As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the specialty retail industry, including Leslie's (NASDAQ: LESL) and its peers.

Some retailers try to sell everything under the sun, while others—appropriately called Specialty Retailers—focus on selling a narrow category and aiming to be exceptional at it. Whether it’s eyeglasses, sporting goods, or beauty and cosmetics, these stores win with depth of product in their category as well as in-store expertise and guidance for shoppers who need it. E-commerce competition exists and waning retail foot traffic impacts these retailers, but the magnitude of the headwinds depends on what they sell and what extra value they provide in their stores.

The 4 specialty retail stocks we track reported a mixed Q4. As a group, revenues along with next quarter’s revenue guidance were in line with analysts’ consensus estimates.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18.4% since the latest earnings results.

Weakest Q4: Leslie's (NASDAQ: LESL)

Named after founder Philip Leslie, who established the company in 1963, Leslie’s (NASDAQ: LESL) is a retailer that sells pool and spa supplies, equipment, and maintenance services.

Leslie's reported revenues of $175.2 million, flat year on year. This print exceeded analysts’ expectations by 0.8%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EBITDA estimates.

Leslie's scored the biggest analyst estimates beat of the whole group. Still, the market seems discontent with the results. The stock is down 5.4% since reporting and currently trades at $0.62.

Read our full report on Leslie's here, it’s free.

Best Q4: National Vision (NASDAQ: EYE)

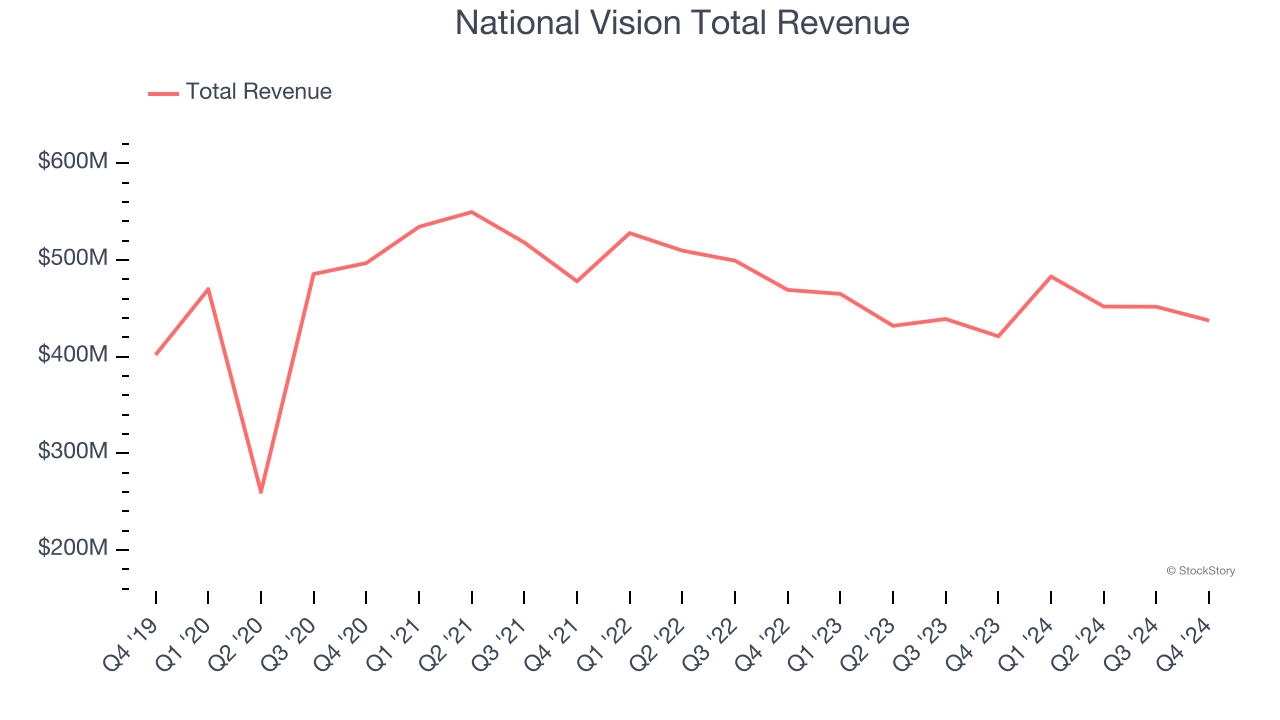

Operating under multiple brands, National Vision (NYSE: EYE) sells optical products such as eyeglasses and provides optical services such as eye exams.

National Vision reported revenues of $437.3 million, up 3.9% year on year, outperforming analysts’ expectations by 0.6%. The business had a very strong quarter with full-year EPS guidance exceeding analysts’ expectations and a solid beat of analysts’ EBITDA estimates.

National Vision delivered the fastest revenue growth among its peers. The stock is down 5.4% since reporting. It currently trades at $10.83.

Is now the time to buy National Vision? Access our full analysis of the earnings results here, it’s free.

Tractor Supply (NASDAQ: TSCO)

Started as a mail-order tractor parts business, Tractor Supply (NASDAQ: TSCO) is a retailer of general goods such as agricultural supplies, hardware, and pet food for the rural consumer.

Tractor Supply reported revenues of $3.77 billion, up 3.1% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EPS guidance missing analysts’ expectations and a miss of analysts’ EBITDA estimates.

Tractor Supply delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 16.9% since the results and currently trades at $47.35.

Read our full analysis of Tractor Supply’s results here.

Petco (NASDAQ: WOOF)

Historically known for its window displays of pets for sale or adoption, Petco (NASDAQ: WOOF) is a specialty retailer of pet food and supplies as well as a provider of services such as wellness checks and grooming.

Petco reported revenues of $1.55 billion, down 7.3% year on year. This number was in line with analysts’ expectations. It was a very strong quarter as it also put up EBITDA guidance for next quarter exceeding analysts’ expectations and an impressive beat of analysts’ EPS estimates.

Petco had the slowest revenue growth among its peers. The stock is up 21.2% since reporting and currently trades at $2.97.

Read our full, actionable report on Petco here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.