Healthcare technology company GE HealthCare Technologies (NASDAQ: GEHC) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 2.8% year on year to $4.78 billion. Its non-GAAP profit of $1.01 per share was 10.6% above analysts’ consensus estimates.

Is now the time to buy GE HealthCare? Find out by accessing our full research report, it’s free.

GE HealthCare (GEHC) Q1 CY2025 Highlights:

- Revenue: $4.78 billion vs analyst estimates of $4.66 billion (2.8% year-on-year growth, 2.5% beat)

- Adjusted EPS: $1.01 vs analyst estimates of $0.91 (10.6% beat)

- Management lowered its full-year Adjusted EPS guidance to $4 at the midpoint, a 14.5% decrease

- Operating Margin: 13.2%, up from 11.6% in the same quarter last year

- Free Cash Flow Margin: 2.1%, down from 5.9% in the same quarter last year

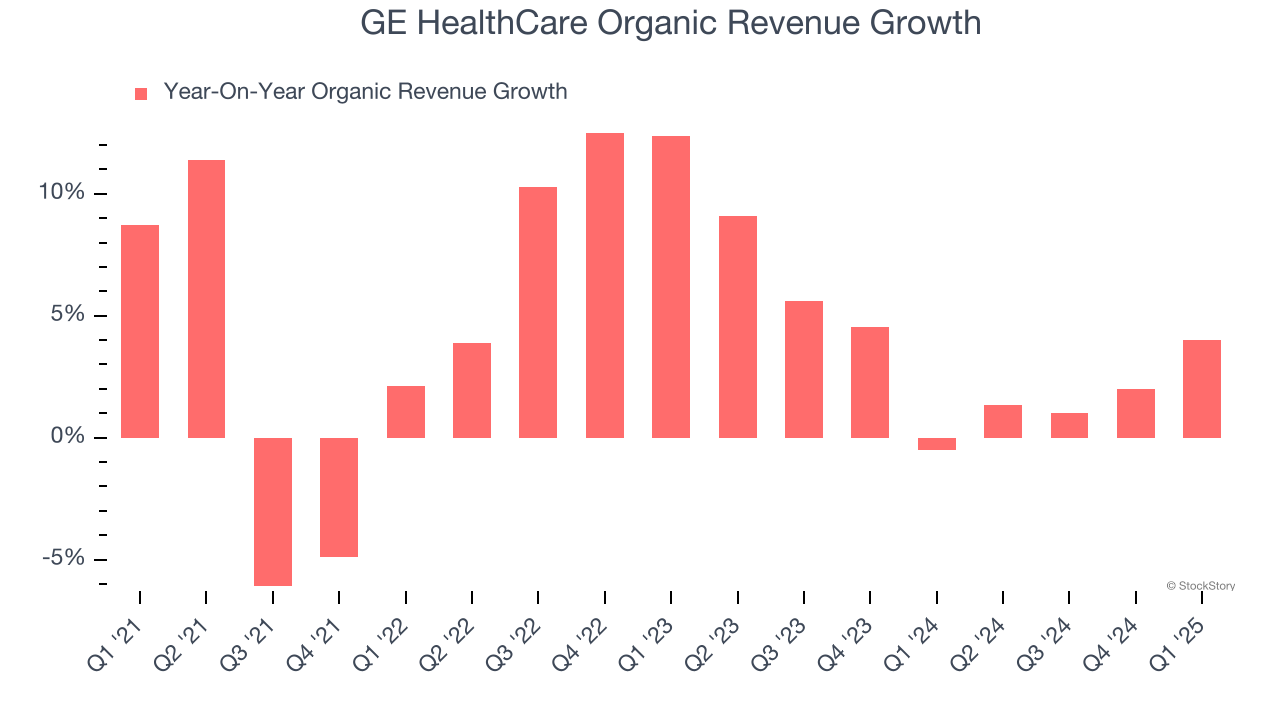

- Organic Revenue rose 4% year on year (-0.5% in the same quarter last year)

- Market Capitalization: $31.17 billion

GE HealthCare President and CEO Peter Arduini said, “First quarter results reflect strong execution as we start the year with robust revenue, orders and profit growth, which were driven by strength in the U.S. We remain focused on delivering on our precision care and growth acceleration strategies, underscored by the closing of our acquisition of Nihon Medi-Physics, which we expect will increase global access to our next-generation radiopharmaceuticals. Regarding the current global trade environment, we are actively driving mitigation actions. We continue to see strong customer demand in many of the markets we serve and are well-positioned to drive long-term value as we invest in future innovation.”

Company Overview

Spun off from industrial giant General Electric in 2023 after over a century as its healthcare division, GE HealthCare (NASDAQ: GEHC) provides medical imaging equipment, patient monitoring systems, diagnostic pharmaceuticals, and AI-enabled healthcare solutions to hospitals and clinics worldwide.

Sales Growth

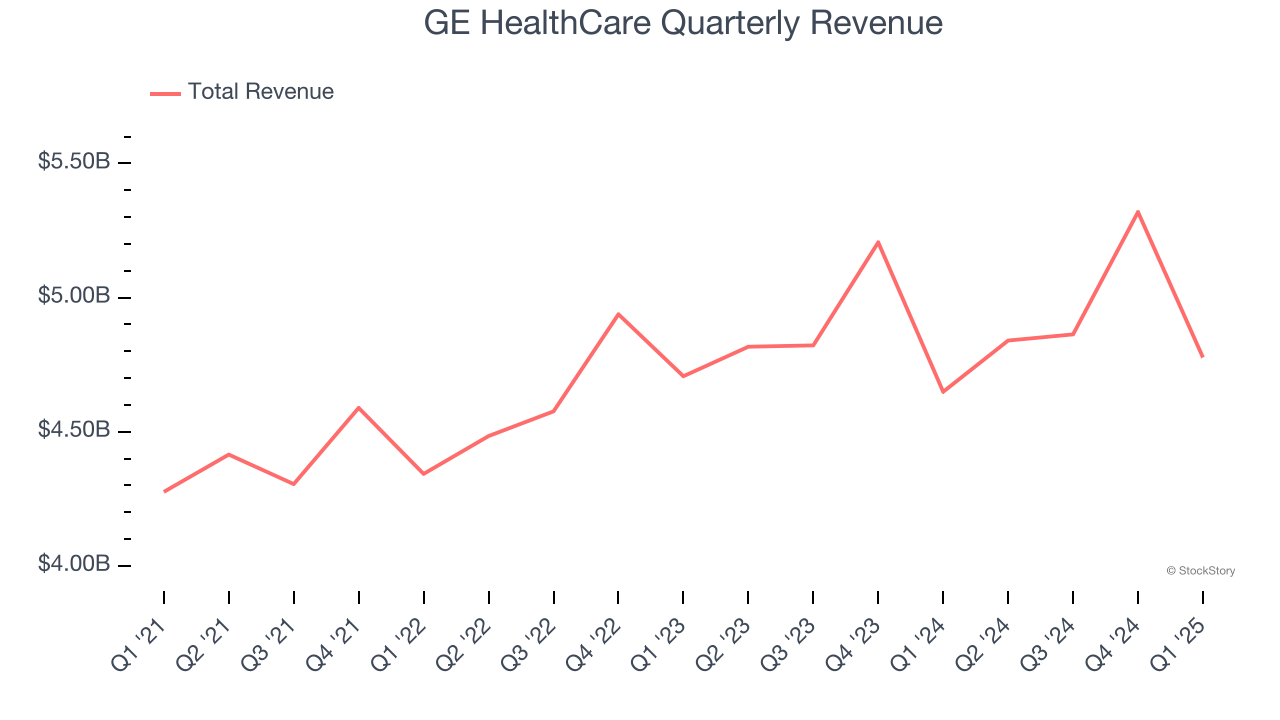

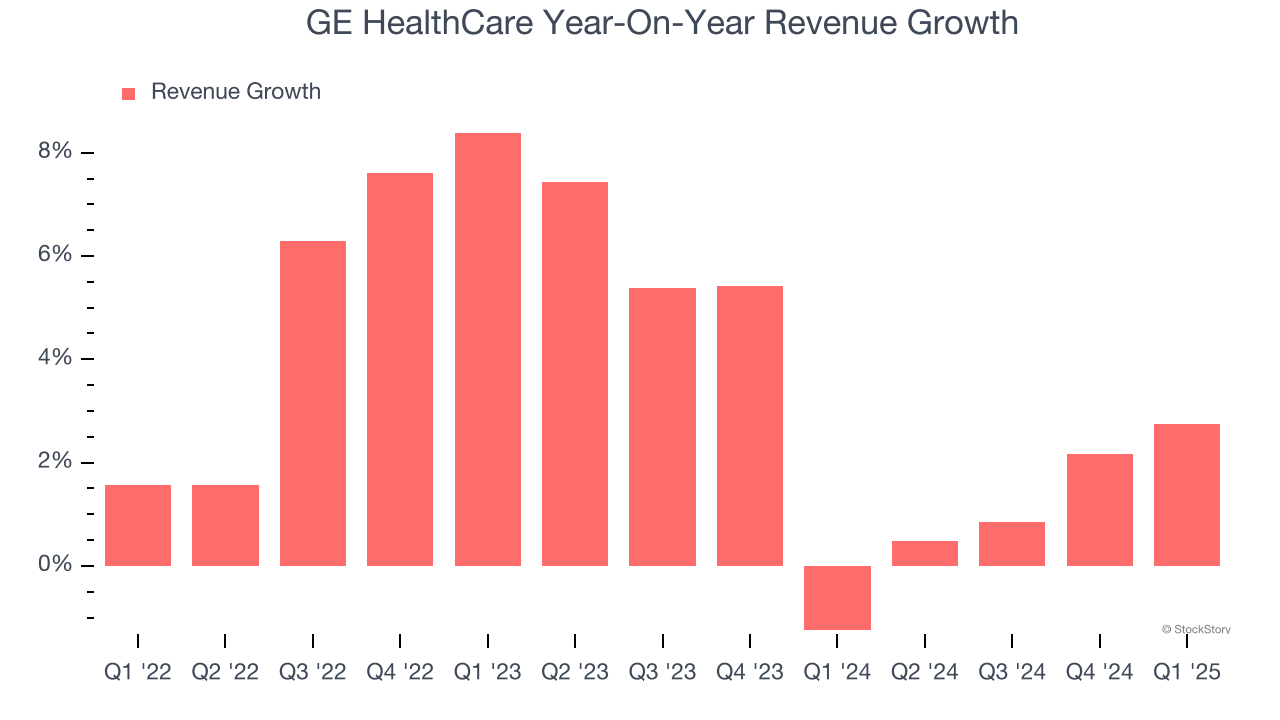

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, GE HealthCare grew its sales at a tepid 3.9% compounded annual growth rate. This fell short of our benchmark for the healthcare sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within healthcare, a stretched historical view may miss new innovations or demand cycles. GE HealthCare’s recent performance shows its demand has slowed as its annualized revenue growth of 2.9% over the last two years was below its three-year trend.

GE HealthCare also reports organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, GE HealthCare’s organic revenue averaged 3.4% year-on-year growth. Because this number aligns with its normal revenue growth, we can see the company’s core operations (not acquisitions and divestitures) drove most of its results.

This quarter, GE HealthCare reported modest year-on-year revenue growth of 2.8% but beat Wall Street’s estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 2.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and implies its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

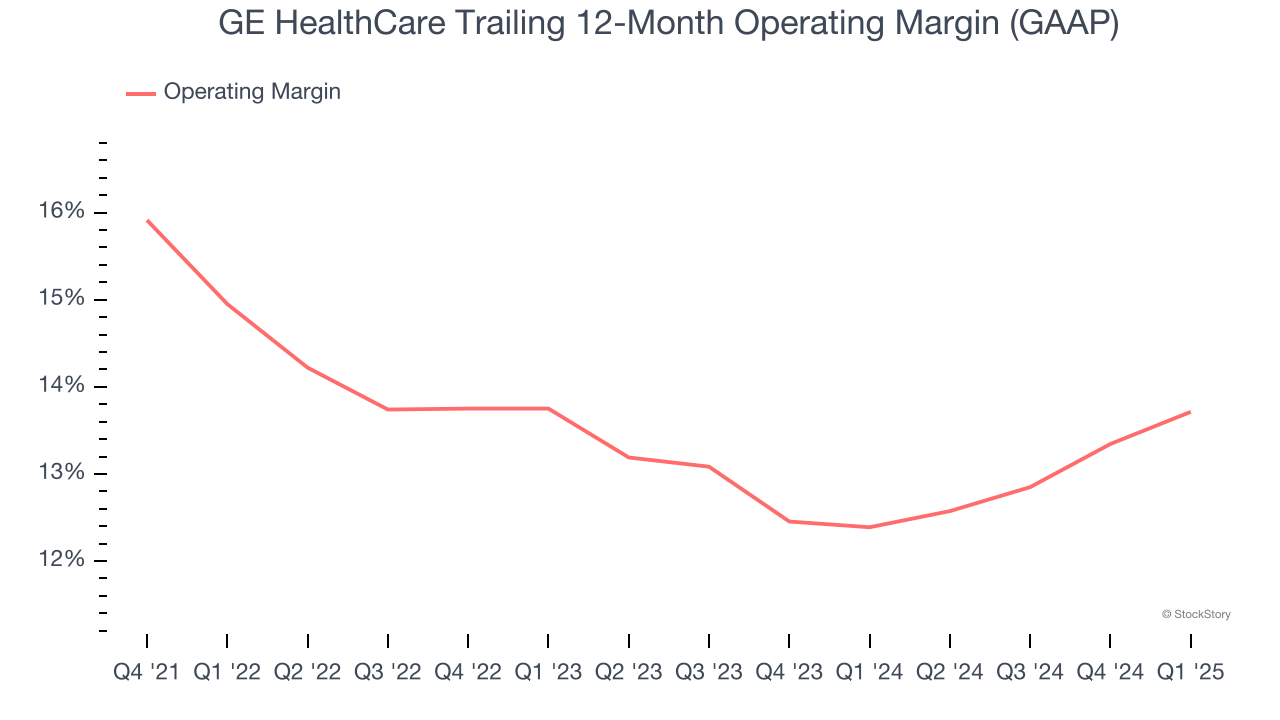

GE HealthCare has done a decent job managing its cost base over the last four years. The company has produced an average operating margin of 13.8%, higher than the broader healthcare sector.

Analyzing the trend in its profitability, GE HealthCare’s operating margin decreased by 1.2 percentage points over the last four years. A silver lining is that on a two-year basis, its margin has stabilized. Still, shareholders will want to see GE HealthCare become more profitable in the future.

This quarter, GE HealthCare generated an operating profit margin of 13.2%, up 1.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

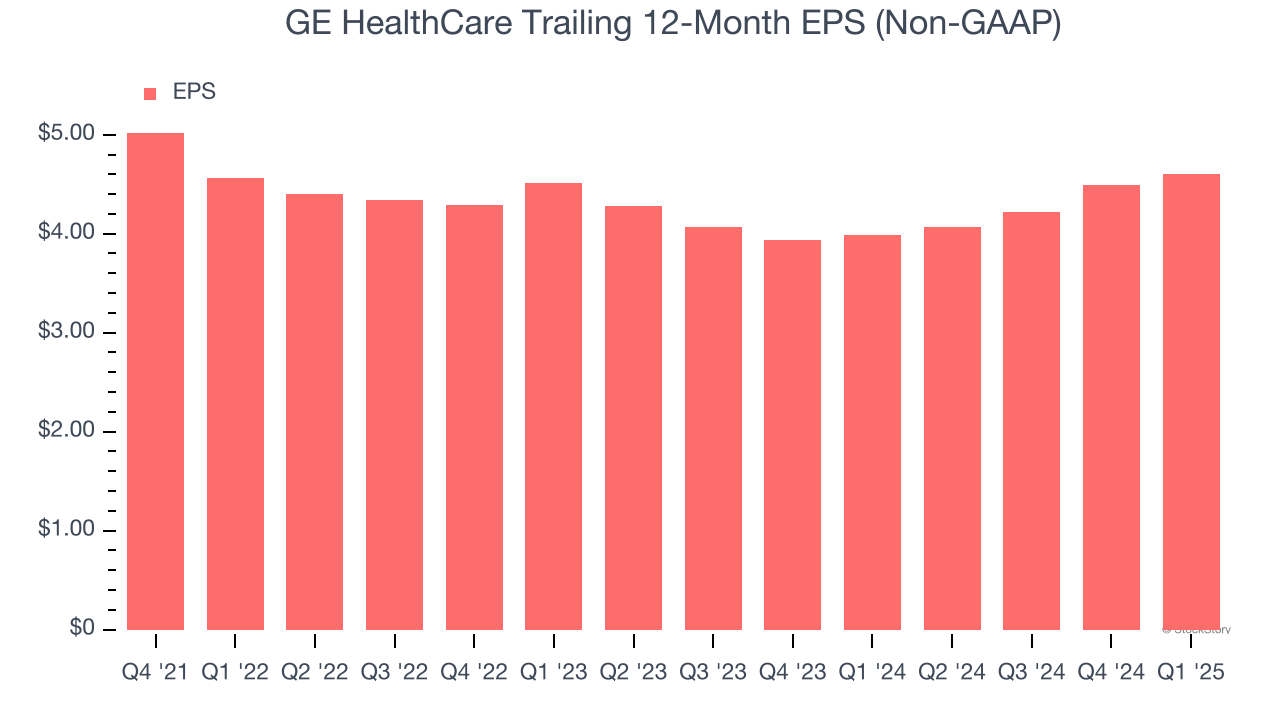

Earnings Per Share

We track the change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

GE HealthCare’s flat EPS over the last three years was below its 3.9% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

In Q1, GE HealthCare reported EPS at $1.01, up from $0.90 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects GE HealthCare’s full-year EPS of $4.60 to grow 5%.

Key Takeaways from GE HealthCare’s Q1 Results

We enjoyed seeing GE HealthCare beat analysts’ organic revenue expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance was lowered and missed. Overall, this quarter was mixed. The stock traded up 1.7% to $69.22 immediately following the results.

So do we think GE HealthCare is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.