Since April 2020, the S&P 500 has delivered a total return of 91.3%. But one standout stock has more than doubled the market - over the past five years, Republic Services has surged 213% to $242.06 per share. Its momentum hasn’t stopped as it’s also gained 17.8% in the last six months thanks to its solid quarterly results, beating the S&P by 26.1%.

Following the strength, is RSG a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does Republic Services Spark Debate?

Processing several million tons of recyclables annually, Republic (NYSE: RSG) provides waste management services for residences, companies, and municipalities.

Two Things to Like:

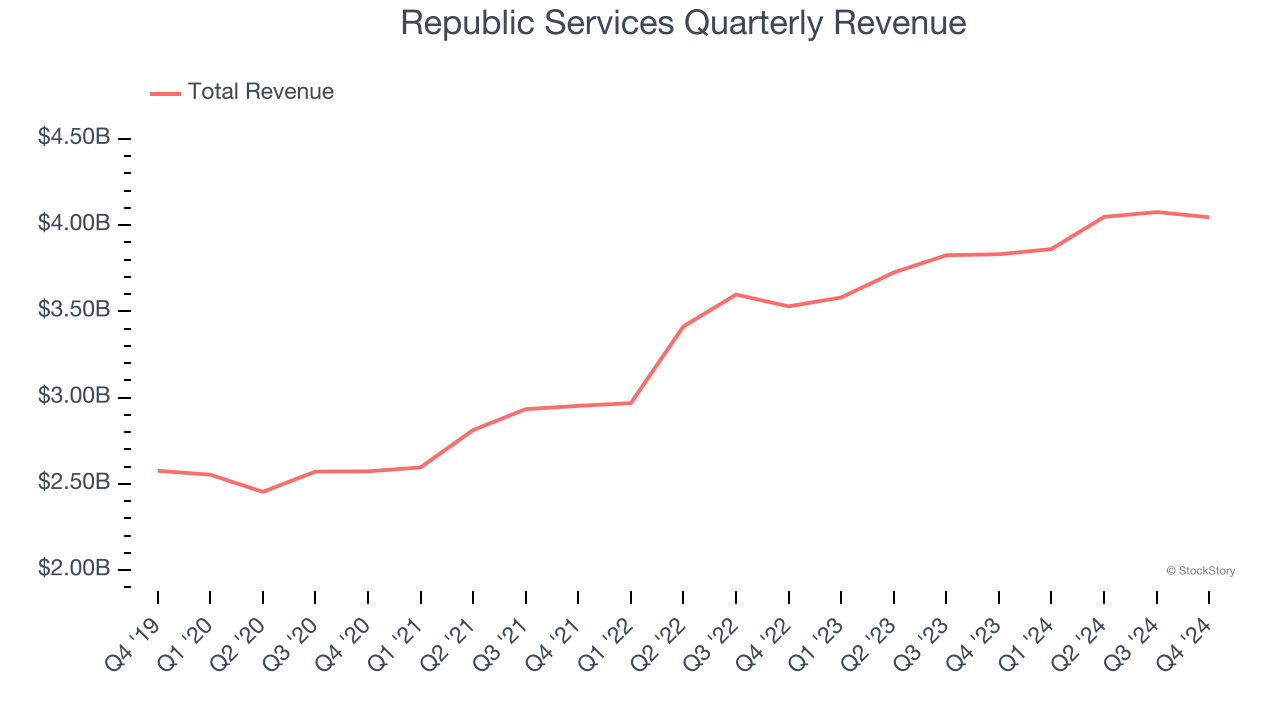

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Republic Services’s 9.3% annualized revenue growth over the last five years was solid. Its growth beat the average industrials company and shows its offerings resonate with customers.

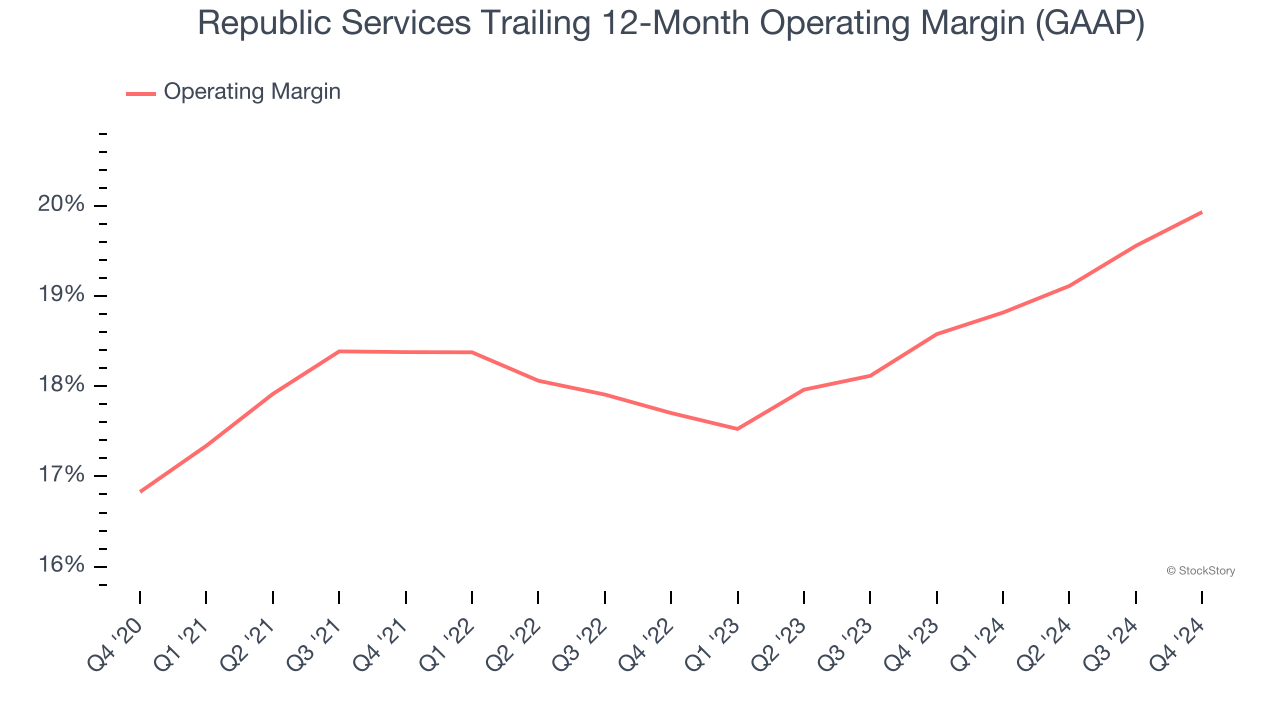

2. Operating Margin Reveals a Well-Run Organization

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Republic Services has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 18.4%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

One Reason to be Careful:

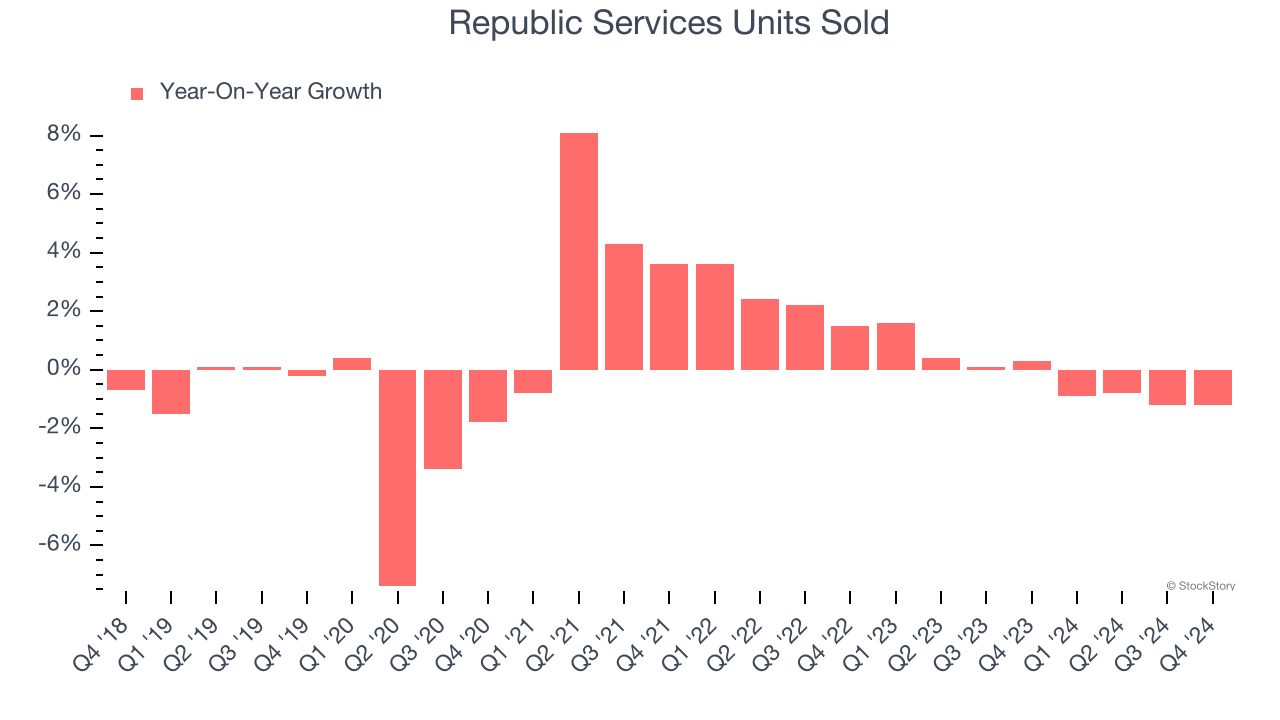

Sales Volumes Stall, Demand Waning

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Waste Management company because there’s a ceiling to what customers will pay.

Over the last two years, Republic Services failed to grow its units sold. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Republic Services might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

Final Judgment

Republic Services’s merits more than compensate for its flaws, and with its shares beating the market recently, the stock trades at 36× forward price-to-earnings (or $242.06 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Republic Services

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.