Video conferencing platform Zoom (NASDAQ: ZM) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 2.9% year on year to $1.17 billion. Guidance for next quarter’s revenue was better than expected at $1.20 billion at the midpoint, 0.6% above analysts’ estimates. Its non-GAAP profit of $1.43 per share was 9.5% above analysts’ consensus estimates.

Is now the time to buy Zoom? Find out by accessing our full research report, it’s free.

Zoom (ZM) Q1 CY2025 Highlights:

- Revenue: $1.17 billion vs analyst estimates of $1.17 billion (2.9% year-on-year growth, 0.8% beat)

- Adjusted EPS: $1.43 vs analyst estimates of $1.31 (9.5% beat)

- Adjusted Operating Income: $467.3 million vs analyst estimates of $446.8 million (39.8% margin, 4.6% beat)

- The company slightly lifted its revenue guidance for the full year to $4.81 billion at the midpoint from $4.79 billion

- Management raised its full-year Adjusted EPS guidance to $5.57 at the midpoint, a 4.1% increase

- Operating Margin: 20.6%, up from 17.8% in the same quarter last year

- Free Cash Flow Margin: 39.4%, up from 35.2% in the previous quarter

- Customers: 4,192 customers paying more than $100,000 annually

- Net Revenue Retention Rate: 98%, in line with the previous quarter

- Market Capitalization: $25.34 billion

Company Overview

Started by Eric Yuan who once ran engineering for Cisco’s video conferencing business, Zoom (NASDAQ: ZM) offers an easy to use, cloud-based platform for video conferencing, audio conferencing and screen sharing.

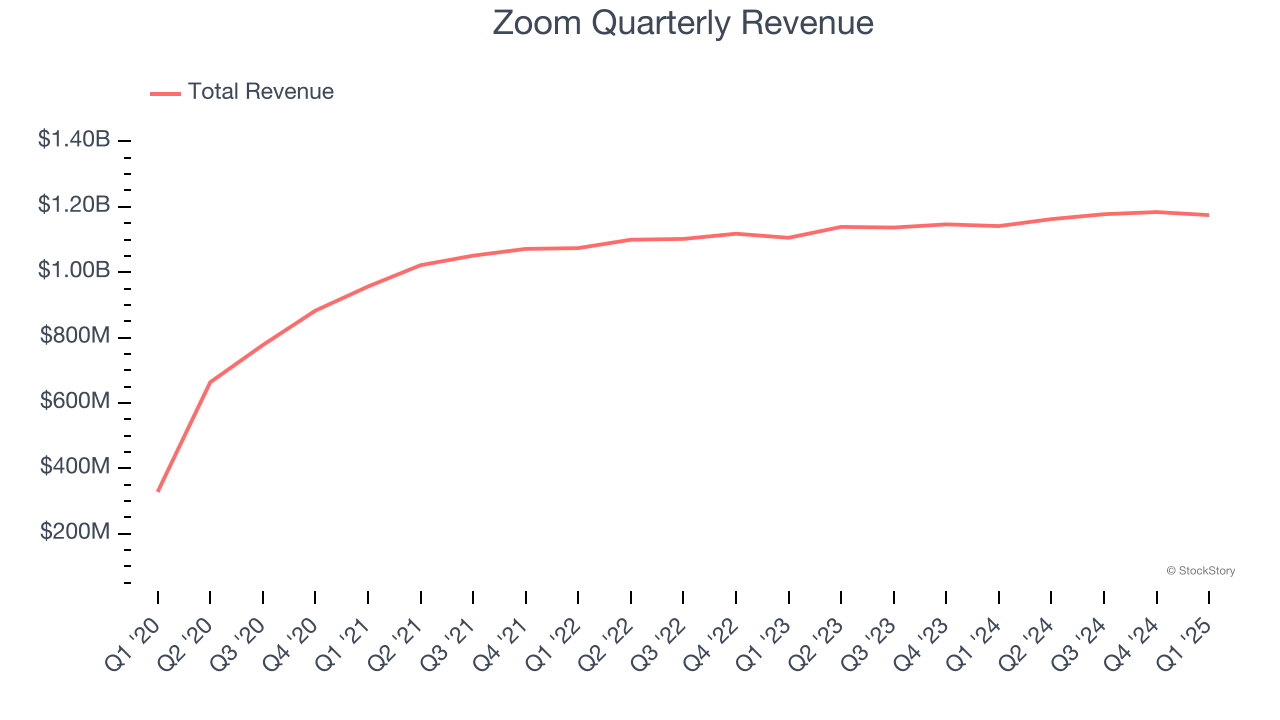

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Regrettably, Zoom’s sales grew at a weak 3.7% compounded annual growth rate over the last three years. This was below our standard for the software sector and is a rough starting point for our analysis.

This quarter, Zoom reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 0.8%. Company management is currently guiding for a 3% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.5% over the next 12 months, similar to its three-year rate. This projection is underwhelming and suggests its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

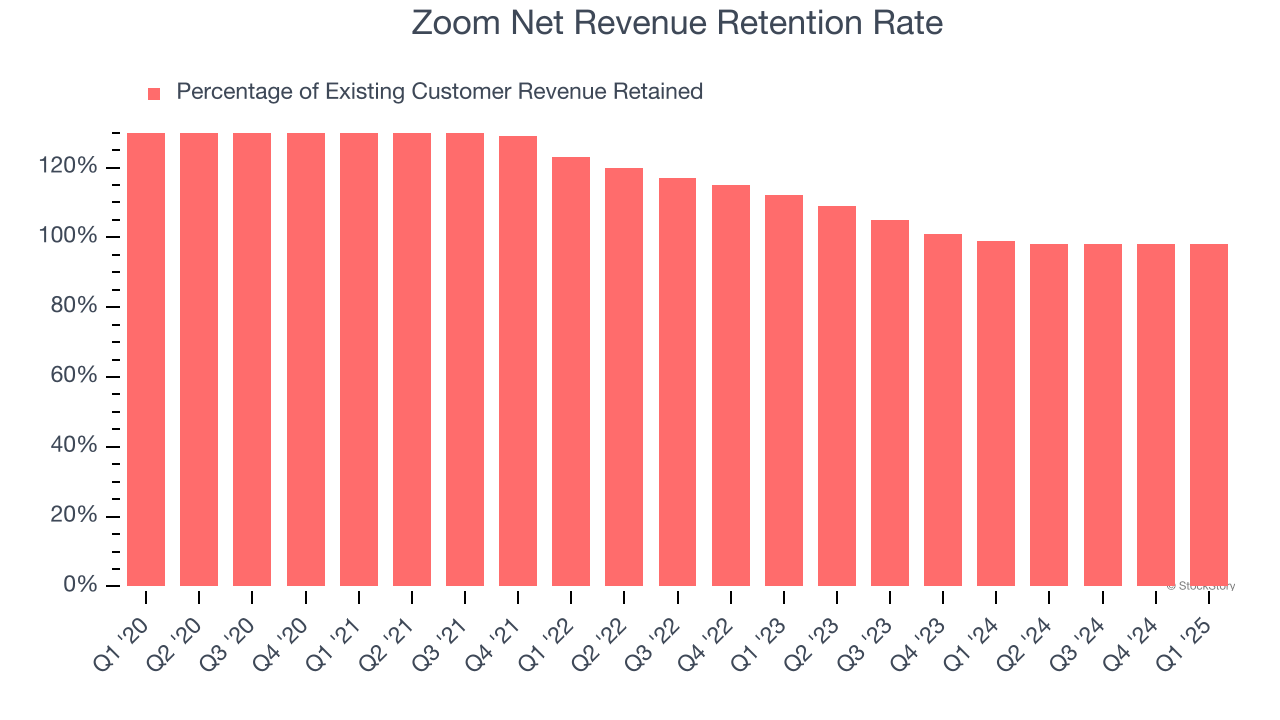

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Zoom’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 98% in Q1. This means Zoom’s revenue would’ve decreased by 2% over the last 12 months if it didn’t win any new customers.

Zoom has a weak net retention rate, signaling that some customers aren’t satisfied with its products, leading to lost contracts and revenue streams.

Key Takeaways from Zoom’s Q1 Results

Revenue and adjusted EPS beat in the quarter, which is a great start. We were also impressed by Zoom’s optimistic full-year EPS guidance, which beat analysts’ expectations. We were also glad its EPS guidance for next quarter exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 3% to $84.53 immediately after reporting.

Indeed, Zoom had a rock-solid quarterly earnings result, but is this stock a good investment here? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.