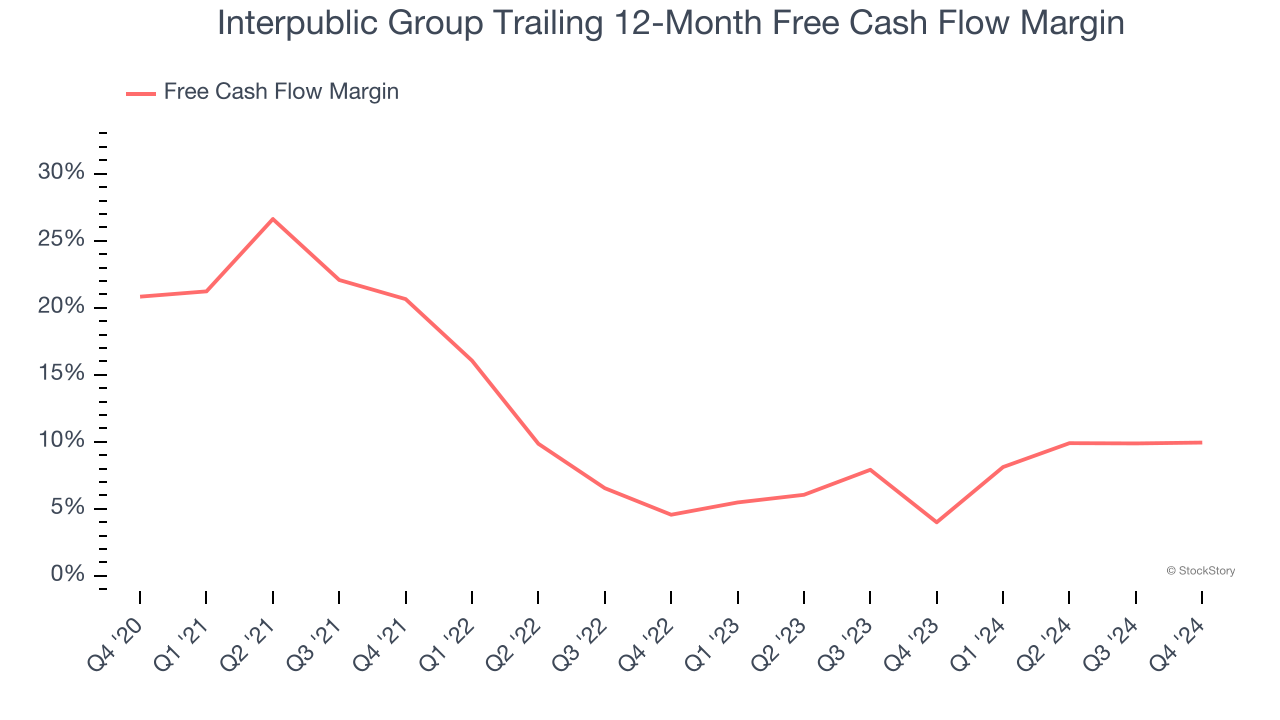

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Interpublic Group’s margin dropped by 10.9 percentage points over the last five years. It may have ticked higher more recently, but shareholders are likely hoping for its margin to at least revert to its historical level. If the longer-term trend returns, it could signal increasing investment needs and capital intensity. Interpublic Group’s free cash flow margin for the trailing 12 months was 9.9%.

Final Judgment

We see the value of companies helping consumers, but in the case of Interpublic Group, we’re out. After the recent drawdown, the stock trades at 9.2× forward price-to-earnings (or $25.03 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are more exciting stocks to buy at the moment. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of Interpublic Group

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.