Over the past six months, Grocery Outlet’s shares (currently trading at $13.56) have posted a disappointing 19.3% loss while the S&P 500 was down 1.6%. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is now the time to buy Grocery Outlet, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we're cautious about Grocery Outlet. Here are three reasons why we avoid GO and a stock we'd rather own.

Why Is Grocery Outlet Not Exciting?

Due to its differentiated procurement and buying approach, Grocery Outlet (NASDAQ: GO) is a discount grocery store chain that offers substantial discounts on name-brand products.

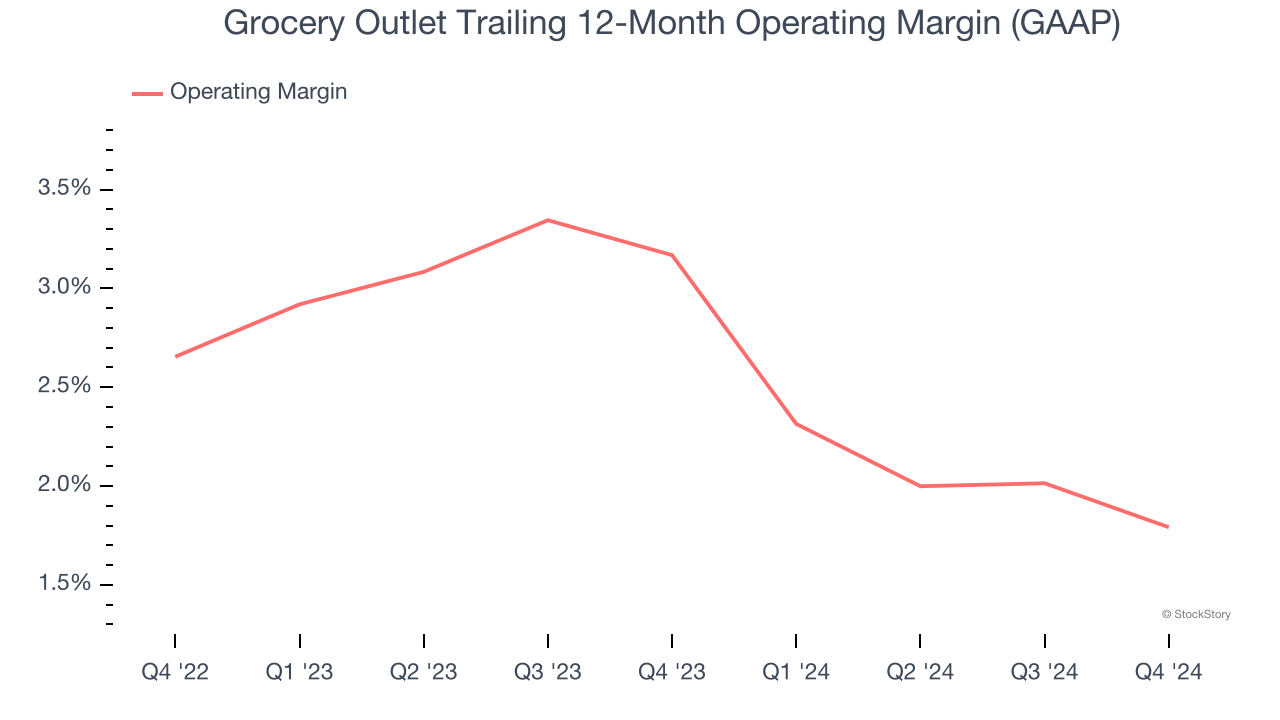

1. Weak Operating Margin Could Cause Trouble

Operating margin is a key profitability metric because it accounts for all expenses necessary to run a store, including wages, inventory, rent, advertising, and other administrative costs.

Grocery Outlet was profitable over the last two years but held back by its large cost base. Its average operating margin of 2.4% was weak for a consumer retail business. This result isn’t too surprising given its low gross margin as a starting point.

2. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Grocery Outlet historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 2.6%, lower than the typical cost of capital (how much it costs to raise money) for consumer retail companies.

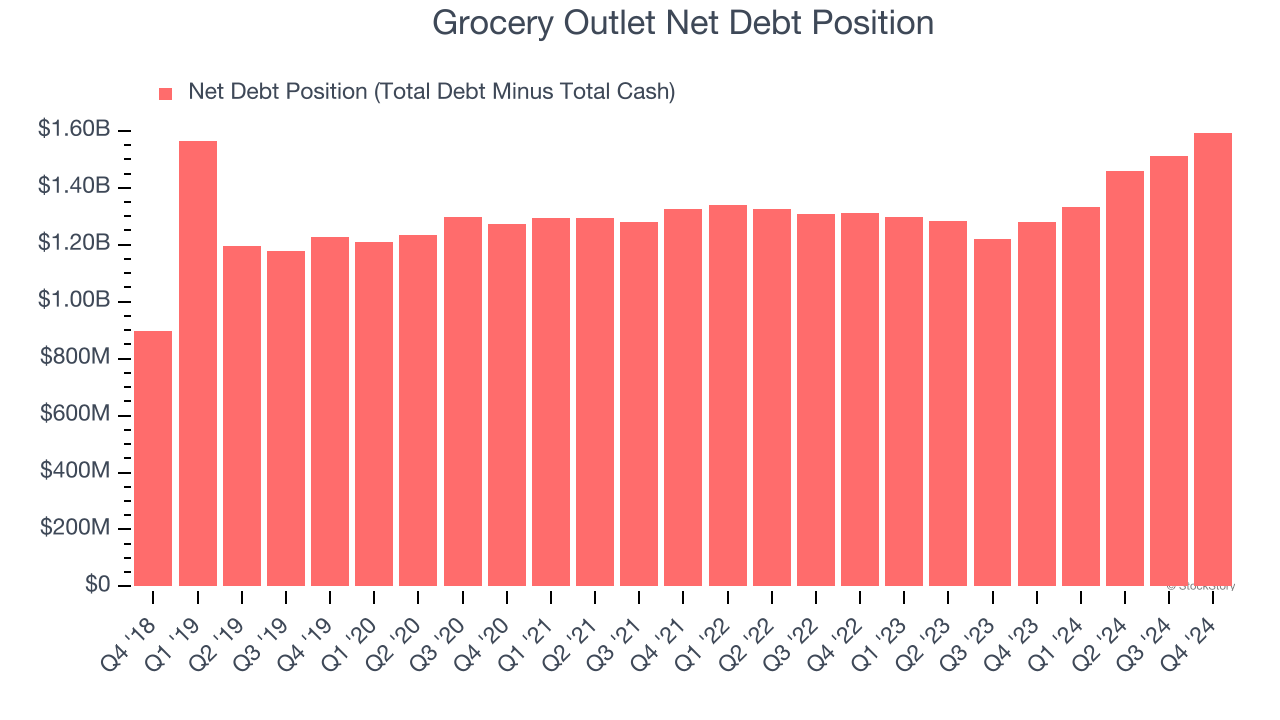

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Grocery Outlet burned through $74.65 million of cash over the last year, and its $1.66 billion of debt exceeds the $62.83 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Grocery Outlet’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Grocery Outlet until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Grocery Outlet isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 14.8× forward price-to-earnings (or $13.56 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Grocery Outlet

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.