Over the last six months, Cracker Barrel shares have sunk to $42.74, producing a disappointing 14.4% loss - worse than the S&P 500’s 5.3% drop. This may have investors wondering how to approach the situation.

Is now the time to buy Cracker Barrel, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even with the cheaper entry price, we don't have much confidence in Cracker Barrel. Here are three reasons why we avoid CBRL and a stock we'd rather own.

Why Do We Think Cracker Barrel Will Underperform?

Known for its country-themed food and merchandise, Cracker Barrel (NASDAQ: CBRL) is a beloved American restaurant and retail chain that celebrates the warmth and charm of Southern hospitality.

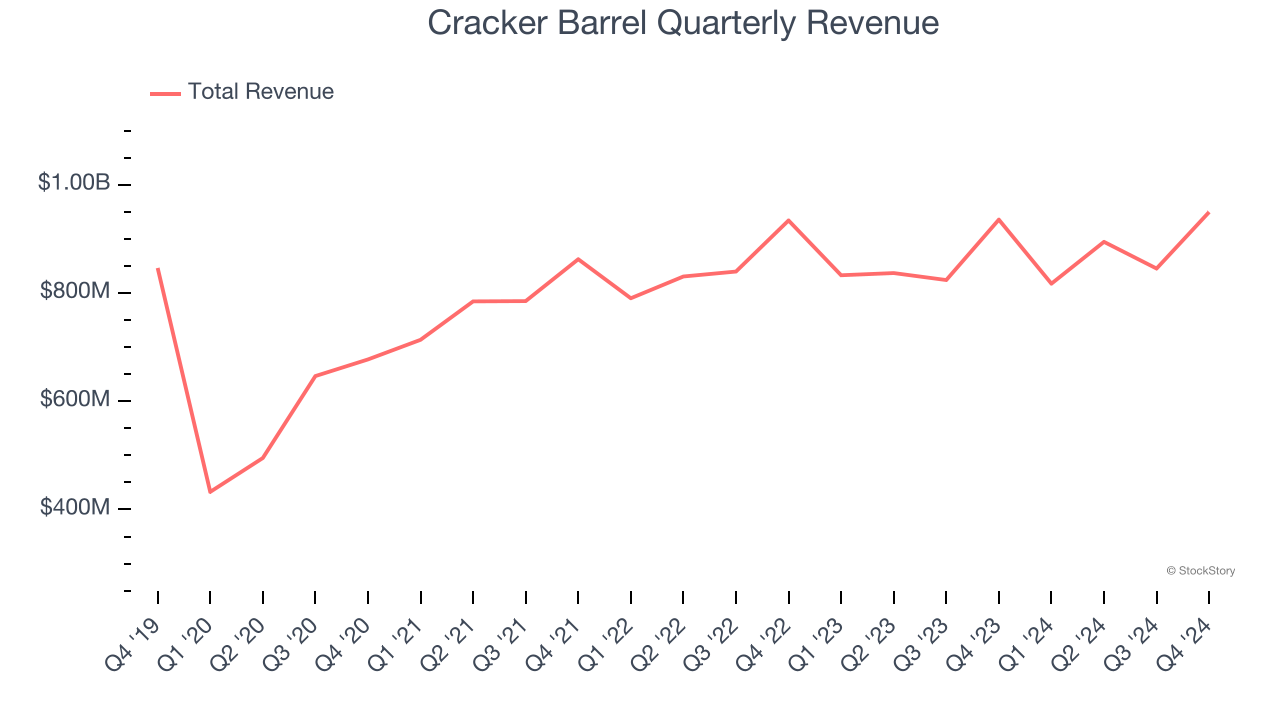

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Cracker Barrel’s sales grew at a weak 2.3% compounded annual growth rate over the last five years. This was below our standards.

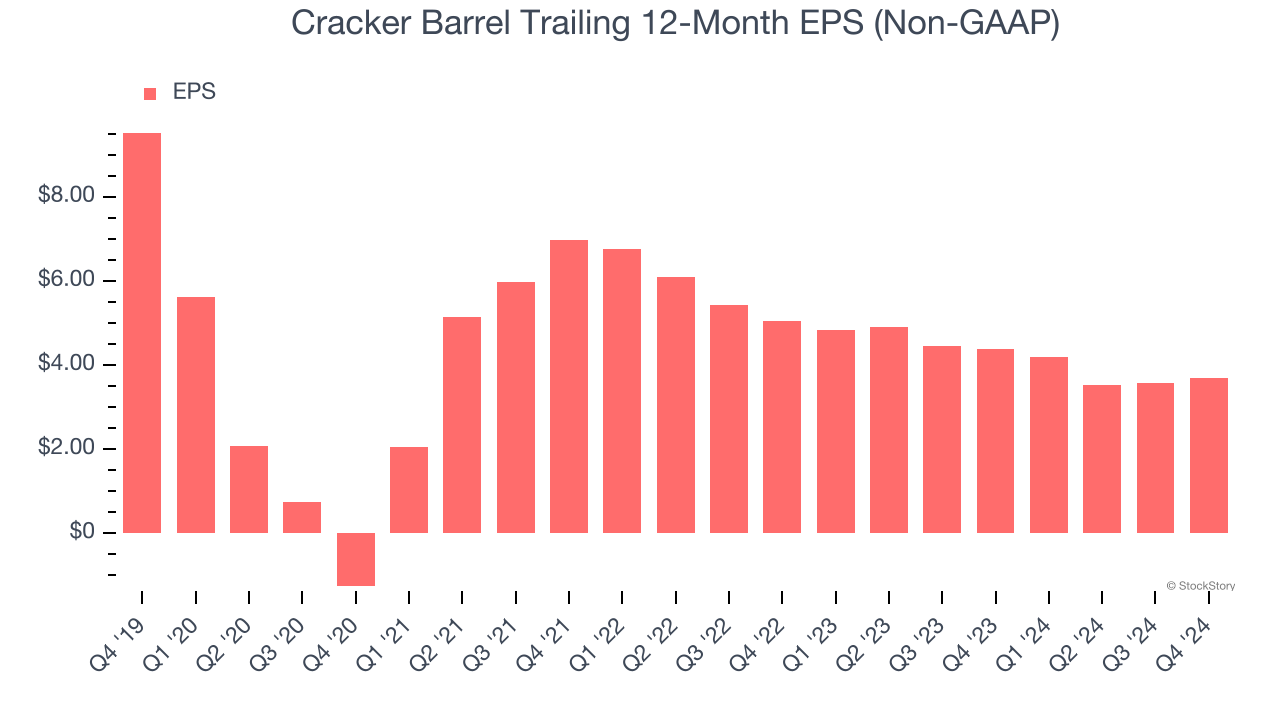

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Cracker Barrel, its EPS declined by 17.2% annually over the last five years while its revenue grew by 2.3%. This tells us the company became less profitable on a per-share basis as it expanded.

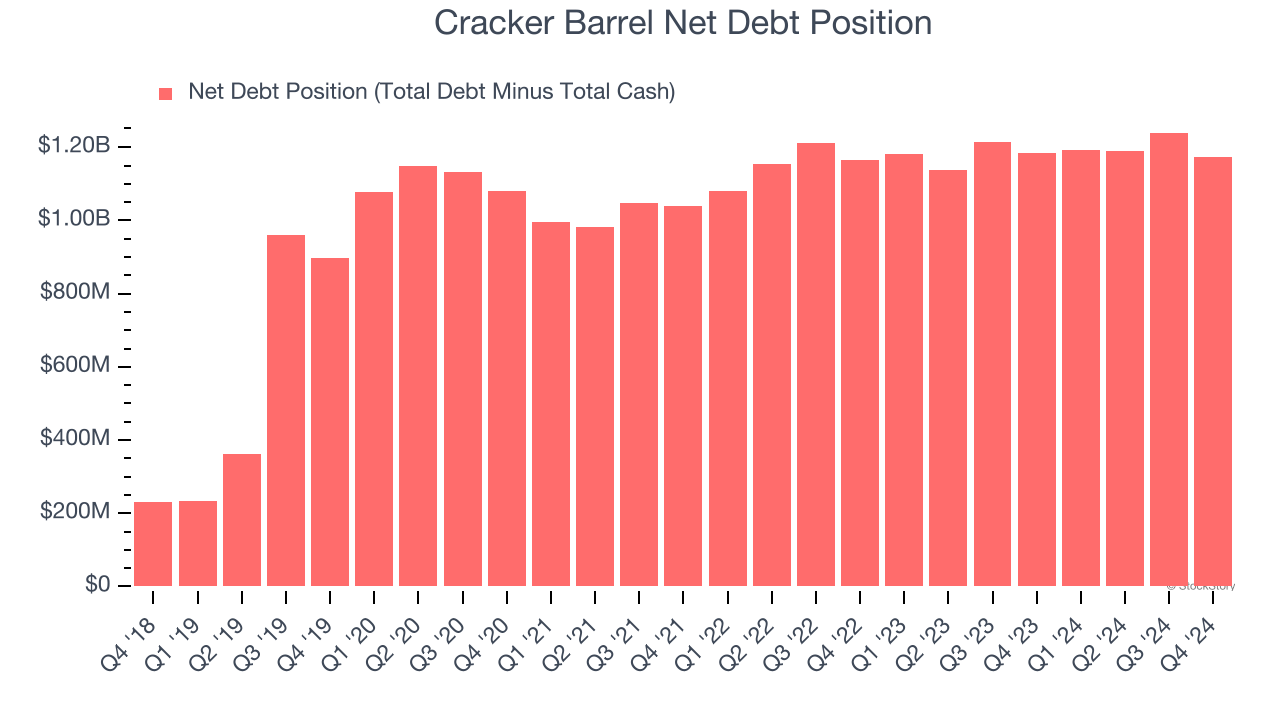

3. High Debt Levels Increase Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly. As long-term investors, we aim to avoid companies taking excessive advantage of this instrument because it could lead to insolvency.

Cracker Barrel’s $1.18 billion of debt exceeds the $10.35 million of cash on its balance sheet. Furthermore, its 5× net-debt-to-EBITDA ratio (based on its EBITDA of $225.7 million over the last 12 months) shows the company is overleveraged.

At this level of debt, incremental borrowing becomes increasingly expensive and credit agencies could downgrade the company’s rating if profitability falls. Cracker Barrel could also be backed into a corner if the market turns unexpectedly – a situation we seek to avoid as investors in high-quality companies.

We hope Cracker Barrel can improve its balance sheet and remain cautious until it increases its profitability or pays down its debt.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Cracker Barrel, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 16.1× forward price-to-earnings (or $42.74 per share). This valuation is reasonable, but the company’s shaky fundamentals present too much downside risk. There are superior stocks to buy right now. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Cracker Barrel

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.