HP has gotten torched over the last six months - since October 2024, its stock price has dropped 33.9% to $23.95 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in HP, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we're swiping left on HP for now. Here are three reasons why HPQ doesn't excite us and a stock we'd rather own.

Why Do We Think HP Will Underperform?

Born from the legendary Silicon Valley garage startup founded by Bill Hewlett and Dave Packard in 1939, HP (NYSE: HPQ) designs and sells personal computers, printers, and related technology products and services to consumers, businesses, and enterprises worldwide.

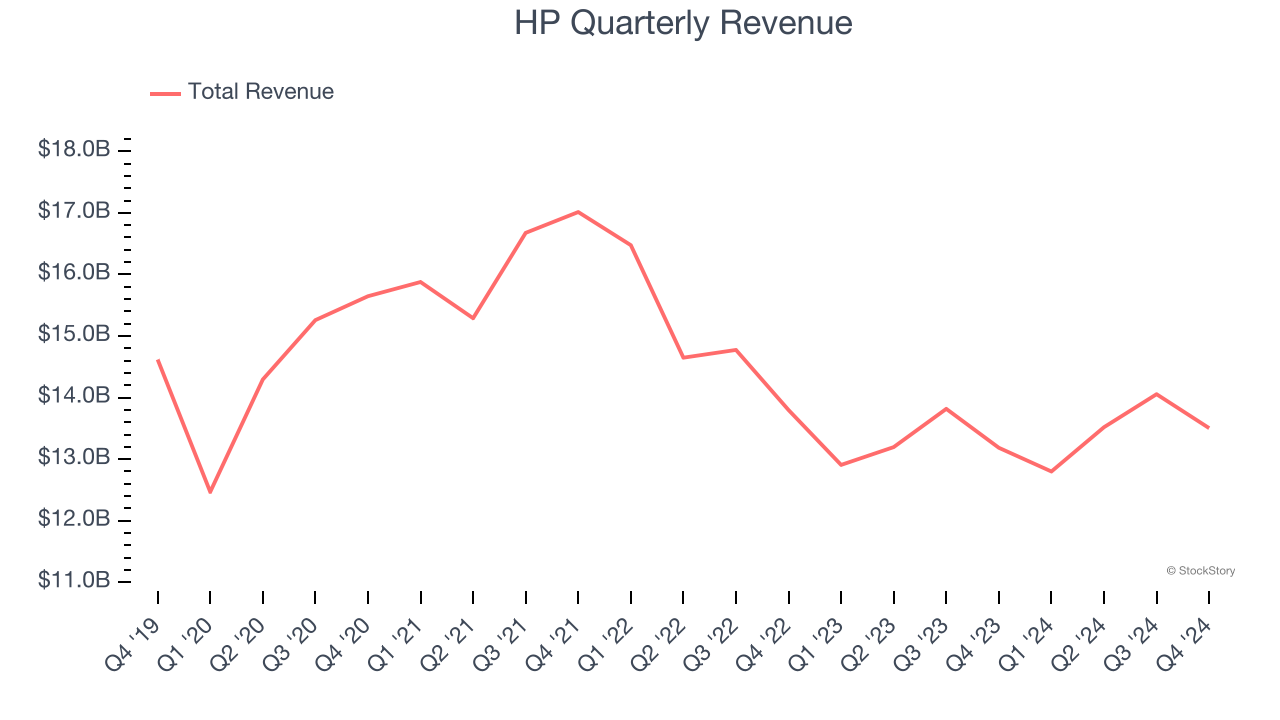

1. Revenue Spiraling Downwards

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, HP’s demand was weak and its revenue declined by 1.7% per year. This wasn’t a great result and signals it’s a low quality business.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect HP’s revenue to rise by 1.8%. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below the sector average.

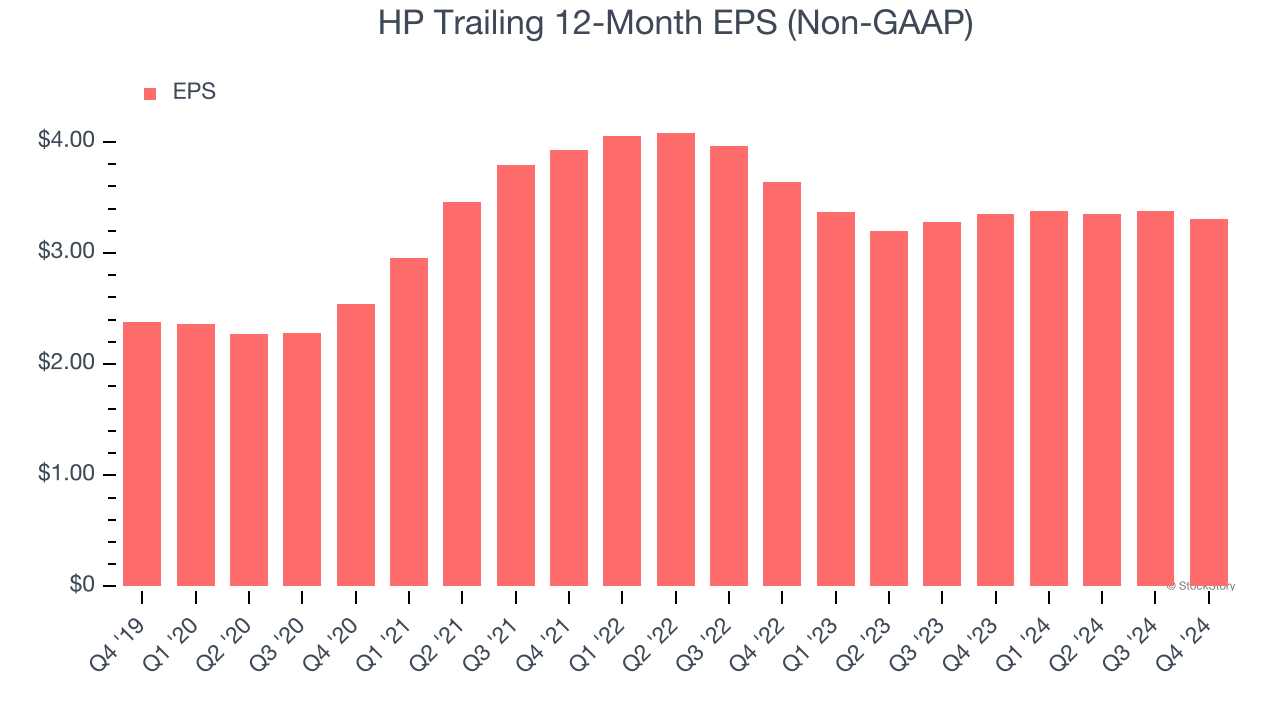

3. EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

HP’s EPS grew at an unimpressive 6.8% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 1.7% annualized revenue declines and tells us management adapted its cost structure in response to a challenging demand environment.

Final Judgment

We see the value of companies helping consumers, but in the case of HP, we’re out. After the recent drawdown, the stock trades at 6.4× forward price-to-earnings (or $23.95 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward an all-weather company that owns household favorite Taco Bell.

Stocks We Would Buy Instead of HP

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.