While the broader market has struggled with the S&P 500 down 6.9% since October 2024, Planet Fitness has surged ahead as its stock price has climbed by 17.2% to $97.01 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Planet Fitness, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

We’re happy investors have made money, but we don't have much confidence in Planet Fitness. Here are three reasons why you should be careful with PLNT and a stock we'd rather own.

Why Is Planet Fitness Not Exciting?

Founded by two brothers who purchased a struggling gym, Planet Fitness (NYSE: PLNT) is a gym franchise that caters to casual fitness users by providing a friendly and inclusive atmosphere.

1. Same-Store Sales Falling Behind Peers

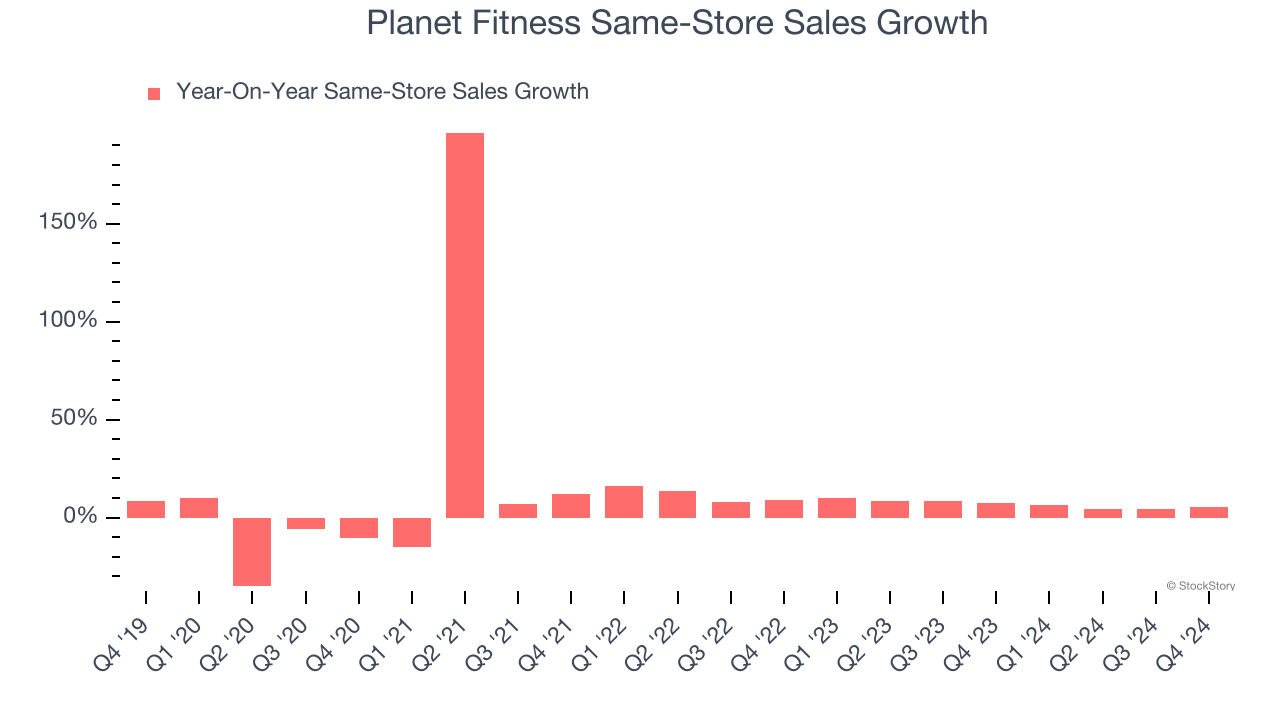

Investors interested in Leisure Facilities companies should track same-store sales in addition to reported revenue. This metric measures the change in sales at brick-and-mortar locations that have existed for at least a year, giving visibility into Planet Fitness’s underlying demand characteristics.

Over the last two years, Planet Fitness’s same-store sales averaged 6.9% year-on-year growth. This performance was underwhelming and suggests it might have to change its strategy or pricing, which can disrupt operations.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Planet Fitness’s revenue to rise by 10.4%, a slight deceleration versus its 12.3% annualized growth for the past two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Planet Fitness’s ROIC averaged 3.5 percentage point decreases over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Planet Fitness isn’t a terrible business, but it doesn’t pass our quality test. With its shares beating the market recently, the stock trades at 33.3× forward price-to-earnings (or $97.01 per share). At this valuation, there’s a lot of good news priced in - you can find better investment opportunities elsewhere. We’d suggest looking at our favorite semiconductor picks and shovels play.

Stocks We Would Buy Instead of Planet Fitness

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.