Earnings results often indicate what direction a company will take in the months ahead. With Q4 behind us, let’s have a look at Exact Sciences (NASDAQ: EXAS) and its peers.

Over the next few years, immuno-oncology companies, which harness the immune system to fight illnesses such as cancer, faces strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 4 immuno-oncology stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 3.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.6% since the latest earnings results.

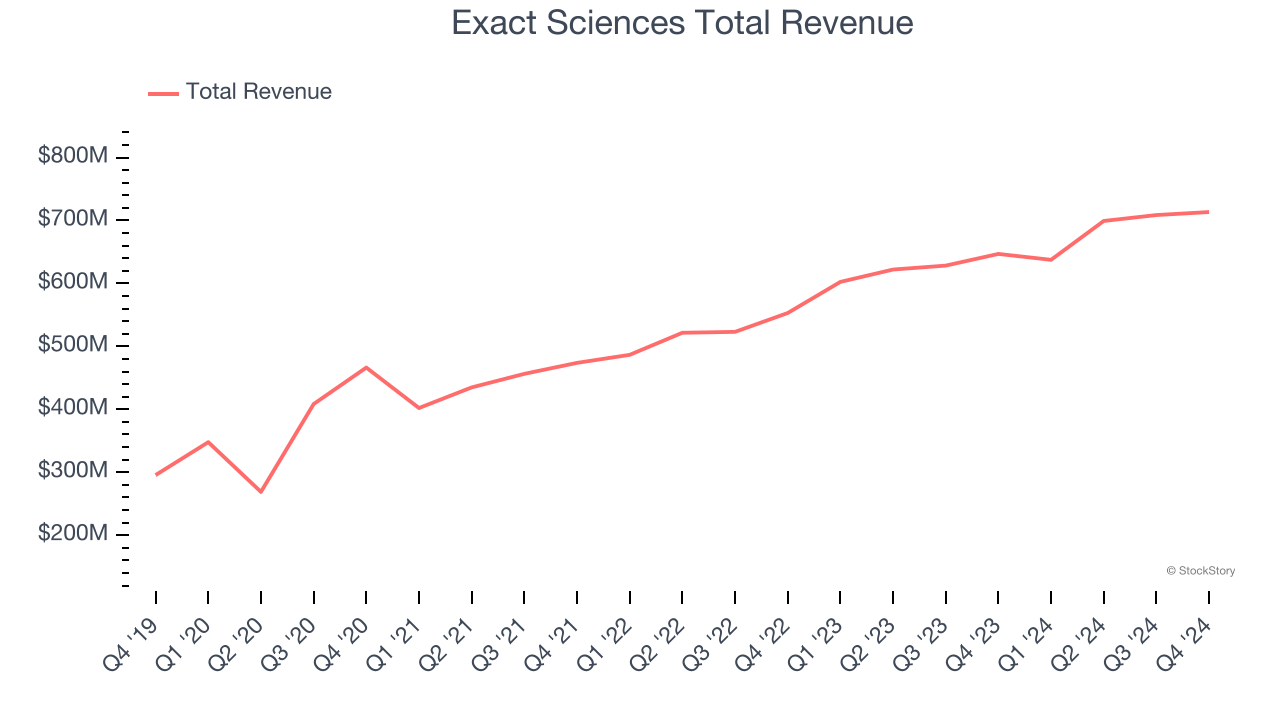

Exact Sciences (NASDAQ: EXAS)

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ: EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

Exact Sciences reported revenues of $713.4 million, up 10.3% year on year. This print exceeded analysts’ expectations by 1.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ constant currency revenue estimates and a solid beat of analysts’ EPS estimates.

“The Exact Sciences team is off to a good start in 2025, building on the momentum we created in the fourth quarter,” said Kevin Conroy, Chairman and CEO of Exact Sciences.

Exact Sciences delivered the slowest revenue growth and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 11.4% since reporting and currently trades at $44.69.

Is now the time to buy Exact Sciences? Access our full analysis of the earnings results here, it’s free.

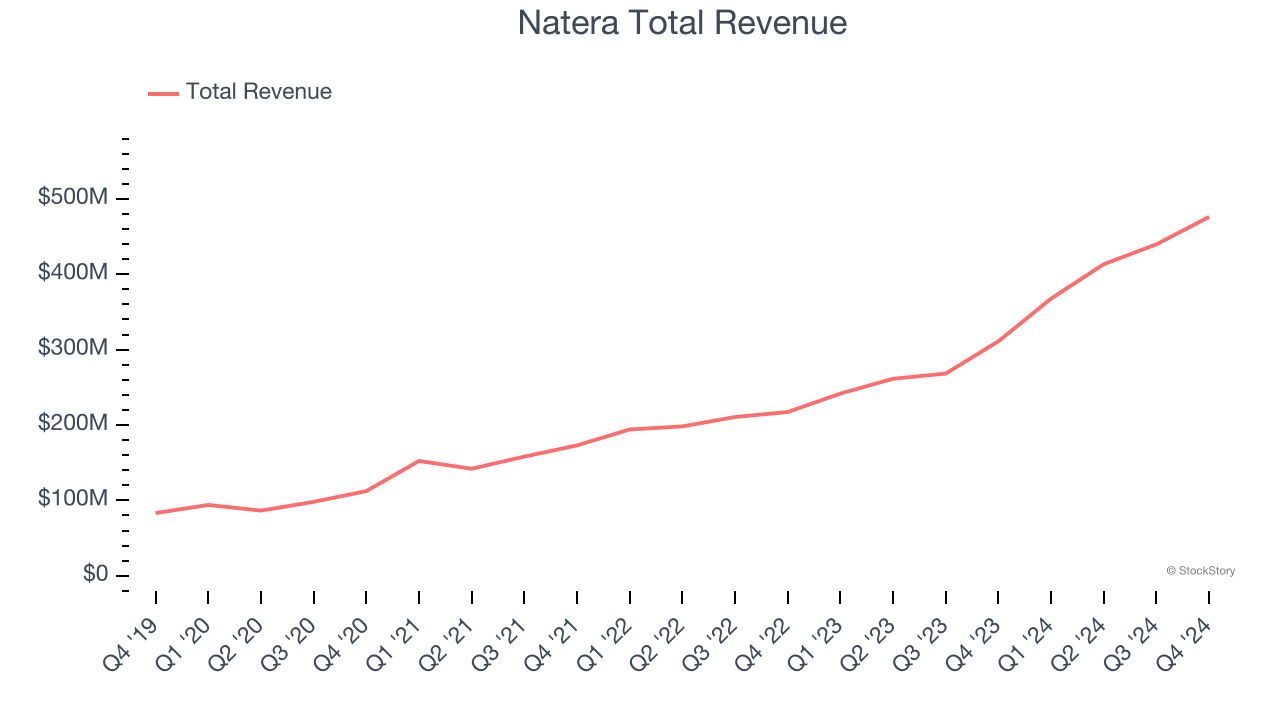

Best Q4: Natera (NASDAQ: NTRA)

Founded in 2003 as Gene Security Network before rebranding in 2012, Natera (NASDAQ: NTRA) develops and commercializes genetic tests for prenatal screening, cancer detection, and organ transplant monitoring using its proprietary cell-free DNA technology.

Natera reported revenues of $476.1 million, up 53% year on year, outperforming analysts’ expectations by 8.6%. The business had a stunning quarter with an impressive beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

Natera pulled off the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise among its peers. The stock is down 5.6% since reporting. It currently trades at $147.91.

Is now the time to buy Natera? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Incyte (NASDAQ: INCY)

Founded in 1991 and evolving from a genomics research firm to a commercial-stage drug developer, Incyte (NASDAQ: INCY) is a biopharmaceutical company that discovers, develops, and commercializes proprietary therapeutics for cancer and inflammatory diseases.

Incyte reported revenues of $1.18 billion, up 16.3% year on year, exceeding analysts’ expectations by 3%. Still, it was a slower quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 19.7% since the results and currently trades at $59.56.

Read our full analysis of Incyte’s results here.

Regeneron (NASDAQ: REGN)

Founded by scientists who wanted to build a company where science could thrive, Regeneron Pharmaceuticals (NASDAQ: REGN) develops and commercializes medicines for serious diseases, with key products treating eye conditions, allergic diseases, cancer, and other disorders.

Regeneron reported revenues of $3.79 billion, up 10.3% year on year. This number beat analysts’ expectations by 1%. Overall, it was a strong quarter as it also recorded a decent beat of analysts’ EPS estimates.

Regeneron had the weakest performance against analyst estimates among its peers. The stock is down 13.8% since reporting and currently trades at $574.

Read our full, actionable report on Regeneron here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.