What a brutal six months it’s been for Amphastar Pharmaceuticals. The stock has dropped 50.3% and now trades at $24.50, rattling many shareholders. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now the time to buy AMPH? Find out in our full research report, it’s free.

Why Does Amphastar Pharmaceuticals Spark Debate?

Founded in 1996 and known for its expertise in complex drug formulations, Amphastar Pharmaceuticals (NASDAQ: AMPH) develops and manufactures technically challenging injectable and inhalation medications, including both generic and proprietary pharmaceutical products.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

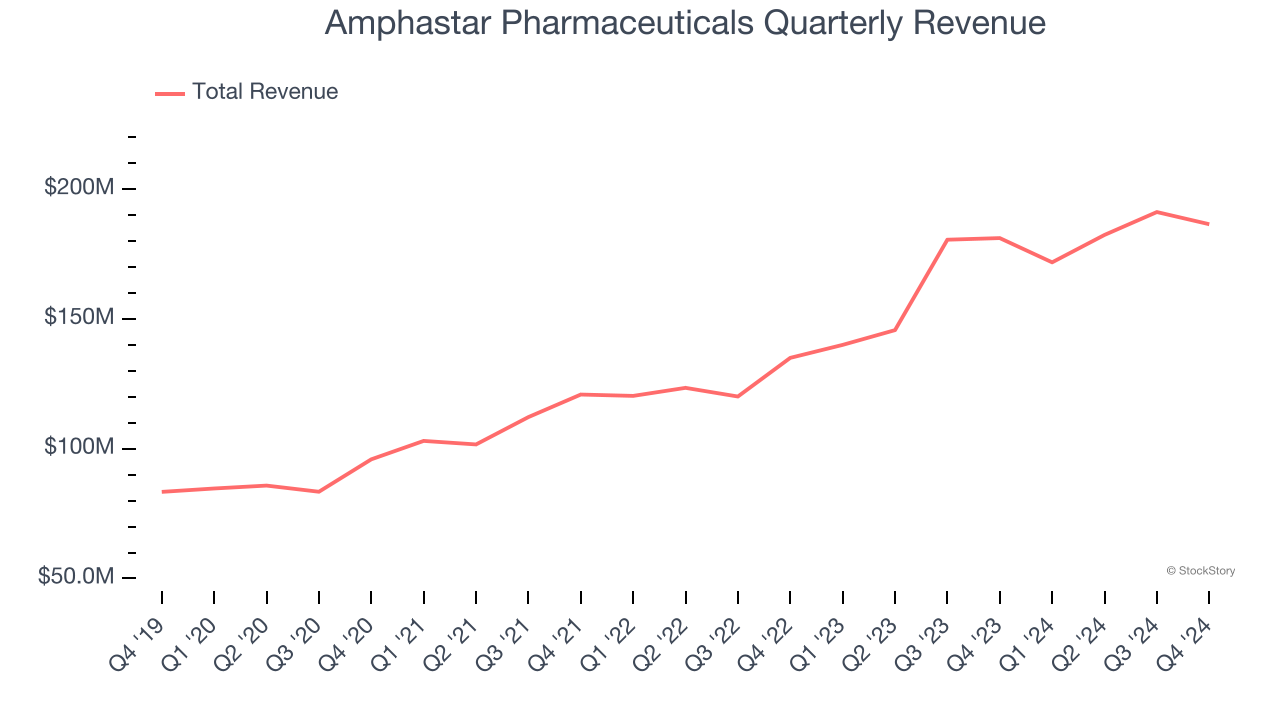

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Amphastar Pharmaceuticals grew its sales at an impressive 17.8% compounded annual growth rate. Its growth surpassed the average healthcare company and shows its offerings resonate with customers.

2. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Amphastar Pharmaceuticals’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

One Reason to be Careful:

Fewer Distribution Channels Limit its Ceiling

Larger companies benefit from economies of scale, where fixed costs like infrastructure, technology, and administration are spread over a higher volume of goods or services, reducing the cost per unit. Scale can also lead to bargaining power with suppliers, greater brand recognition, and more investment firepower. A virtuous cycle can ensue if a scaled company plays its cards right.

With just $732 million in revenue over the past 12 months, Amphastar Pharmaceuticals is a small company in an industry where scale matters. This makes it difficult to build trust with customers because healthcare is heavily regulated, complex, and resource-intensive. On the bright side, Amphastar Pharmaceuticals’s smaller revenue base allows it to grow faster if it can execute well.

Final Judgment

Amphastar Pharmaceuticals’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 6.5× forward price-to-earnings (or $24.50 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Amphastar Pharmaceuticals

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.