What a brutal six months it’s been for Exact Sciences. The stock has dropped 37.2% and now trades at $44.10, rattling many shareholders. This may have investors wondering how to approach the situation.

Following the pullback, is this a buying opportunity for EXAS? Find out in our full research report, it’s free.

Why Does EXAS Stock Spark Debate?

With a mission to detect cancer earlier when it's more treatable, Exact Sciences (NASDAQ: EXAS) develops and markets cancer screening and diagnostic tests, including its flagship Cologuard stool-based colorectal cancer screening test.

Two Things to Like:

1. Constant Currency Revenue Propels Growth

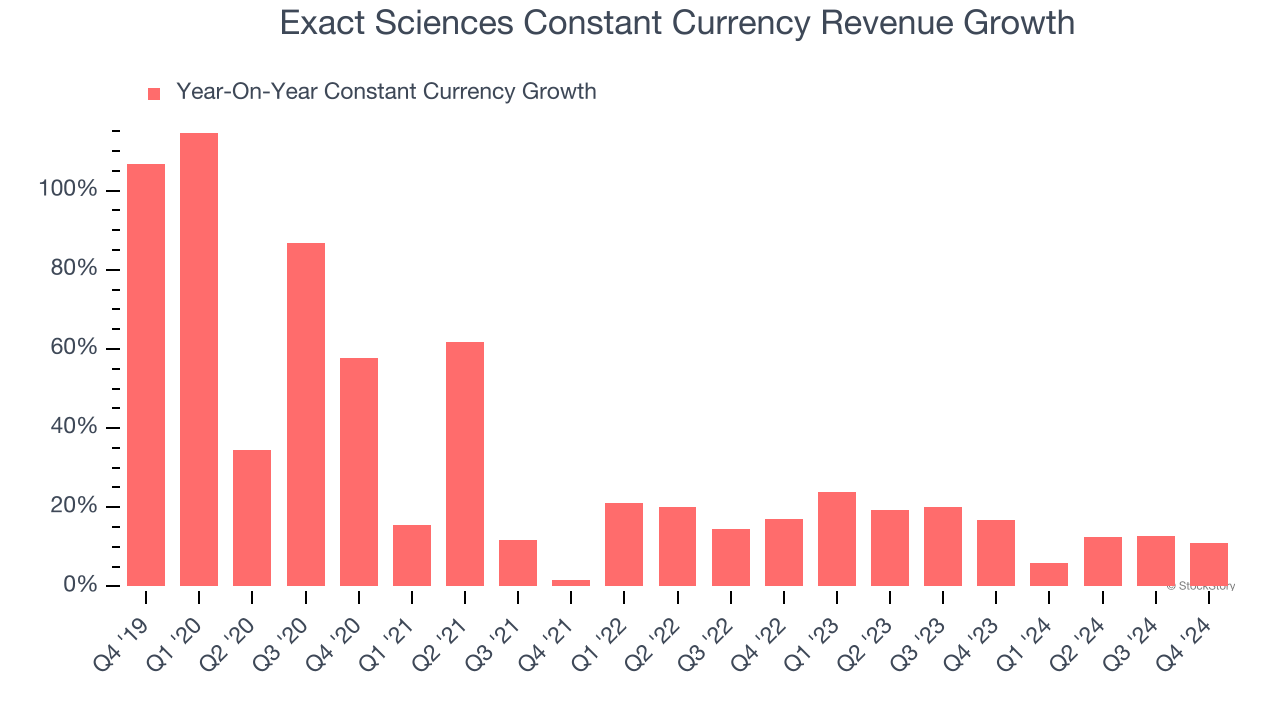

Investors interested in Immuno-Oncology companies should track constant currency revenue in addition to reported revenue. This metric excludes currency movements, which are outside of Exact Sciences’s control and are not indicative of underlying demand.

Over the last two years, Exact Sciences’s constant currency revenue averaged 15.3% year-on-year growth. This performance was impressive and shows it can expand quickly on a global scale regardless of the macroeconomic environment.

2. Adjusted Operating Margin Rising, Profits Up

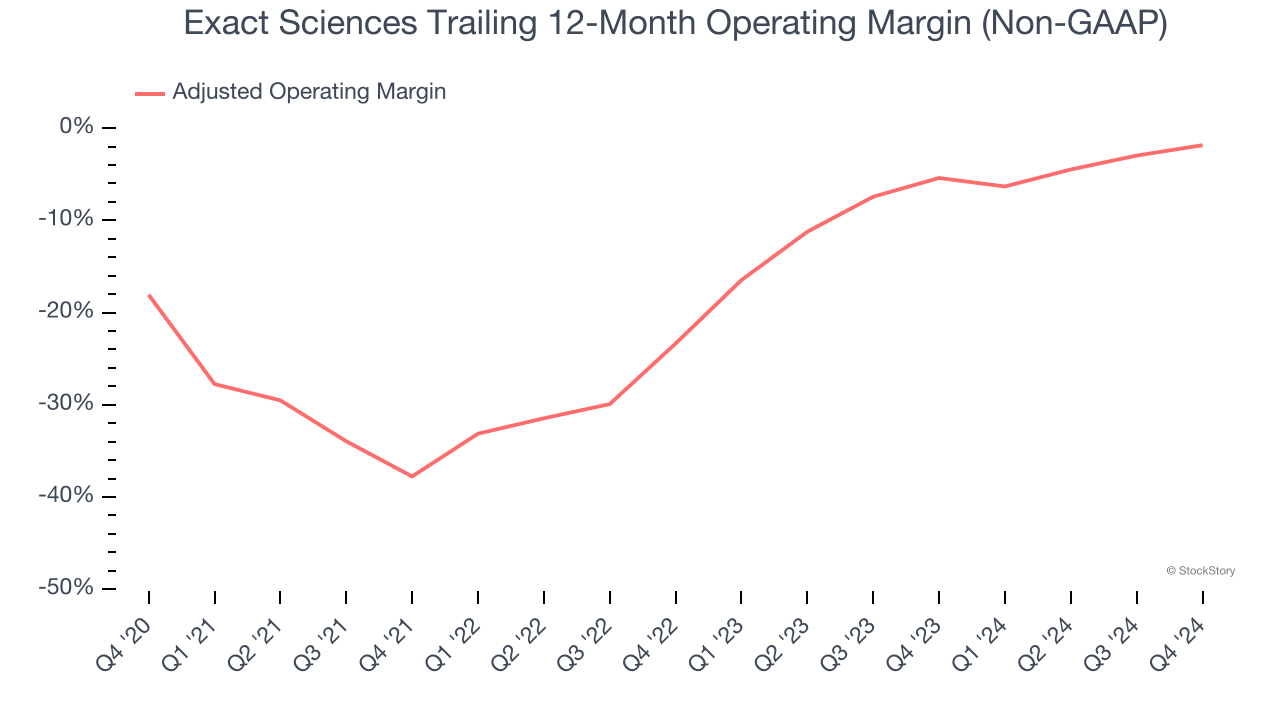

Adjusted operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D. It also removes various one-time costs to paint a better picture of normalized profits.

Exact Sciences’s adjusted operating margin rose by 21.5 percentage points over the last two years, as its sales growth gave it operating leverage. Although its adjusted operating margin for the trailing 12 months was negative 1.9%, we’re confident it can one day reach sustainable profitability.

One Reason to be Careful:

Previous Growth Initiatives Have Lost Money

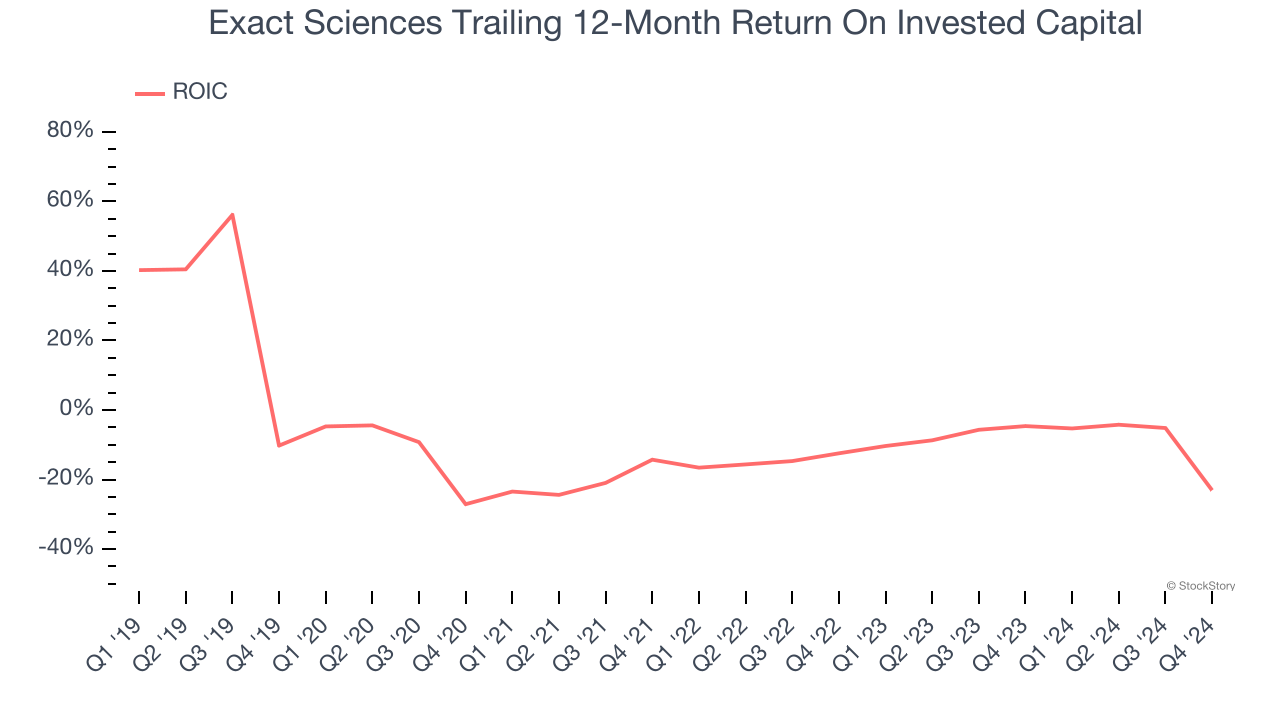

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Exact Sciences has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 16.3%, meaning management lost money while trying to expand the business.

Final Judgment

Exact Sciences has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 222× forward price-to-earnings (or $44.10 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Exact Sciences

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.