Since November 2024, Walmart has been in a holding pattern, posting a small return of 4.9% while floating around $96.39. However, the stock is beating the S&P 500’s 3.3% decline during that period.

Is there a buying opportunity in Walmart, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Walmart Not Exciting?

Despite the relative momentum, we're swiping left on Walmart for now. Here are three reasons why there are better opportunities than WMT and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last six years, Walmart grew its sales at a sluggish 4.8% compounded annual growth rate. This fell short of our benchmark for the consumer retail sector.

2. Low Gross Margin Reveals Weak Structural Profitability

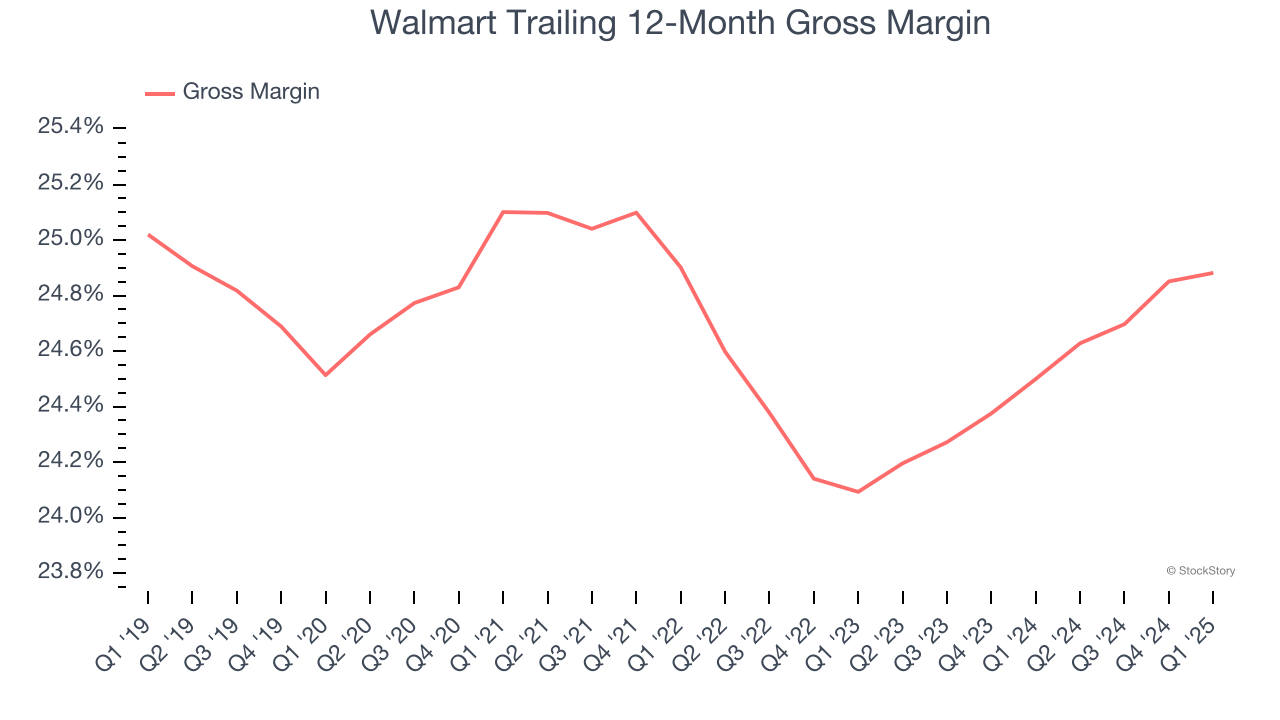

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Walmart has bad unit economics for a retailer, signaling it operates in a competitive market and lacks pricing power because its inventory is sold in many places. As you can see below, it averaged a 24.7% gross margin over the last two years. That means Walmart paid its suppliers a lot of money ($75.31 for every $100 in revenue) to run its business.

3. EPS Trending Down

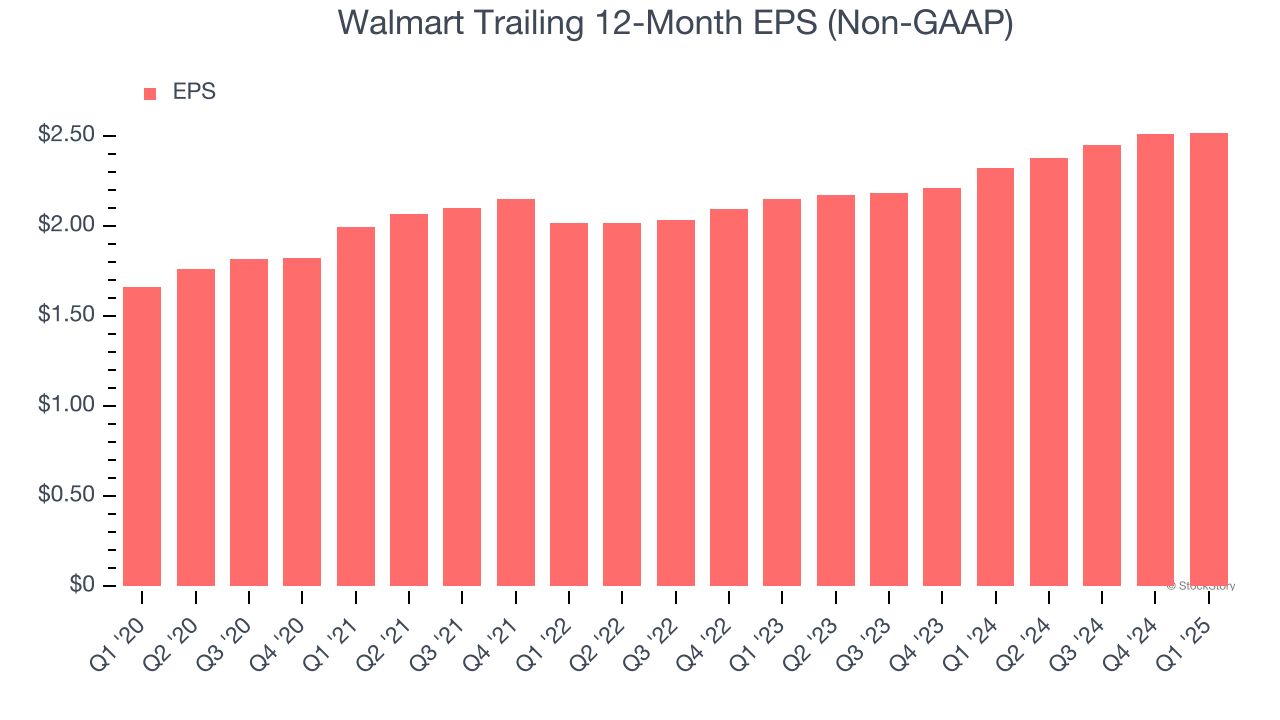

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Walmart, its EPS declined by 10.9% annually over the last six years while its revenue grew by 4.8%. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

Walmart isn’t a terrible business, but it isn’t one of our picks. Following its recent outperformance in a weaker market environment, the stock trades at 36× forward P/E (or $96.39 per share). This valuation tells us a lot of optimism is priced in - we think there are better opportunities elsewhere. Let us point you toward a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.