Cybersecurity software maker Tenable (NASDAQ: TENB) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 10.7% year on year to $239.1 million. Guidance for next quarter’s revenue was better than expected at $242 million at the midpoint, 0.6% above analysts’ estimates. Its non-GAAP profit of $0.36 per share was 27.5% above analysts’ consensus estimates.

Is now the time to buy Tenable? Find out by accessing our full research report, it’s free.

Tenable (TENB) Q1 CY2025 Highlights:

- Revenue: $239.1 million vs analyst estimates of $233.6 million (10.7% year-on-year growth, 2.4% beat)

- Adjusted EPS: $0.36 vs analyst estimates of $0.28 (27.5% beat)

- Adjusted Operating Income: $48.68 million vs analyst estimates of $41.81 million (20.4% margin, 16.4% beat)

- Full-year billings guidance of $1.035 billion vs. analyst estimates of $1.071 billion (3.4% miss)

- The company reconfirmed its revenue guidance for the full year of $975 million at the midpoint

- Operating Margin: -7.4%, down from -4.1% in the same quarter last year

- Free Cash Flow Margin: 33.5%, similar to the previous quarter

- Market Capitalization: $3.98 billion

"We had a strong start to the year with better-than-expected results on both the top and bottom line," said Steve Vintz, Co-CEO of Tenable.

Company Overview

Founded in 2002 by three cybersecurity veterans, Tenable (NASDAQ: TENB) provides software as a service that helps companies understand where they are exposed to cyber security risk and how to reduce it.

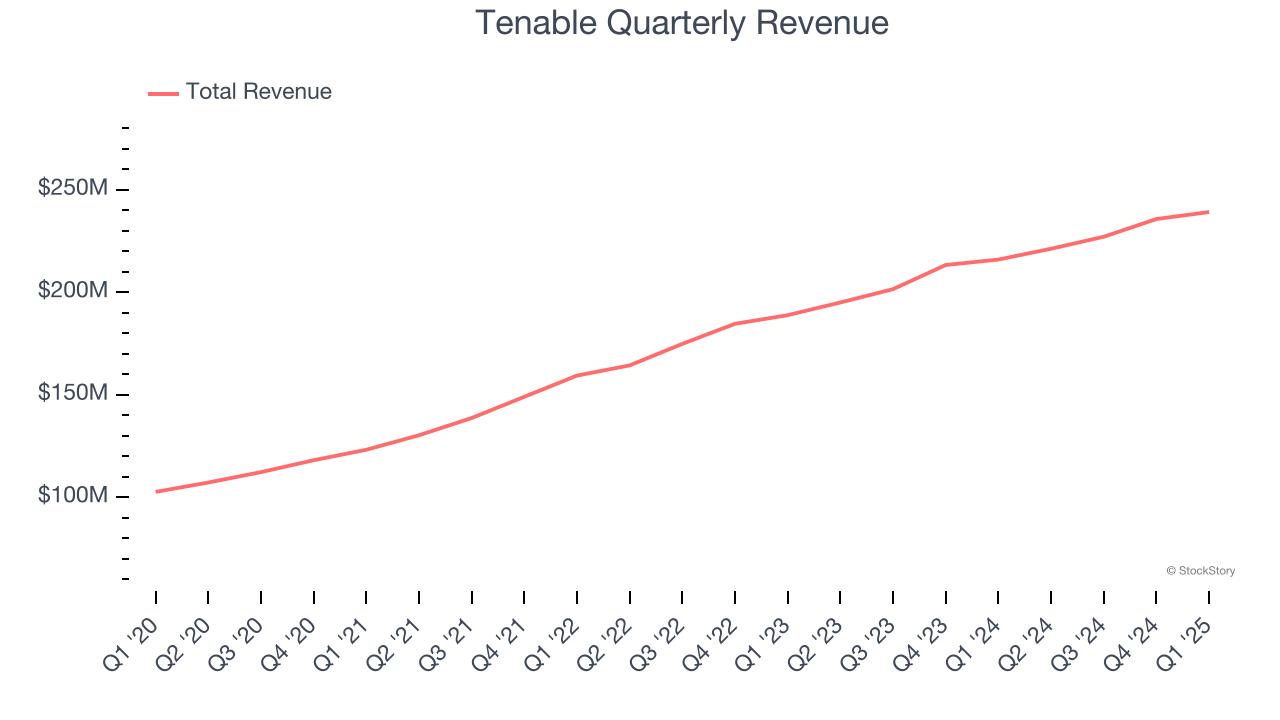

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Tenable grew its sales at a 16.9% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Tenable reported year-on-year revenue growth of 10.7%, and its $239.1 million of revenue exceeded Wall Street’s estimates by 2.4%. Company management is currently guiding for a 9.4% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 8.4% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

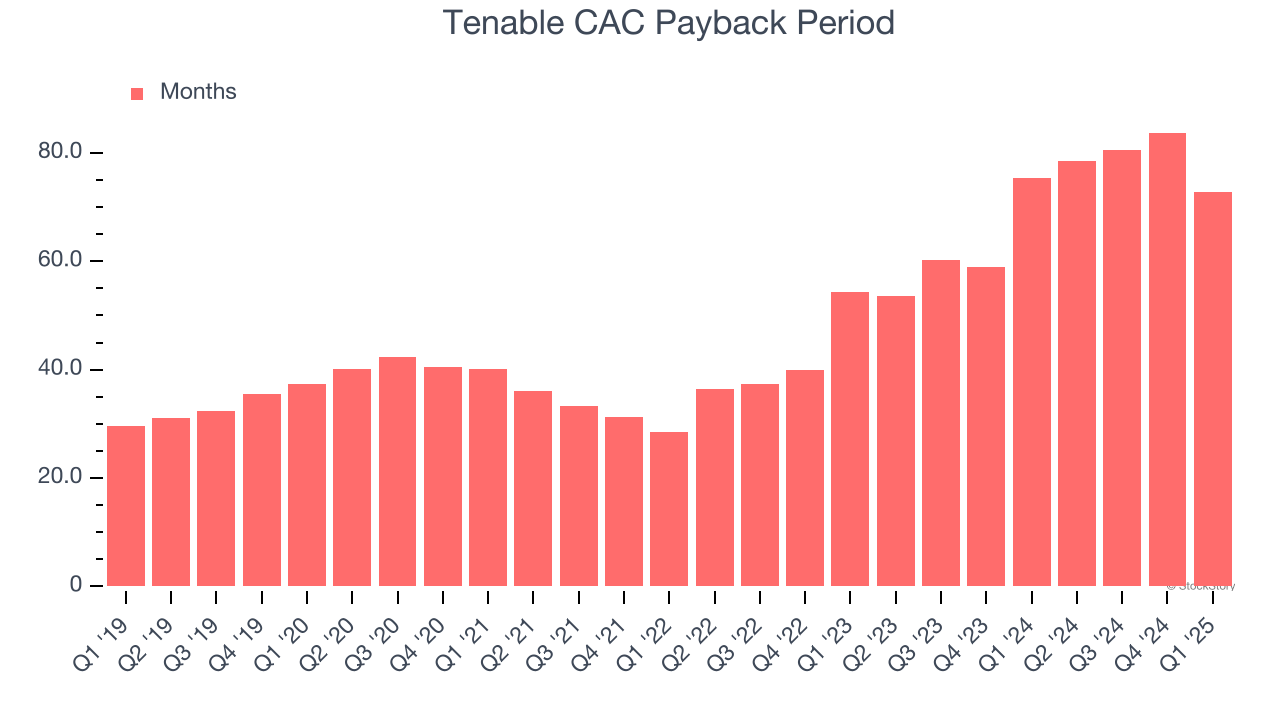

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

It’s relatively expensive for Tenable to acquire new customers as its CAC payback period checked in at 72.8 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Tenable’s Q1 Results

It was encouraging to see Tenable beat analysts’ revenue expectations this quarter. We were also glad its revenue guidance for next quarter slightly exceeded Wall Street’s estimates. On the other hand, its full-year billings guidance missed. This is weighing on shares because billings is a key leading indicator of future revenues. The stock traded down 10.5% to $30.14 immediately after reporting.

Is Tenable an attractive investment opportunity at the current price? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.