Booz Allen Hamilton’s stock price has taken a beating over the past six months, shedding 31.1% of its value and falling to $124.98 per share. This may have investors wondering how to approach the situation.

Following the drawdown, is this a buying opportunity for BAH? Find out in our full research report, it’s free.

Why Is Booz Allen Hamilton a Good Business?

With roots dating back to 1914 and deep ties to nearly all U.S. cabinet-level departments, Booz Allen Hamilton (NYSE: BAH) provides management consulting, technology services, and cybersecurity solutions primarily to U.S. government agencies and military branches.

1. Core Business Firing on All Cylinders

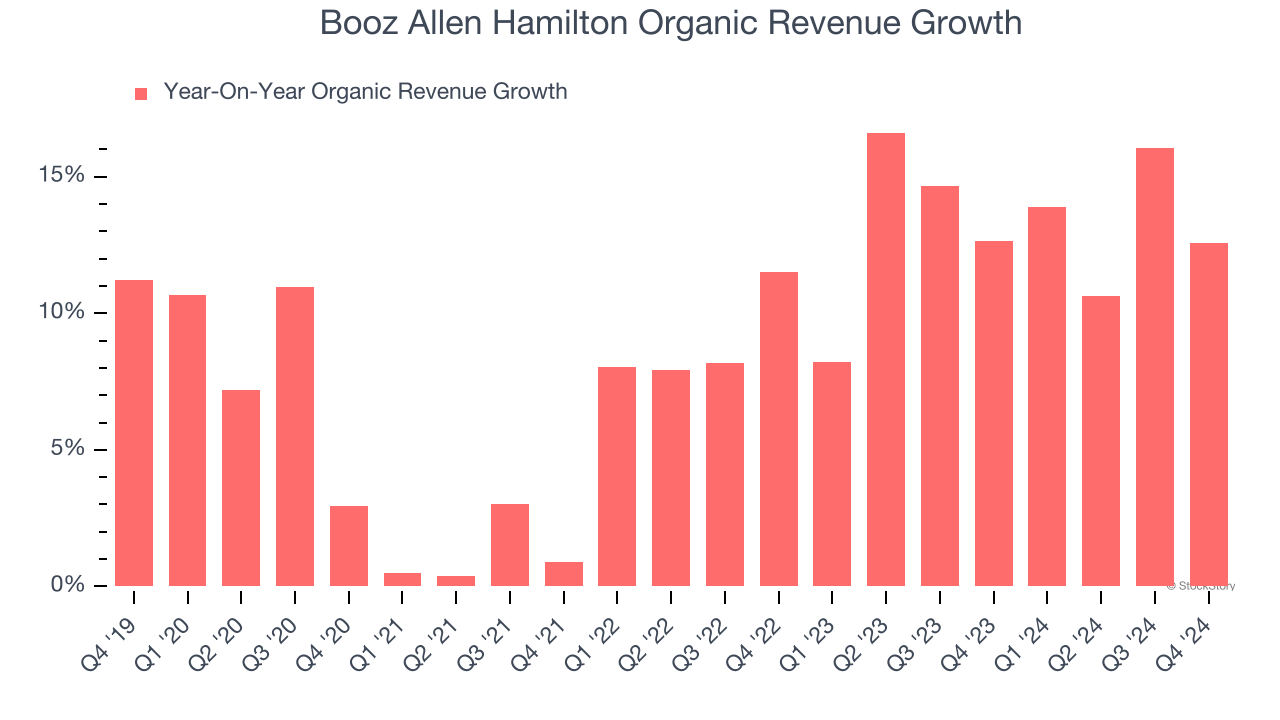

We can better understand Government & Technical Consulting companies by analyzing their organic revenue. This metric gives visibility into Booz Allen Hamilton’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Booz Allen Hamilton’s organic revenue averaged 13.2% year-on-year growth. This performance was fantastic and shows it can expand quickly without relying on expensive (and risky) acquisitions.

2. Economies of Scale Give It Negotiating Leverage with Suppliers

With $11.78 billion in revenue over the past 12 months, Booz Allen Hamilton is one of the larger companies in the business services industry and benefits from a well-known brand that influences purchasing decisions.

3. Outstanding Long-Term EPS Growth

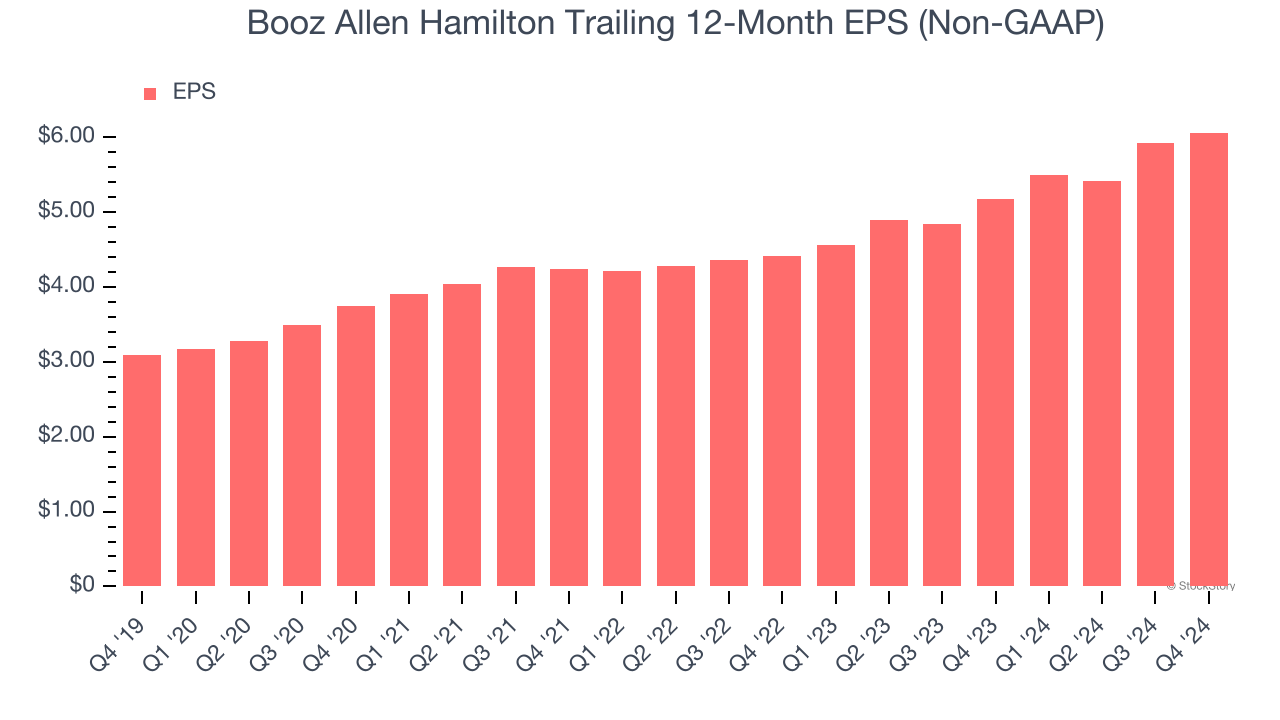

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Booz Allen Hamilton’s EPS grew at a spectacular 14.5% compounded annual growth rate over the last five years, higher than its 10.1% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Final Judgment

These are just a few reasons why we're bullish on Booz Allen Hamilton. With the recent decline, the stock trades at 18.1× forward P/E (or $124.98 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks That Overcame Trump’s 2018 Tariffs

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.