As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the healthcare providers & services industry, including AMN Healthcare Services (NYSE: AMN) and its peers.

The healthcare providers and services sector, encompassing insurers to hospitals to outpatient care facilities, benefit from the consistent demand for healthcare services. Stable or even recurring revenues can be earned through insurance premiums, patient care contracts, and testing services agreements. However, the business models face challenges such as high operational costs especially if significant labor is involved. Reimbursement pressures from public and private payers can impact margins and an evolving regulatory landscape adds uncertainty to it all. Looking forward, this sector is poised to benefit from tailwinds such as the aging population, which means rising prevalence of chronic diseases. There is also broad demand for value-based care models, which emphasize cost efficiency and patient outcomes. Advances in telehealth, data analytics, and personalized medicine are likely to create new revenue opportunities for companies that can successfully digitize. However, headwinds abound, including labor shortages in clinical settings, continued reimbursement cuts, and regulatory scrutiny over pricing and care quality.

The 40 healthcare providers & services stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

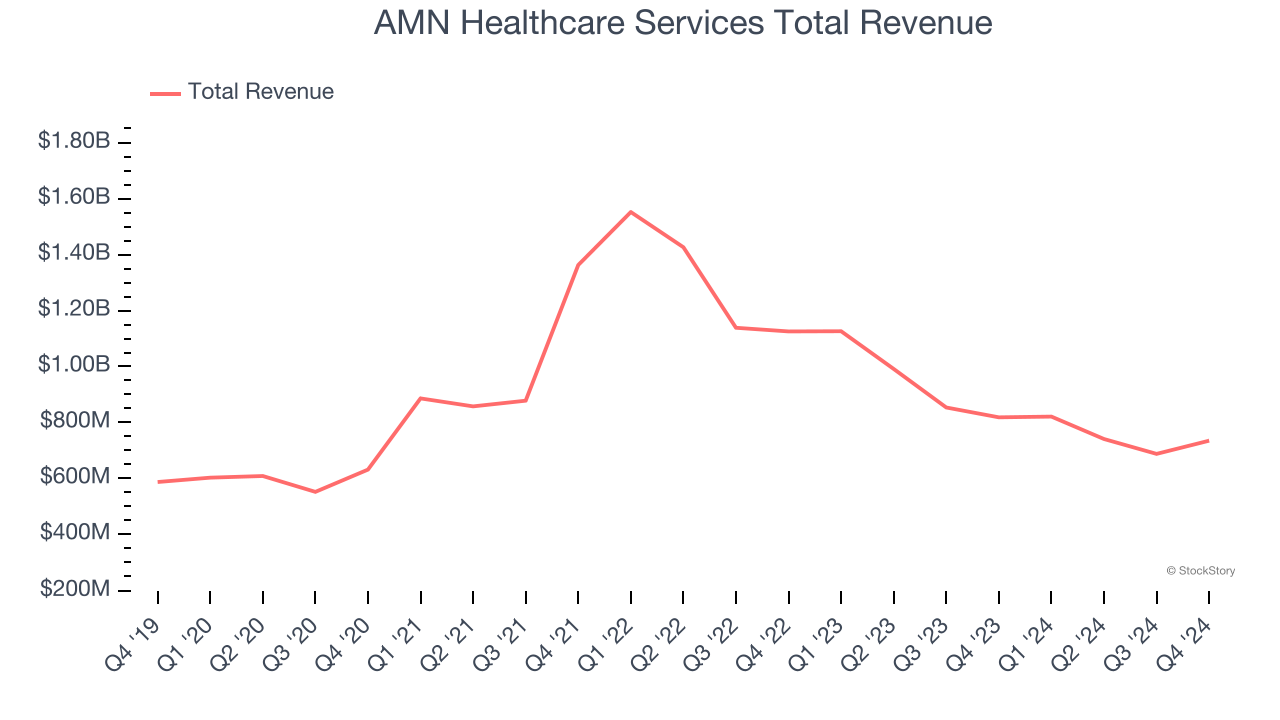

AMN Healthcare Services (NYSE: AMN)

With a network of thousands of healthcare professionals ranging from nurses to physicians to executives, AMN Healthcare (NYSE: AMN) provides healthcare workforce solutions including temporary staffing, permanent placement, and technology platforms for hospitals and healthcare facilities across the United States.

AMN Healthcare Services reported revenues of $734.7 million, down 10.2% year on year. This print exceeded analysts’ expectations by 5.8%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates.

“AMN recorded a solid fourth quarter that outperformed our expectations, and we continue to see a more normalized operating environment compared with the past two years,” said Cary Grace, AMN President and Chief Executive Officer.

AMN Healthcare Services delivered the slowest revenue growth of the whole group. The stock is down 6.1% since reporting and currently trades at $24.28.

Is now the time to buy AMN Healthcare Services? Access our full analysis of the earnings results here, it’s free.

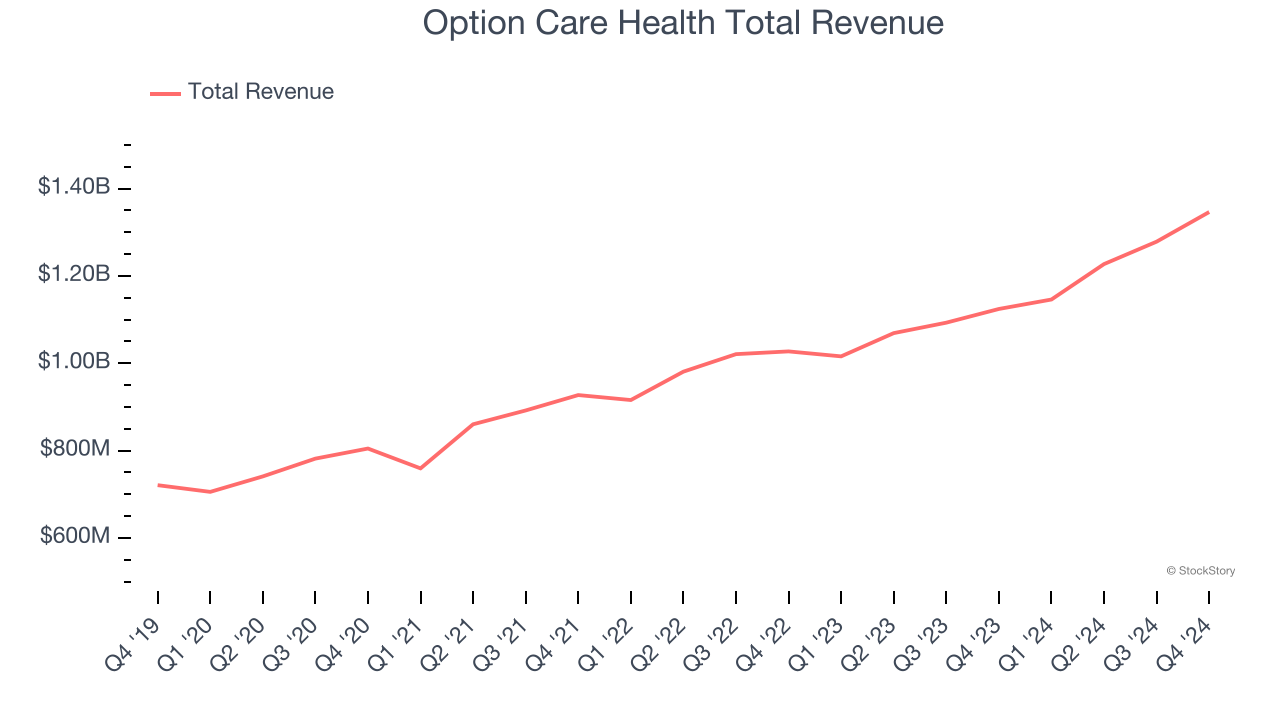

Best Q4: Option Care Health (NASDAQ: OPCH)

With a nationwide network of 177 locations serving 43 states and a team of over 4,500 clinicians, Option Care Health (NASDAQ: OPCH) is the largest independent provider of home and alternate site infusion services, delivering medications and clinical support to patients across the United States.

Option Care Health reported revenues of $1.35 billion, up 19.7% year on year, outperforming analysts’ expectations by 4.9%. The business had an exceptional quarter with an impressive beat of analysts’ full-year EPS guidance estimates.

The market seems happy with the results as the stock is up 9.6% since reporting. It currently trades at $35.79.

Is now the time to buy Option Care Health? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: agilon health (NYSE: AGL)

Transforming how doctors care for seniors by shifting financial incentives from volume to outcomes, agilon health (NYSE: AGL) provides a platform that helps primary care physicians transition to value-based care models for Medicare patients through long-term partnerships and global capitation arrangements.

agilon health reported revenues of $1.52 billion, up 44.2% year on year, in line with analysts’ expectations. It was a softer quarter as it posted full-year EBITDA guidance missing analysts’ expectations and a significant miss of analysts’ EPS estimates.

agilon health delivered the weakest full-year guidance update in the group. The company added 2,000 customers to reach a total of 527,000. Interestingly, the stock is up 12.7% since the results and currently trades at $4.08.

Read our full analysis of agilon health’s results here.

The Pennant Group (NASDAQ: PNTG)

Spun off from The Ensign Group in 2019 to focus on non-skilled nursing healthcare services, Pennant Group (NASDAQ: PNTG) operates home health, hospice, and senior living facilities across 13 western and midwestern states, serving patients of all ages including seniors.

The Pennant Group reported revenues of $188.9 million, up 29.4% year on year. This number beat analysts’ expectations by 1.4%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ sales volume estimates and full-year revenue guidance beating analysts’ expectations.

The stock is down 3.6% since reporting and currently trades at $24.62.

Read our full, actionable report on The Pennant Group here, it’s free.

RadNet (NASDAQ: RDNT)

With over 350 imaging facilities across seven states and a growing artificial intelligence division, RadNet (NASDAQ: RDNT) operates a network of outpatient diagnostic imaging centers across the United States, offering services like MRI, CT scans, PET scans, mammography, and X-rays.

RadNet reported revenues of $477.1 million, up 13.5% year on year. This result topped analysts’ expectations by 4.2%. It was a strong quarter as it also logged an impressive beat of analysts’ same-store sales and EPS estimates.

The stock is down 13% since reporting and currently trades at $50.11.

Read our full, actionable report on RadNet here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.