Hubbell has gotten torched over the last six months - since October 2024, its stock price has dropped 22.3% to $332.12 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Given the weaker price action, is now the time to buy HUBB? Find out in our full research report, it’s free.

Why Does Hubbell Spark Debate?

A respected player in the electrical segment, Hubbell (NYSE: HUBB) manufactures electronic products for the construction, industrial, utility, and telecommunications markets.

Two Things to Like:

1. Operating Margin Rising, Profits Up

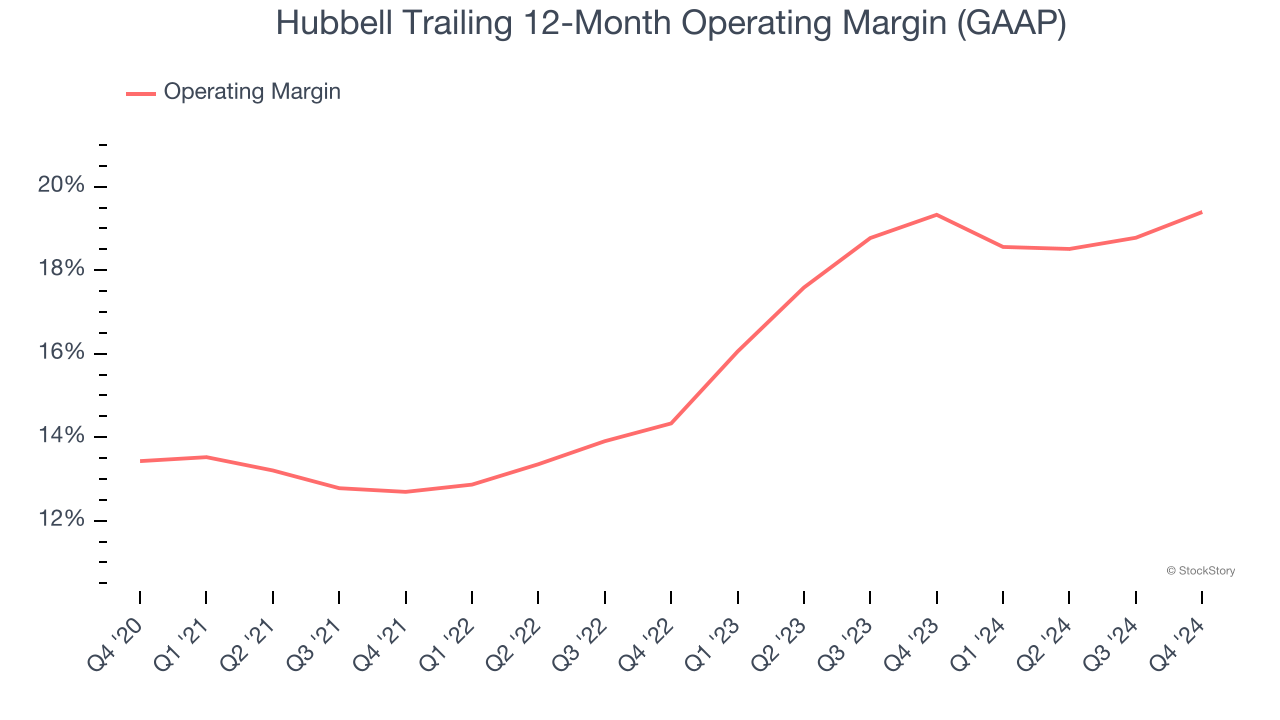

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Analyzing the trend in its profitability, Hubbell’s operating margin rose by 6 percentage points over the last five years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 19.4%.

2. Outstanding Long-Term EPS Growth

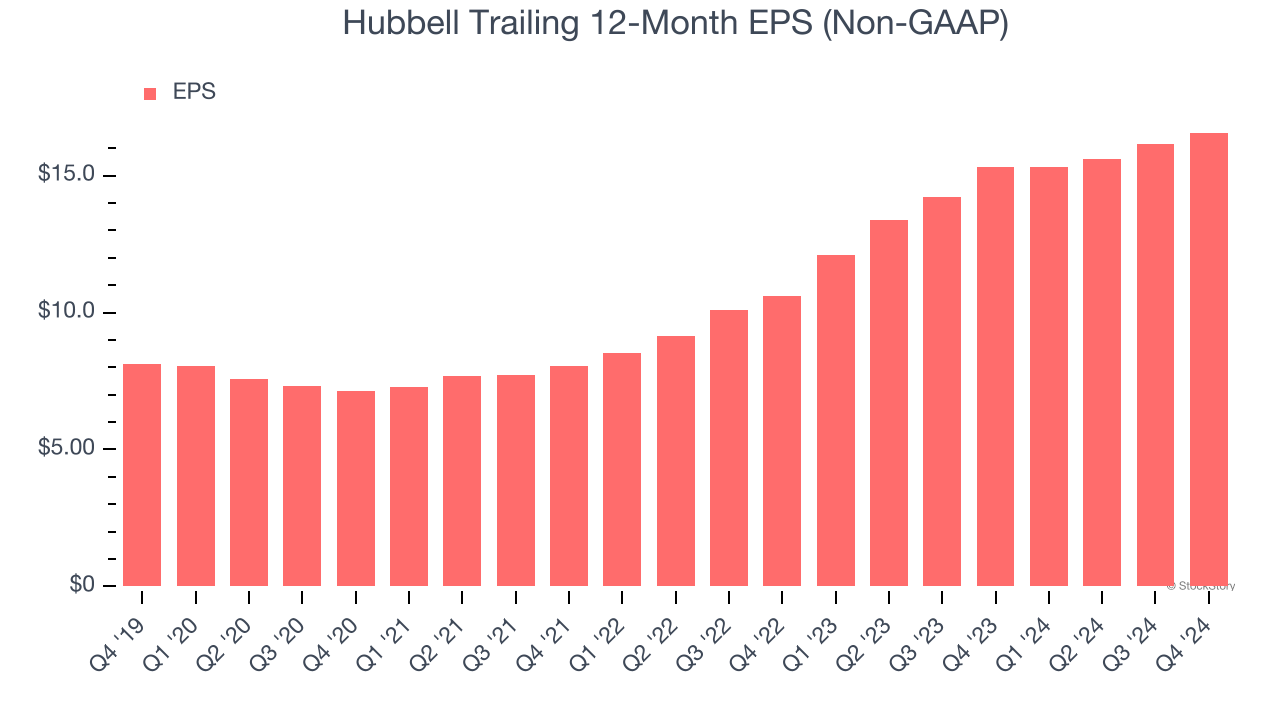

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Hubbell’s EPS grew at a spectacular 15.3% compounded annual growth rate over the last five years, higher than its 4.2% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Slow Organic Growth Suggests Waning Demand In Core Business

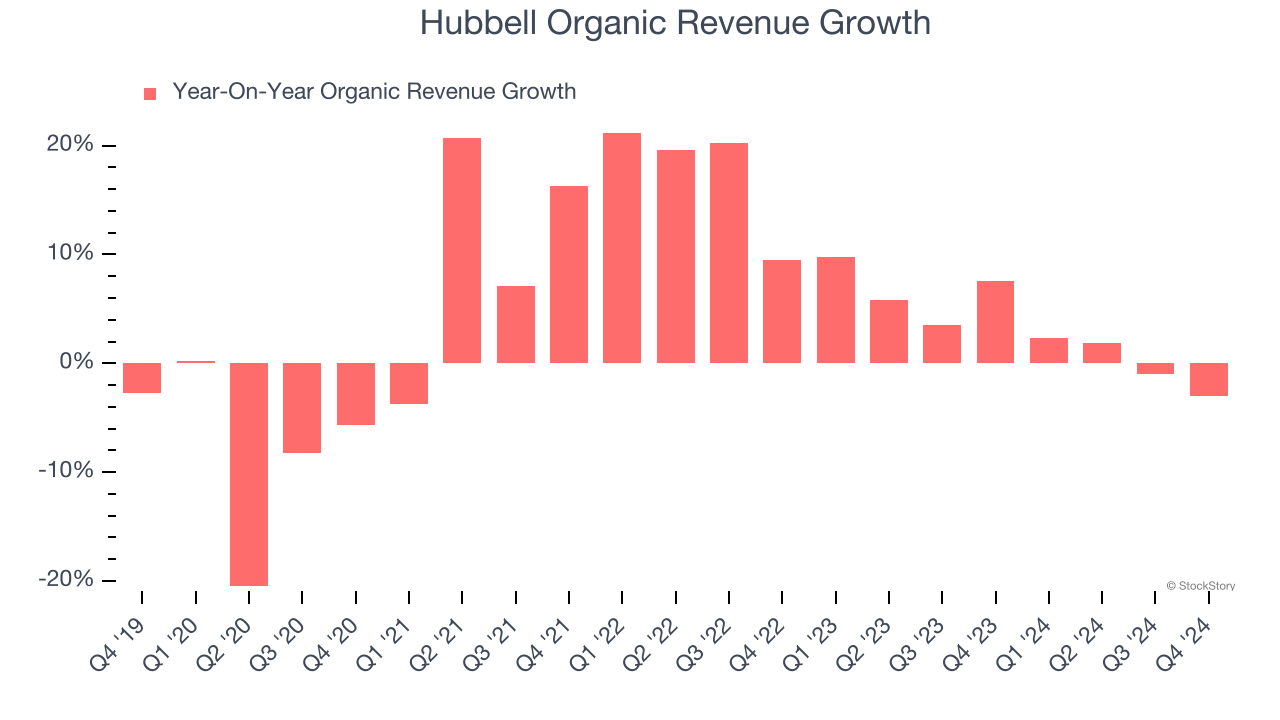

In addition to reported revenue, organic revenue is a useful data point for analyzing Electrical Systems companies. This metric gives visibility into Hubbell’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Hubbell’s organic revenue averaged 3.4% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

Hubbell’s positive characteristics outweigh the negatives. With the recent decline, the stock trades at 18.8× forward price-to-earnings (or $332.12 per share). Is now the right time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Hubbell

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.