What a brutal six months it’s been for Semtech. The stock has dropped 33.8% and now trades at $30.12, rattling many shareholders. This might have investors contemplating their next move.

Is now the time to buy Semtech, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even though the stock has become cheaper, we're cautious about Semtech. Here are three reasons why there are better opportunities than SMTC and a stock we'd rather own.

Why Do We Think Semtech Will Underperform?

A public company since the late 1960s, Semtech (NASDAQ: SMTC) is a provider of analog and mixed-signal semiconductors used for Internet of Things systems and cloud connectivity.

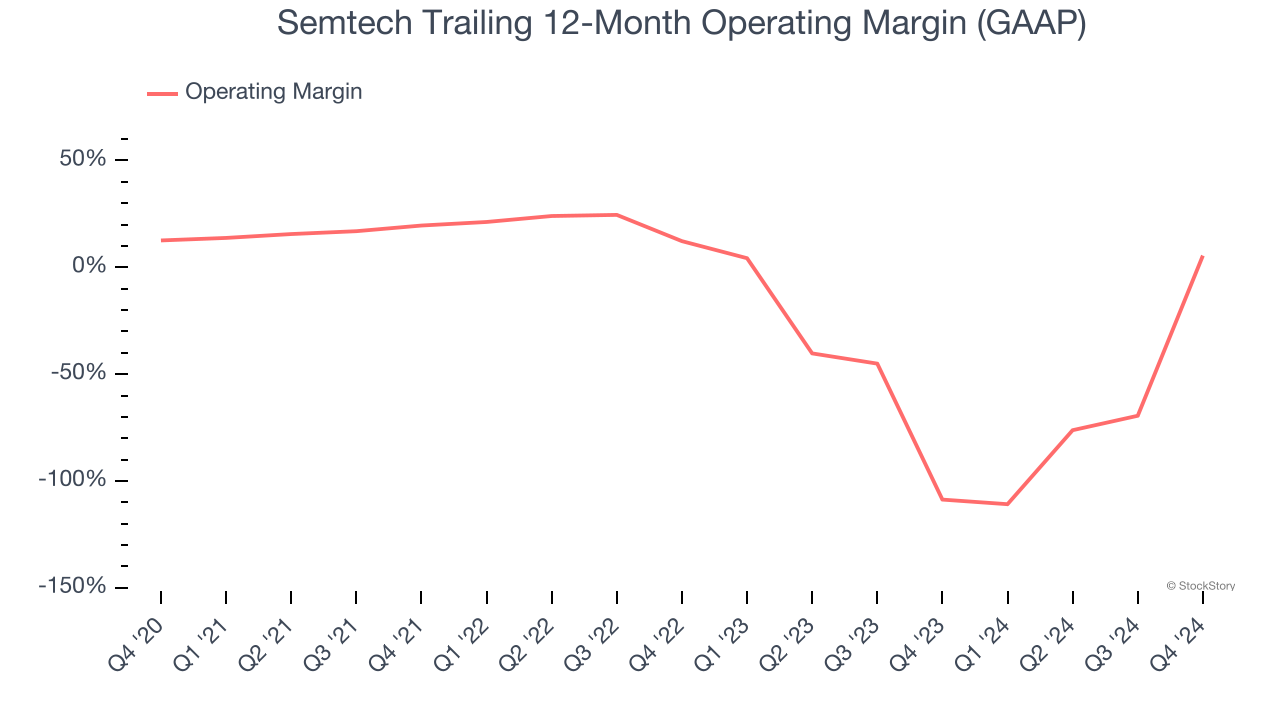

1. Operating Losses Sound the Alarms

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after procuring and manufacturing its products, marketing and selling those products, and most importantly, keeping them relevant through research and development.

Although Semtech was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 50.3% over the last two years. Unprofitable semiconductor companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

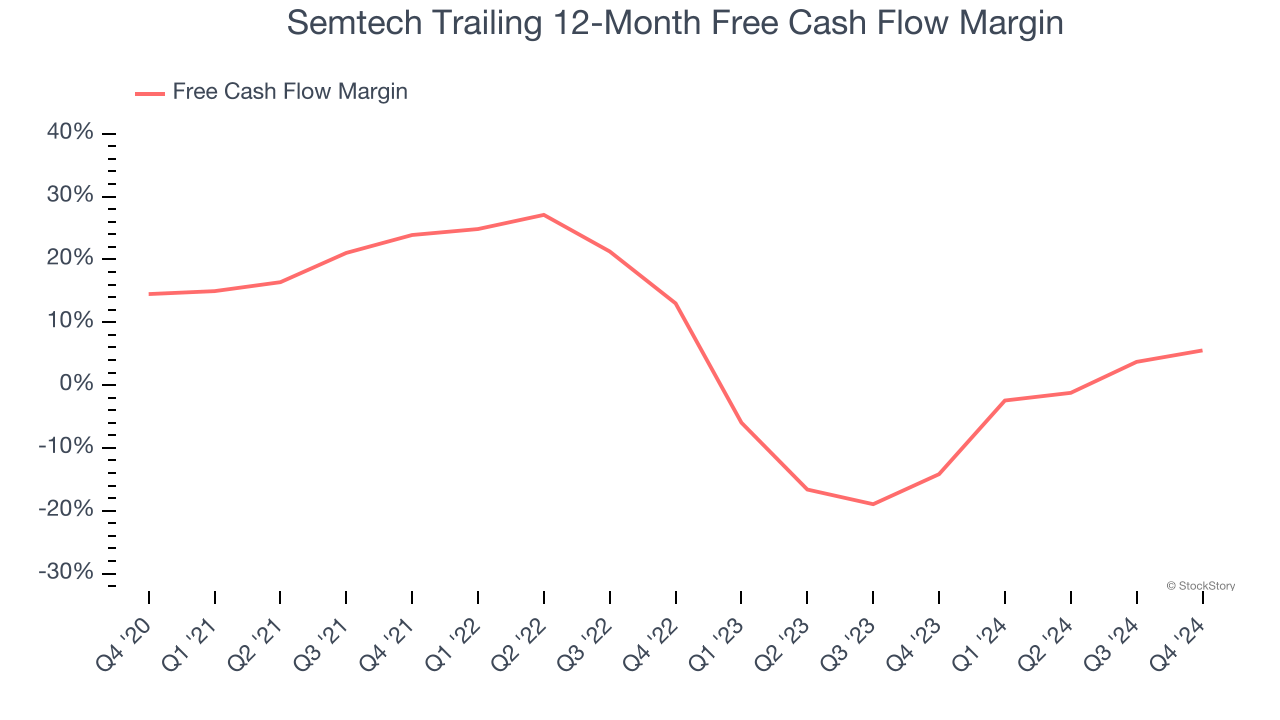

2. Cash Burn Ignites Concerns

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

While Semtech posted positive free cash flow this quarter, the broader story hasn’t been so clean. Semtech’s demanding reinvestments have consumed many resources over the last two years, contributing to an average free cash flow margin of negative 4.1%. This means it lit $4.10 of cash on fire for every $100 in revenue.

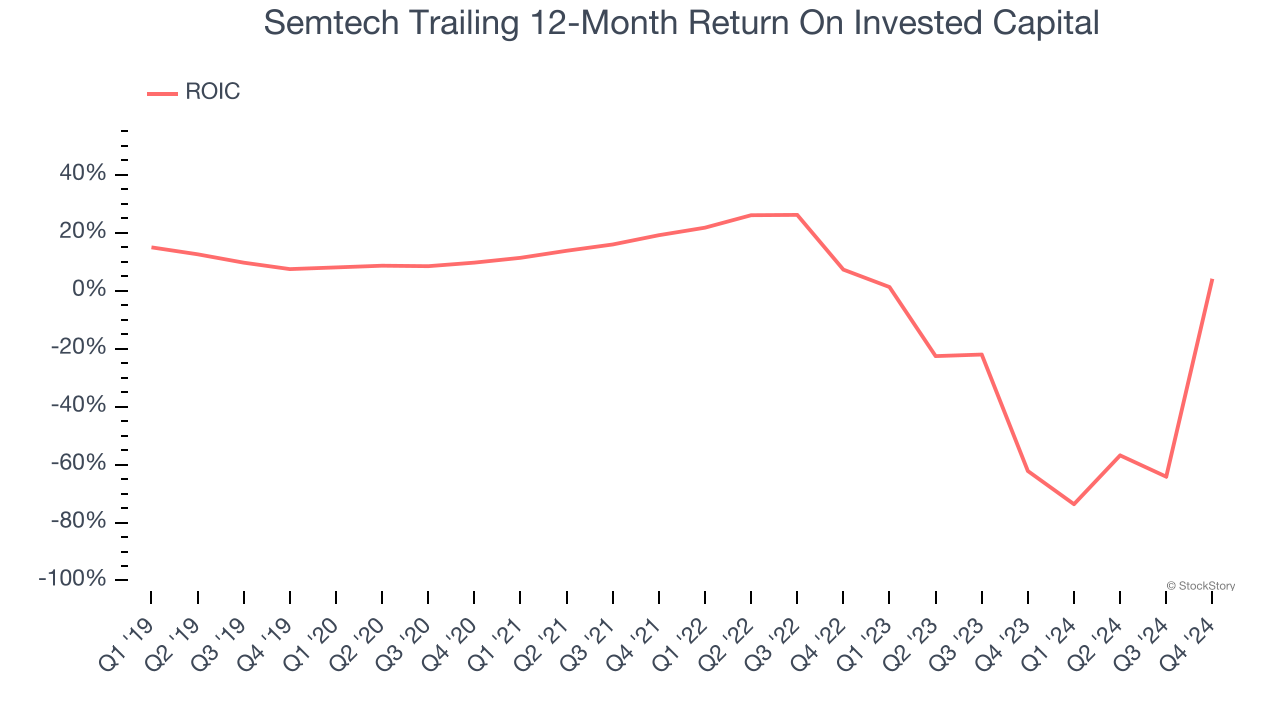

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Semtech’s five-year average ROIC was negative 4.4%, meaning management lost money while trying to expand the business. Its returns were among the worst in the semiconductor sector.

Final Judgment

Semtech doesn’t pass our quality test. After the recent drawdown, the stock trades at 17.4× forward price-to-earnings (or $30.12 per share). This valuation tells us a lot of optimism is priced in - you can find better investment opportunities elsewhere. We’d suggest looking at one of our all-time favorite software stocks.

Stocks We Like More Than Semtech

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.