The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how beverages, alcohol, and tobacco stocks fared in Q4, starting with Altria (NYSE: MO).

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the rise of cannabis, craft beer, and vaping or the steady decline of soda and cigarettes. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

The 16 beverages, alcohol, and tobacco stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was 0.6% below.

In light of this news, share prices of the companies have held steady as they are up 4.5% on average since the latest earnings results.

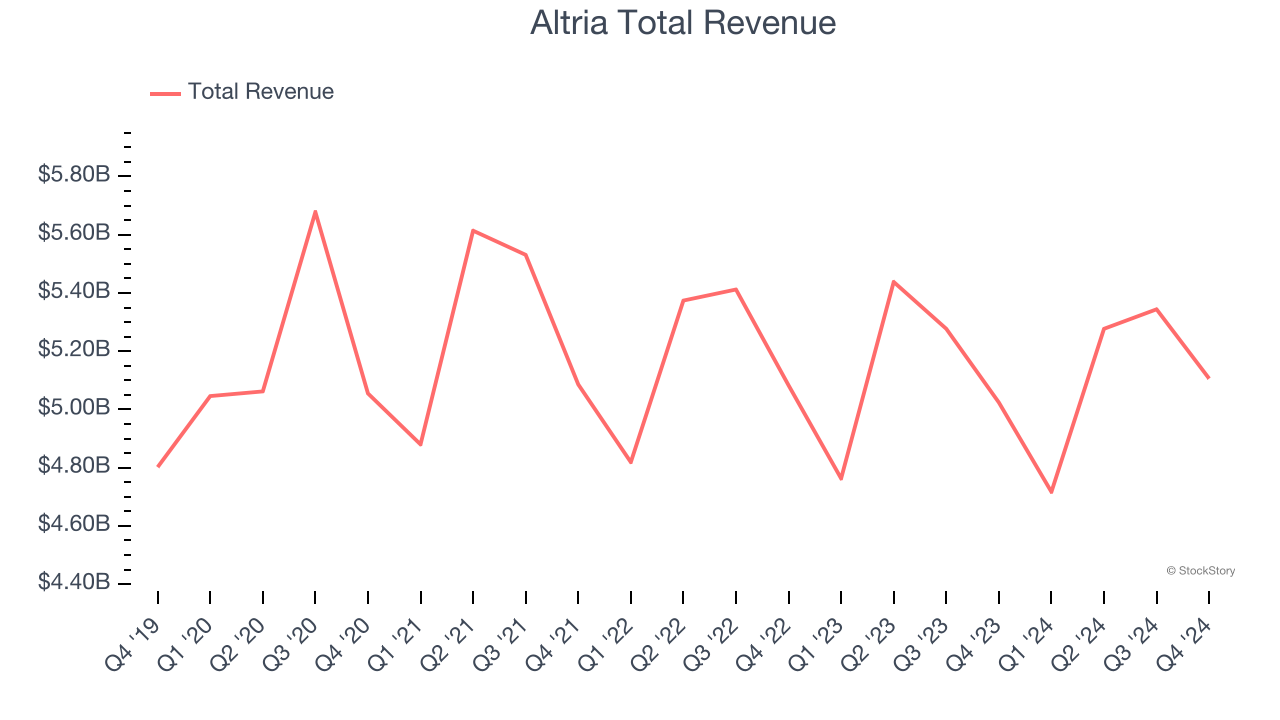

Altria (NYSE: MO)

Best known for its Marlboro brand of cigarettes, Altria (NYSE: MO) offers tobacco and nicotine products.

Altria reported revenues of $5.11 billion, up 1.6% year on year. This print exceeded analysts’ expectations by 0.6%. Despite the top-line beat, it was still a mixed quarter for the company with a narrow beat of analysts’ EPS estimates but a miss of analysts’ EBITDA estimates.

“2024 was another pivotal year for Altria, headlined by meaningful progress toward our Vision, strong financial results and significant cash returns to shareholders,” said Billy Gifford, Altria’s Chief Executive Officer.

The stock is up 8.9% since reporting and currently trades at $57.35.

Is now the time to buy Altria? Access our full analysis of the earnings results here, it’s free.

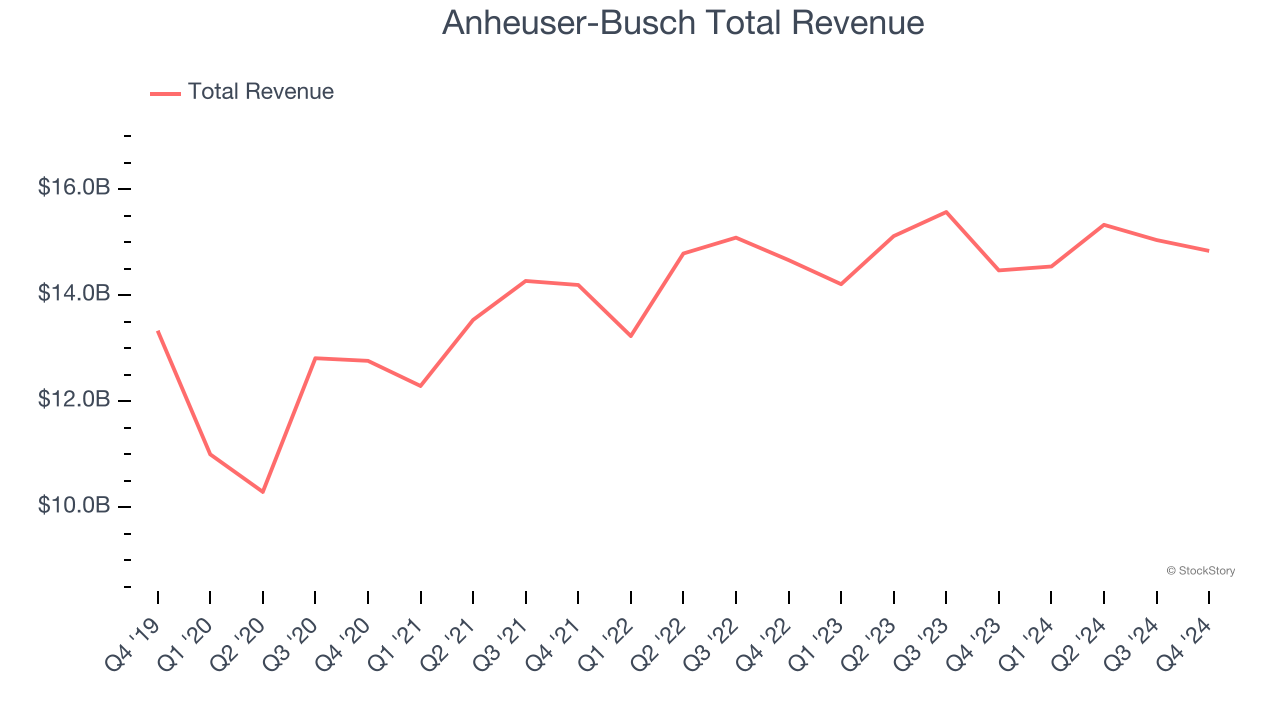

Best Q4: Anheuser-Busch (NYSE: BUD)

Born out of a complicated web of mergers and acquisitions, Anheuser-Busch InBev (NYSE: BUD) boasts a powerhouse beer portfolio of Budweiser, Stella Artois, Corona, and local favorites around the world.

Anheuser-Busch reported revenues of $14.84 billion, up 2.5% year on year, outperforming analysts’ expectations by 5.5%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 15.6% since reporting. It currently trades at $63.28.

Is now the time to buy Anheuser-Busch? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Brown-Forman (NYSE: BF.B)

Best known for its Jack Daniel’s whiskey, Brown-Forman (NYSE: BF.B) is an alcoholic beverage company with a broad portfolio of brands in wines and spirits.

Brown-Forman reported revenues of $1.04 billion, down 3.2% year on year, falling short of analysts’ expectations by 3.5%. It was a slower quarter as it posted a miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 9.6% since the results and currently trades at $34.45.

Read our full analysis of Brown-Forman’s results here.

Philip Morris (NYSE: PM)

Founded in 1847, Philip Morris International (NYSE: PM) manufactures and sells a wide range of tobacco and nicotine-containing products, including cigarettes, heated tobacco products, and oral nicotine pouches.

Philip Morris reported revenues of $9.71 billion, up 7.3% year on year. This number surpassed analysts’ expectations by 2.8%. Overall, it was a strong quarter as it also put up an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ gross margin estimates.

The stock is up 20.6% since reporting and currently trades at $158.04.

Read our full, actionable report on Philip Morris here, it’s free.

Vita Coco (NASDAQ: COCO)

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ: COCO) offers coconut water products that are a natural way to quench thirst.

Vita Coco reported revenues of $127.3 million, up 19.9% year on year. This result beat analysts’ expectations by 4.4%. It was a very strong quarter as it also logged a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Vita Coco achieved the fastest revenue growth and highest full-year guidance raise among its peers. The stock is down 17.1% since reporting and currently trades at $31.71.

Read our full, actionable report on Vita Coco here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.