Getty Images has gotten torched over the last six months - since October 2024, its stock price has dropped 51.6% to $1.94 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Getty Images, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Getty Images. Here are three reasons why you should be careful with GETY and a stock we'd rather own.

Why Is Getty Images Not Exciting?

With a vast library of over 562 million visual assets documenting everything from breaking news to iconic historical moments, Getty Images (NYSE: GETY) is a global visual content marketplace that licenses photos, videos, illustrations, and music to businesses, media outlets, and creative professionals.

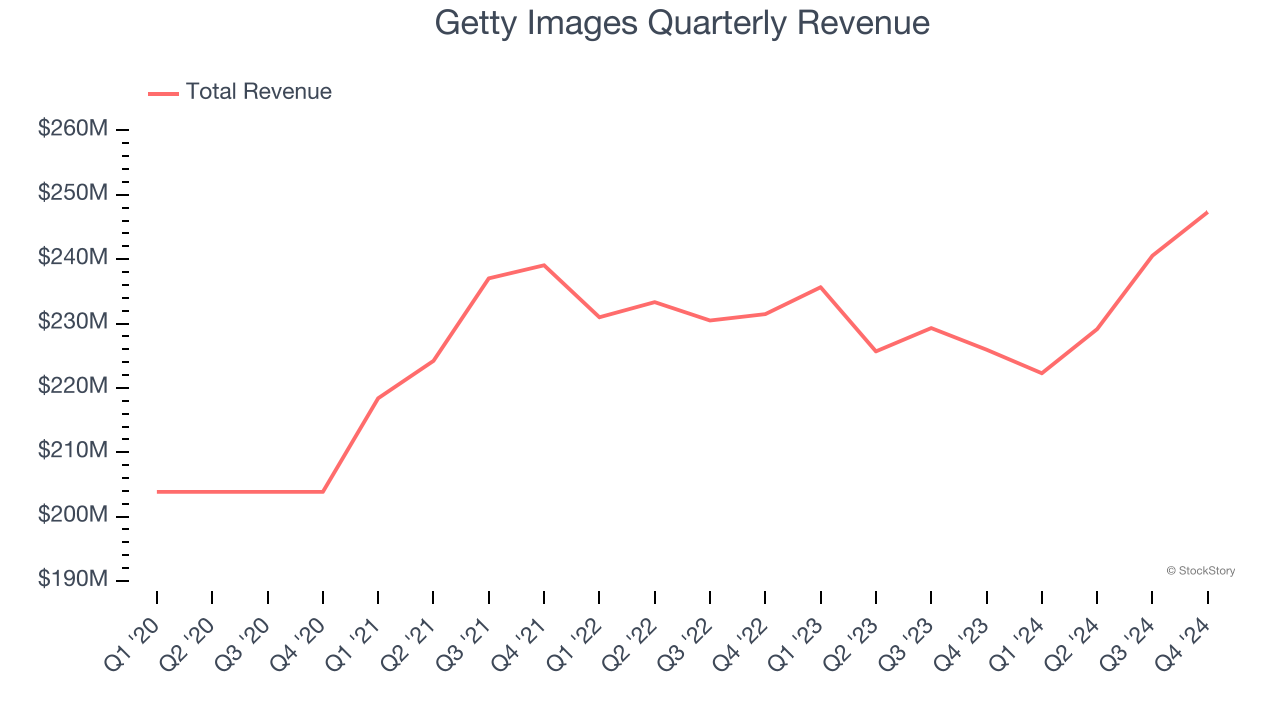

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Getty Images’s 3.6% annualized revenue growth over the last four years was tepid. This fell short of our benchmark for the business services sector.

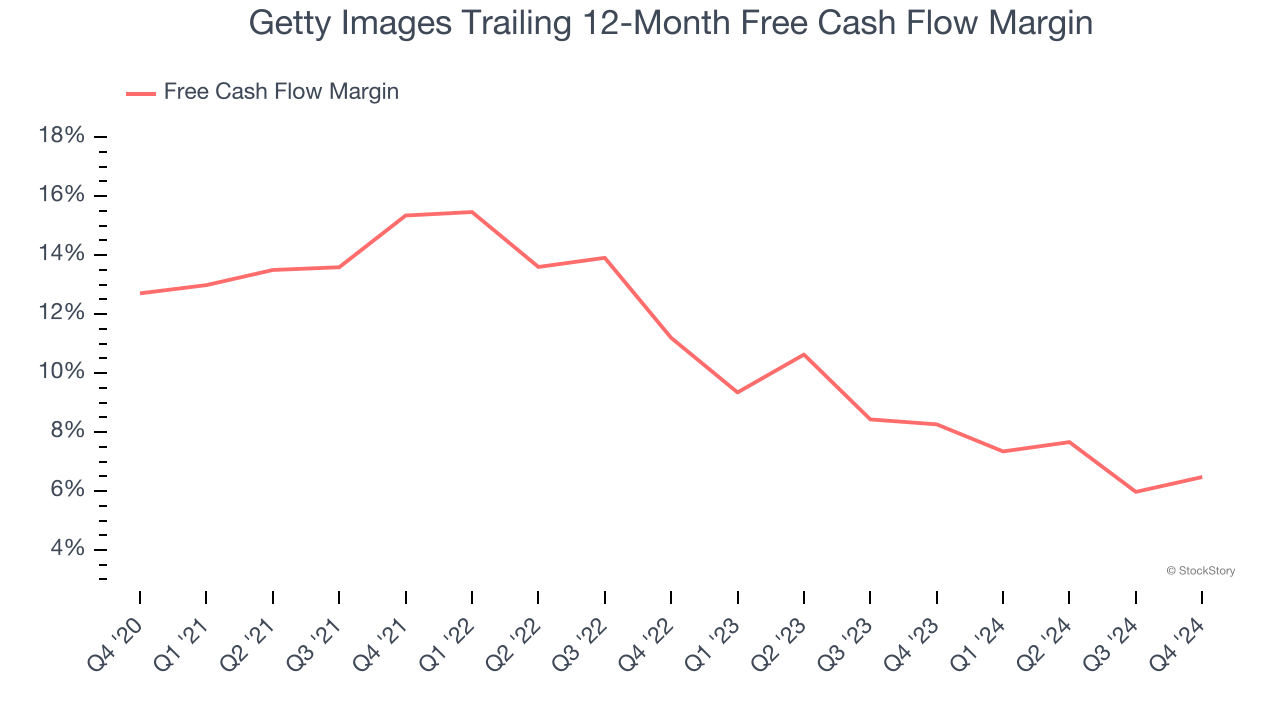

2. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Getty Images’s margin dropped by 6.2 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. Getty Images’s free cash flow margin for the trailing 12 months was 6.5%.

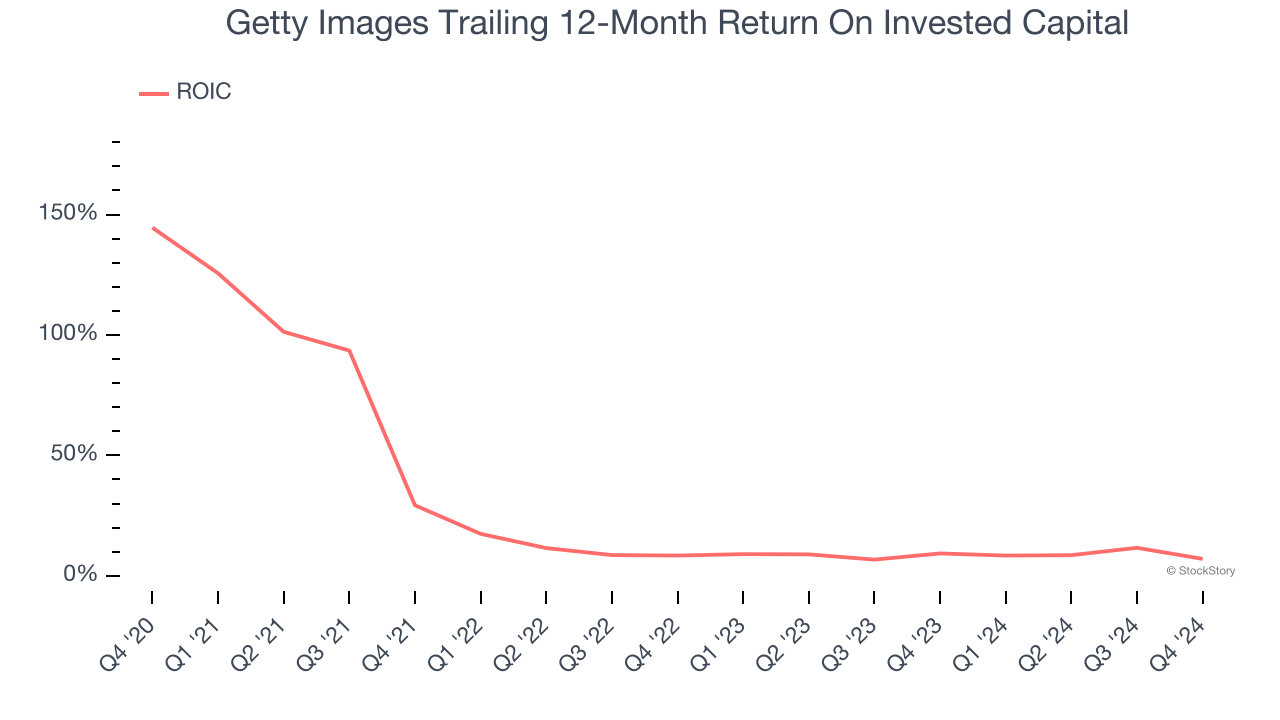

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Getty Images’s ROIC has unfortunately decreased significantly. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Getty Images isn’t a terrible business, but it doesn’t pass our quality test. Following the recent decline, the stock trades at 8.1× forward price-to-earnings (or $1.94 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Like More Than Getty Images

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.