Visual content marketplace Getty Images (NYSE: GETY) missed Wall Street’s revenue expectations in Q1 CY2025, with sales flat year on year at $224.1 million. On the other hand, the company’s full-year revenue guidance of $949.5 million at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP loss of $0.14 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Getty Images? Find out by accessing our full research report, it’s free.

Getty Images (GETY) Q1 CY2025 Highlights:

- Revenue: $224.1 million vs analyst estimates of $235 million (flat year on year, 4.7% miss)

- Adjusted EPS: -$0.14 vs analyst estimates of $0.08 (significant miss)

- Adjusted EBITDA: $70.13 million vs analyst estimates of $70.77 million (31.3% margin, 0.9% miss)

- The company lifted its revenue guidance for the full year to $949.5 million at the midpoint from $936.5 million, a 1.4% increase

- EBITDA guidance for the full year is $287 million at the midpoint, above analyst estimates of $284.5 million

- Operating Margin: 12.2%, down from 18.5% in the same quarter last year

- Free Cash Flow was -$322,000, down from $7 million in the same quarter last year

- Market Capitalization: $775.6 million

“Results in the first quarter were consistent with our expectations, with growth highlighted by gains across our subscription business, and continued customer value delivered through our offerings,” said Craig Peters, Chief Executive Officer for Getty Images.

Company Overview

With a vast library of over 562 million visual assets documenting everything from breaking news to iconic historical moments, Getty Images (NYSE: GETY) is a global visual content marketplace that licenses photos, videos, illustrations, and music to businesses, media outlets, and creative professionals.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $941.1 million in revenue over the past 12 months, Getty Images is a small player in the business services space, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and numerous distribution channels.

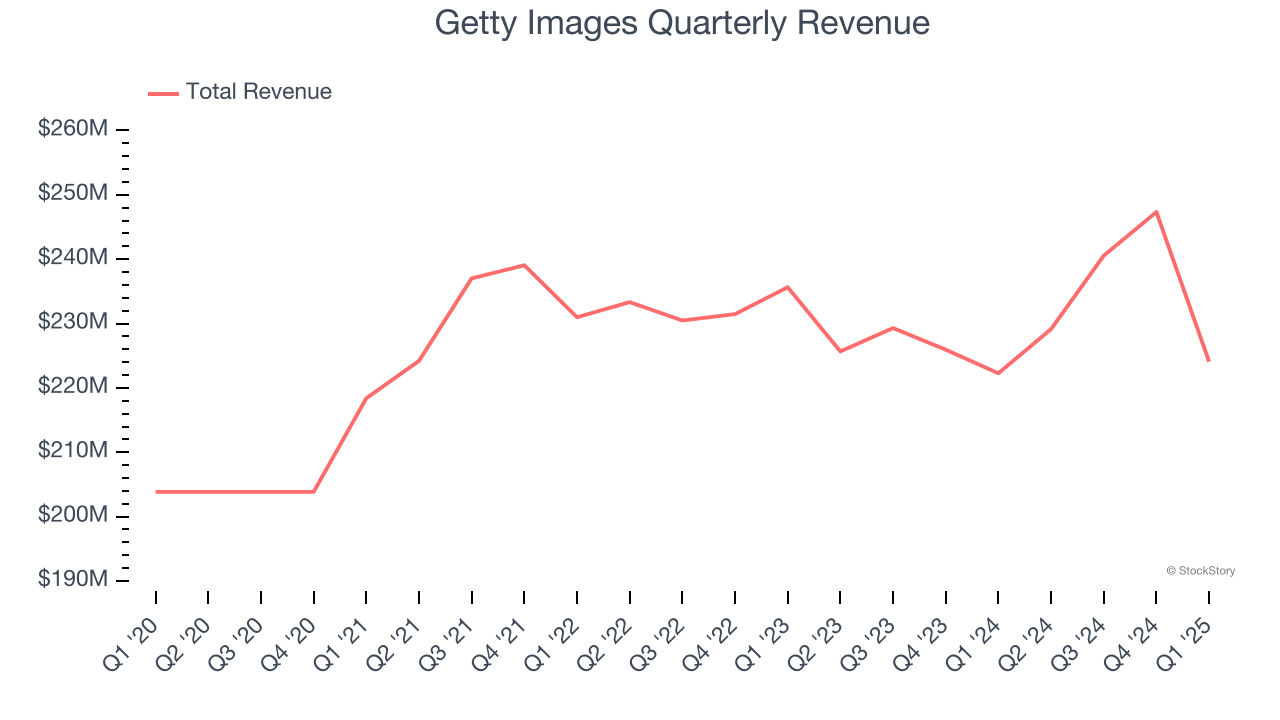

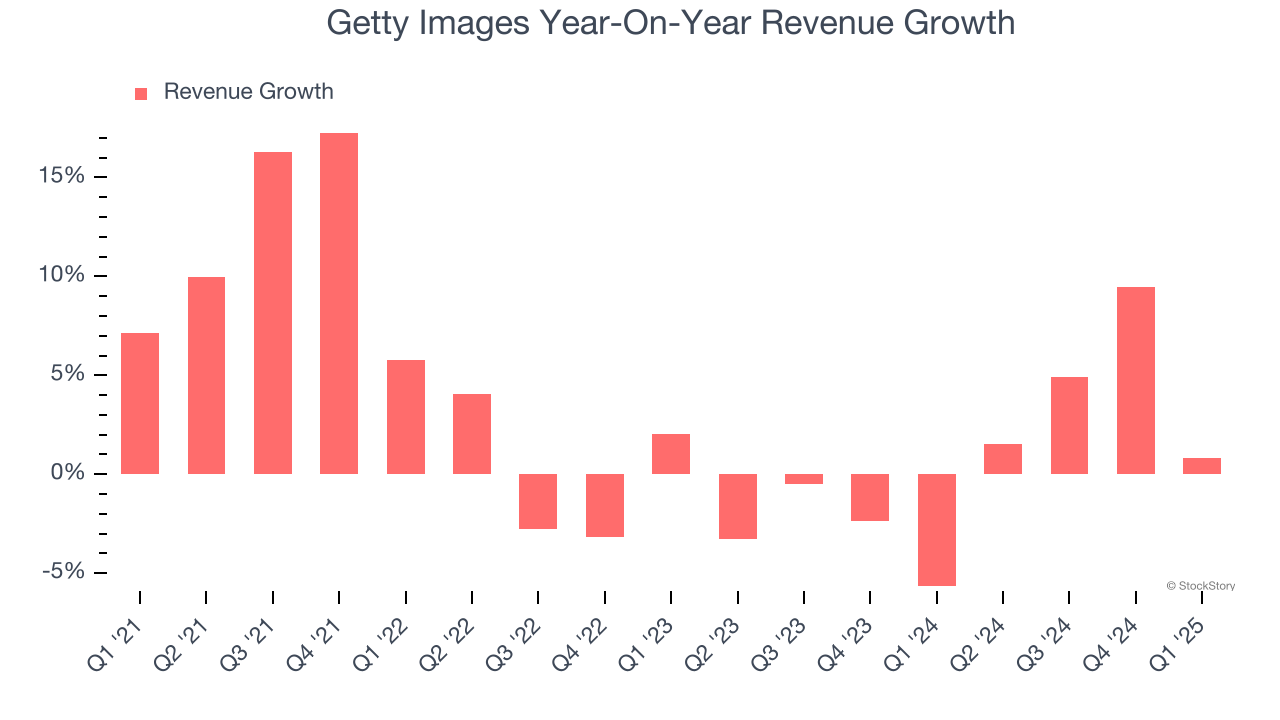

As you can see below, Getty Images’s sales grew at a tepid 3.2% compounded annual growth rate over the last four years. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Getty Images’s recent performance shows its demand has slowed as its revenue was flat over the last two years.

This quarter, Getty Images’s $224.1 million of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not lead to better top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

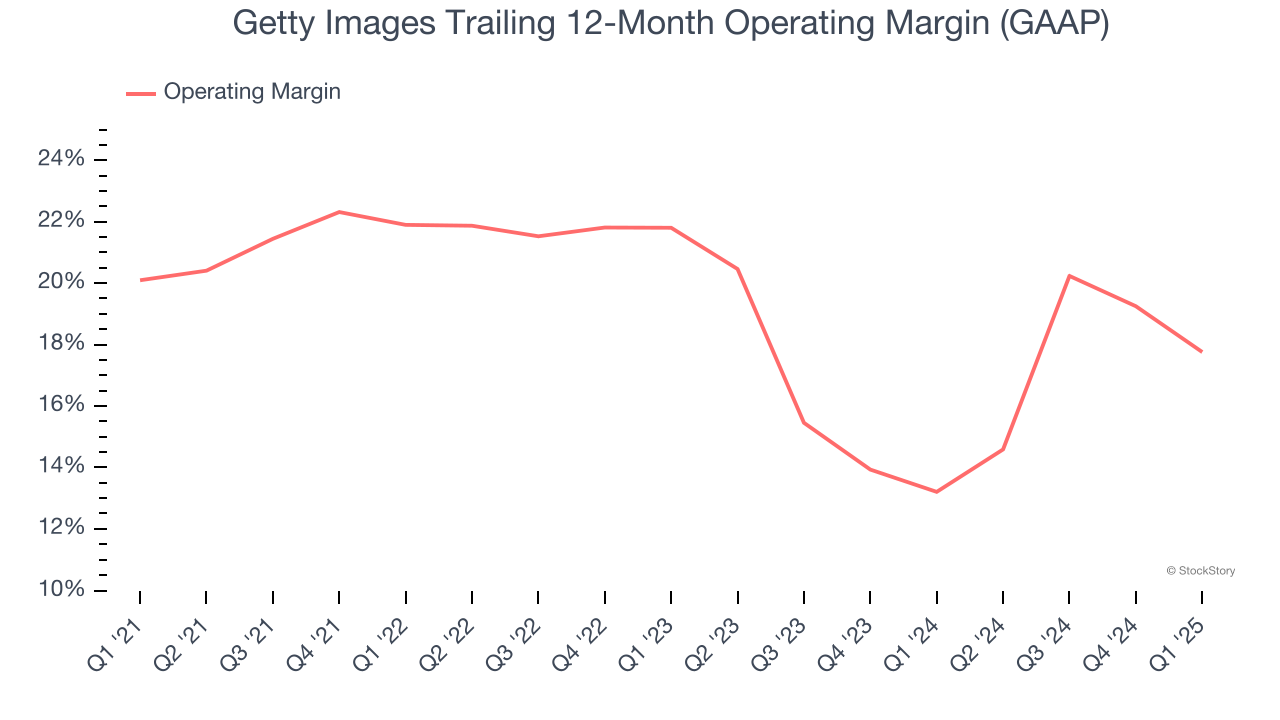

Getty Images has been a well-oiled machine over the last five years. It demonstrated elite profitability for a business services business, boasting an average operating margin of 19%.

Looking at the trend in its profitability, Getty Images’s operating margin decreased by 2.3 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

In Q1, Getty Images generated an operating profit margin of 12.2%, down 6.3 percentage points year on year. This contraction shows it was less efficient because its expenses increased relative to its revenue.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

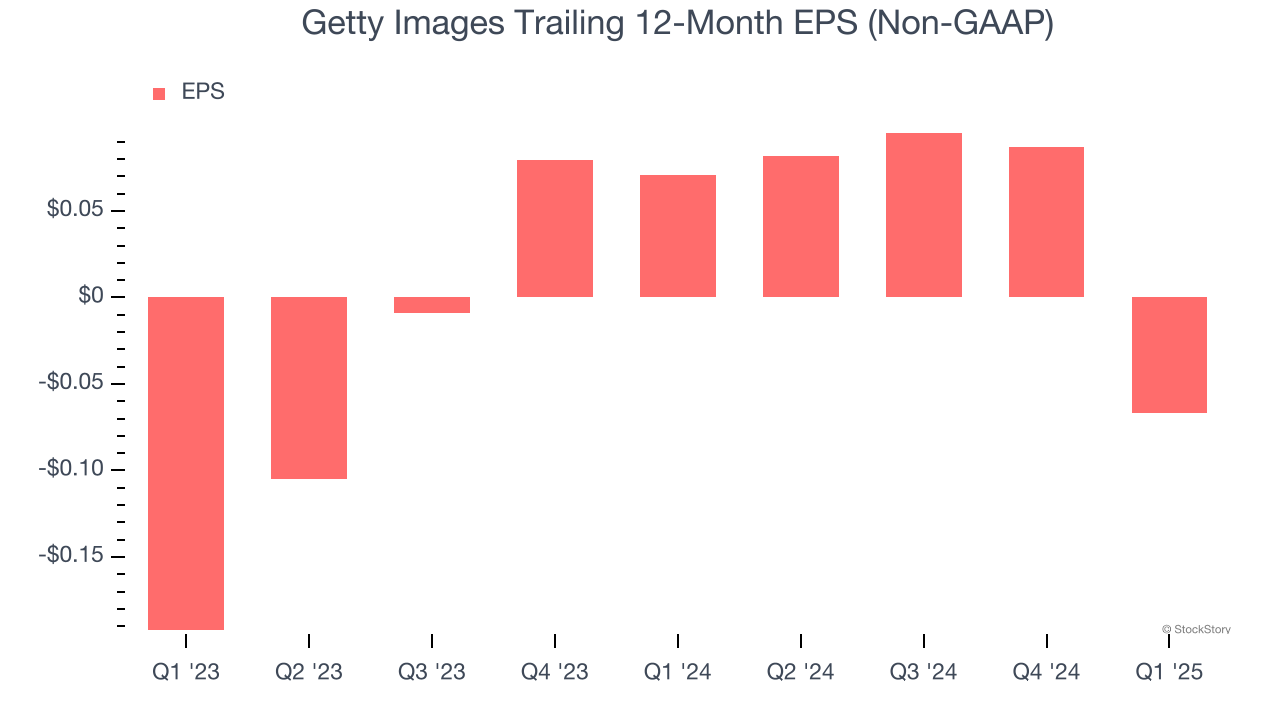

Although Getty Images’s full-year earnings are still negative, it reduced its losses and improved its EPS by 41.1% annually over the last two years. The next few quarters will be critical for assessing its long-term profitability.

In Q1, Getty Images reported EPS at negative $0.14, down from $0.01 in the same quarter last year. This print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Getty Images’s Q1 Results

It was good to see Getty Images provide full-year revenue and EBITDA guidance that slightly beat analysts’ expectations. On the other hand, this quarter's revenue, EPS and EBITDA missed. Overall, this was a softer print. The stock traded down 3.7% to $1.97 immediately following the results.

Getty Images may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.