BigCommerce has been treading water for the past six months, recording a small loss of 2.3% while holding steady at $5.20.

Is there a buying opportunity in BigCommerce, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

We're cautious about BigCommerce. Here are three reasons why there are better opportunities than BIGC and a stock we'd rather own.

Why Is BigCommerce Not Exciting?

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ: BIGC) provides software for businesses to easily create online stores.

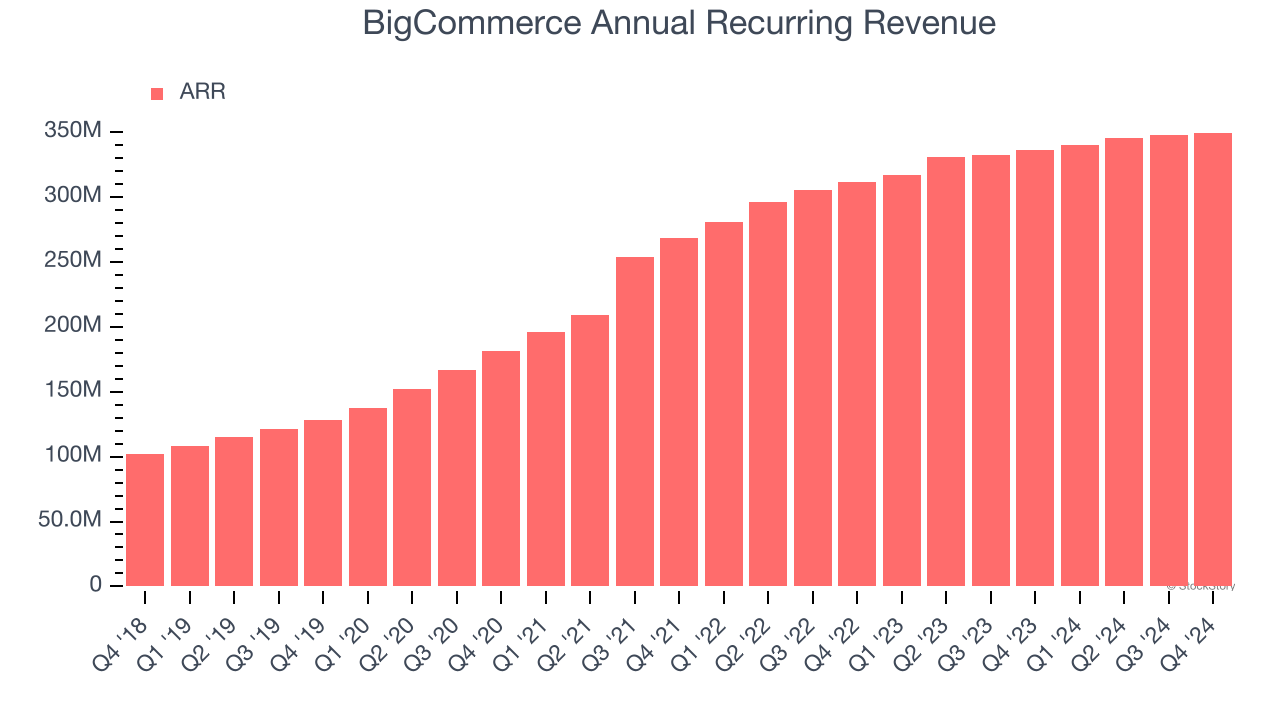

1. Weak ARR Points to Soft Demand

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

BigCommerce’s ARR came in at $349.6 million in Q4, and over the last four quarters, its year-on-year growth averaged 5.1%. This performance was underwhelming and suggests that increasing competition is causing challenges in securing longer-term commitments.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect BigCommerce’s revenue to rise by 3.5%, a deceleration versus its 14.8% annualized growth for the past three years. This projection is underwhelming and implies its products and services will face some demand challenges.

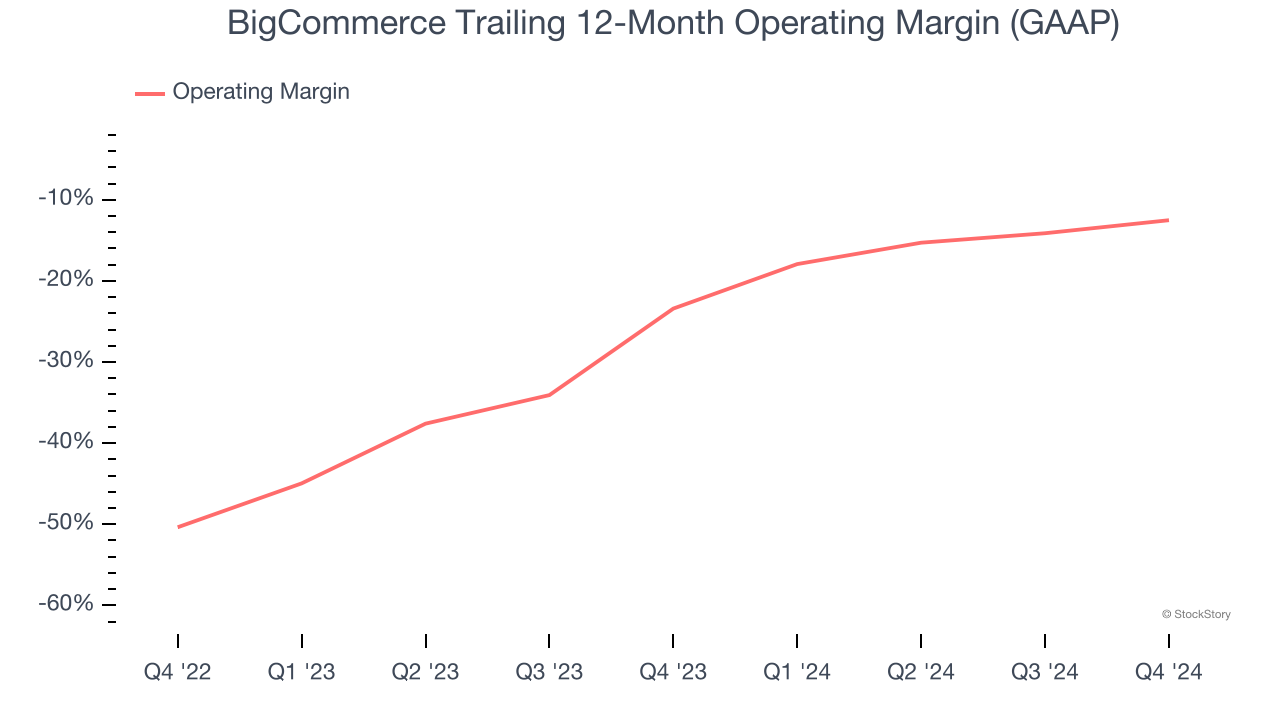

3. Operating Losses Sound the Alarms

Many software businesses adjust their profits for stock-based compensation (SBC), but we prioritize GAAP operating margin because SBC is a real expense used to attract and retain engineering and sales talent. This metric shows how much revenue remains after accounting for all core expenses – everything from the cost of goods sold to sales and R&D.

Although BigCommerce broke even this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 12.5% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if BigCommerce reeled back its investments. Wall Street seems to think it will face some obstacles, and we tend to agree.

Final Judgment

BigCommerce isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 1.2× forward price-to-sales (or $5.20 per share). This valuation is reasonable, but the company’s shakier fundamentals present too much downside risk. We're fairly confident there are better stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than BigCommerce

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.