Comcast has gotten torched over the last six months - since November 2024, its stock price has dropped 22.2% to $33.90 per share. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Comcast, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Comcast Will Underperform?

Even with the cheaper entry price, we're sitting this one out for now. Here are three reasons why CMCSA doesn't excite us and a stock we'd rather own.

1. Inability to Grow Domestic Broadband Customers Points to Weak Demand

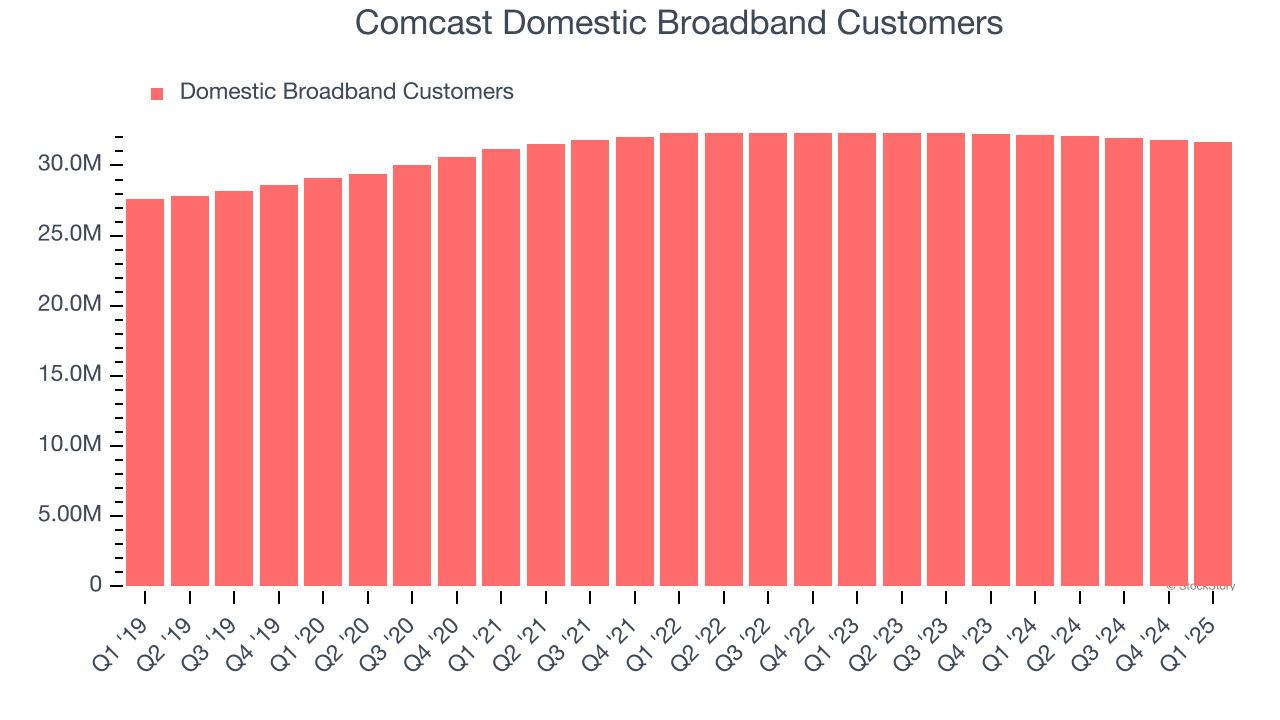

Revenue growth can be broken down into changes in price and volume (for companies like Comcast, our preferred volume metric is domestic broadband customers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Over the last two years, Comcast failed to grow its domestic broadband customers, which came in at 31.64 million in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Comcast might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Projected Revenue Growth Shows Limited Upside

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Comcast’s revenue to stall, close to its 1.4% annualized growth for the past two years. This projection is underwhelming and indicates its newer products and services will not lead to better top-line performance yet.

3. Previous Growth Initiatives Haven’t Impressed

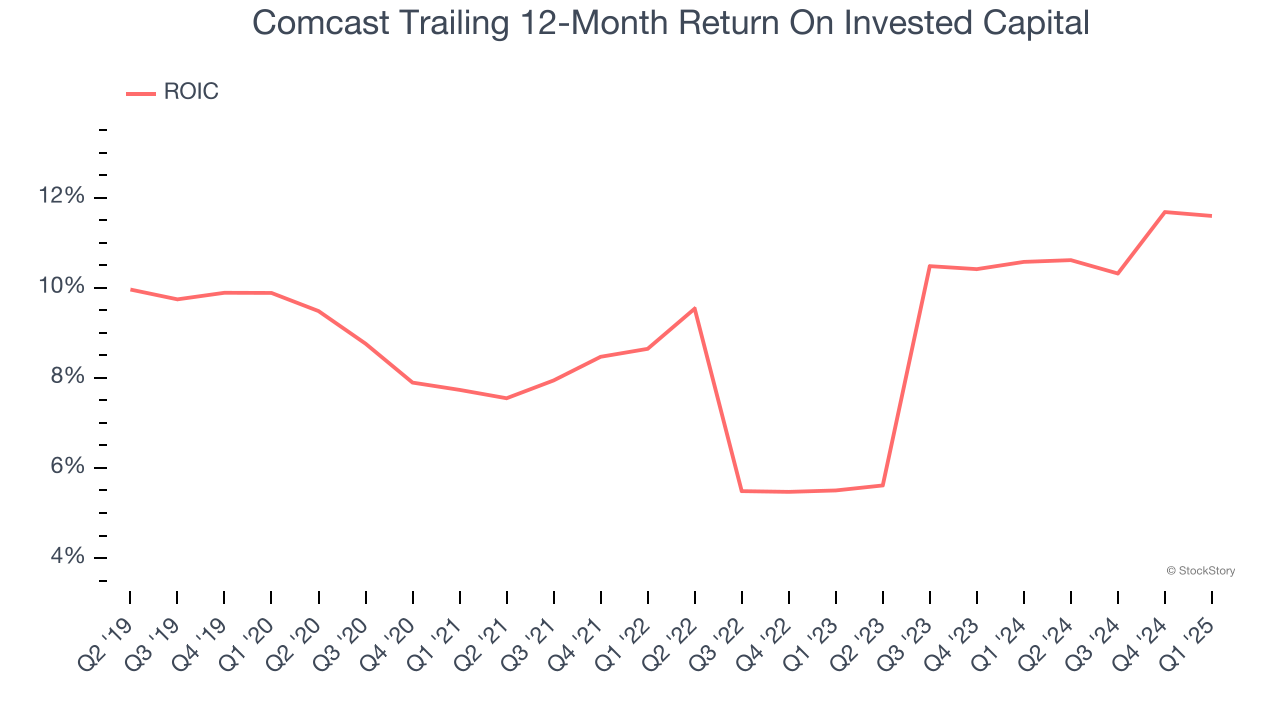

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Comcast historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 8.8%, somewhat low compared to the best consumer discretionary companies that consistently pump out 25%+.

Final Judgment

We see the value of companies helping consumers, but in the case of Comcast, we’re out. After the recent drawdown, the stock trades at 7.8× forward price-to-earnings (or $33.90 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are better investments elsewhere. We’d recommend looking at a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of Comcast

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.