Cloud security platform Zscaler (NASDAQ: ZS) reported Q1 CY2025 results exceeding the market’s revenue expectations, with sales up 22.6% year on year to $678 million. The company expects next quarter’s revenue to be around $706 million, close to analysts’ estimates. Its non-GAAP profit of $0.84 per share was 10.8% above analysts’ consensus estimates.

Is now the time to buy Zscaler? Find out by accessing our full research report, it’s free.

Zscaler (ZS) Q1 CY2025 Highlights:

- Revenue: $678 million vs analyst estimates of $667 million (22.6% year-on-year growth, 1.6% beat)

- Adjusted EPS: $0.84 vs analyst estimates of $0.76 (10.8% beat)

- Adjusted Operating Income: $146.7 million vs analyst estimates of $141.8 million (21.6% margin, 3.4% beat)

- Revenue Guidance for Q2 CY2025 is $706 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for the full year is $3.19 at the midpoint, beating analyst estimates by 3.3%

- Operating Margin: -3.7%, down from -0.5% in the same quarter last year

- Free Cash Flow Margin: 17.6%, down from 22.1% in the previous quarter

- Billings: $784.5 million at quarter end, up 24.9% year on year

- Market Capitalization: $39.25 billion

“We delivered outstanding Q3 results as an increasing number of customers adopt our expanding Zero Trust Exchange platform. We enable customers to realize Zero Trust Everywhere while lowering operational cost and complexity,” said Jay Chaudhry, Chairman and CEO of Zscaler.

Company Overview

After successfully selling all four of his previous cybersecurity companies, Jay Chaudhry's fifth venture, Zscaler (NASDAQ: ZS) offers software-as-a-service that helps companies securely connect to applications and networks in the cloud.

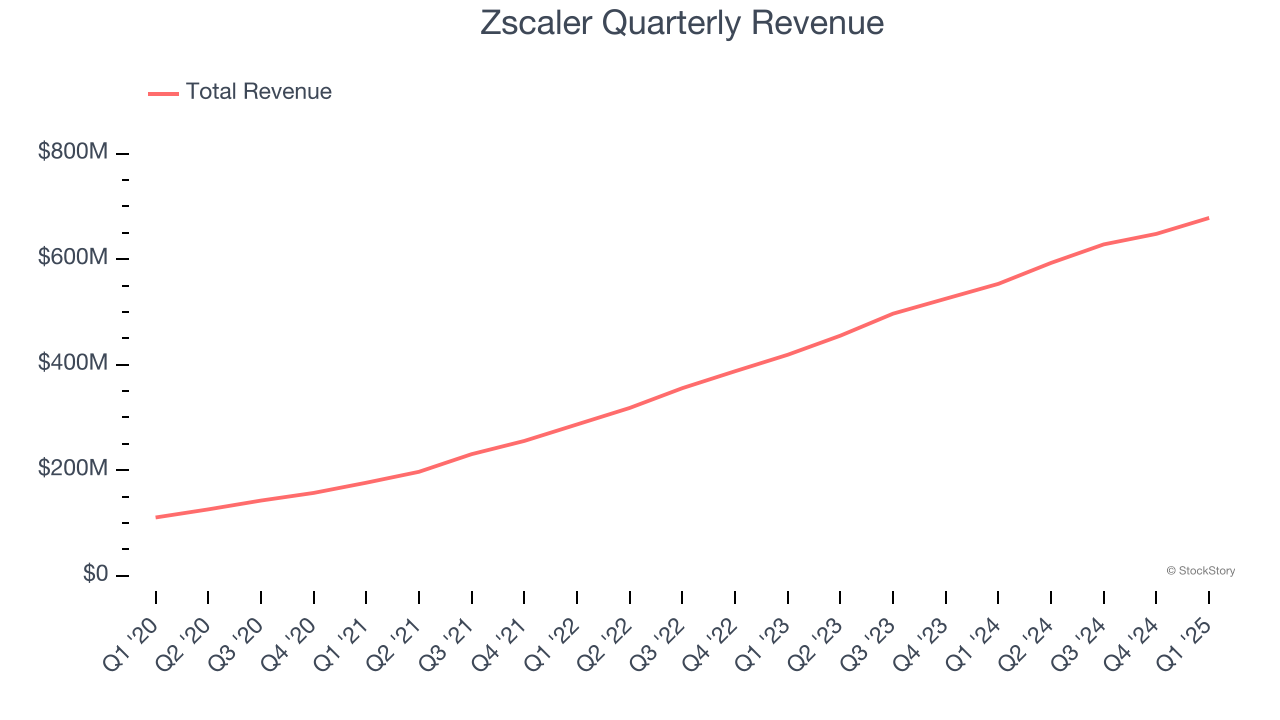

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Zscaler grew its sales at an exceptional 38% compounded annual growth rate. Its growth surpassed the average software company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Zscaler reported robust year-on-year revenue growth of 22.6%, and its $678 million of revenue topped Wall Street estimates by 1.6%. Company management is currently guiding for a 19.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 19.3% over the next 12 months, a deceleration versus the last three years. Still, this projection is healthy and indicates the market sees success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

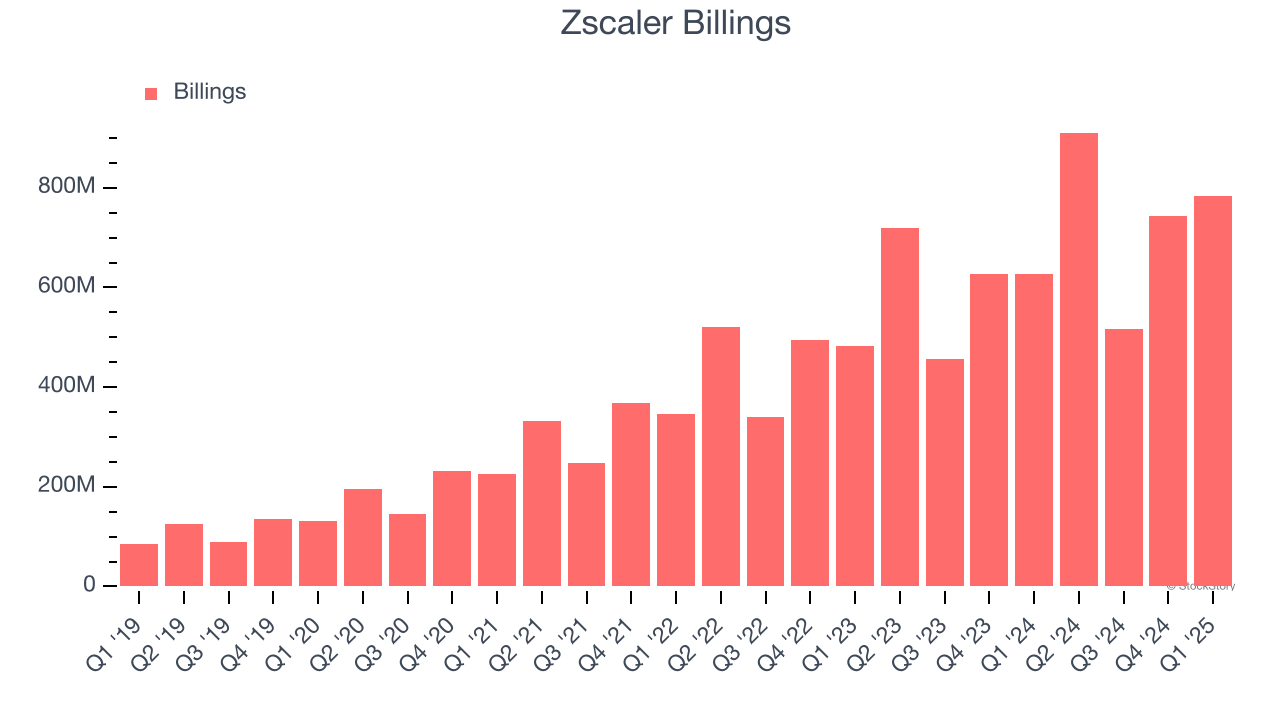

Billings

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Zscaler’s billings punched in at $784.5 million in Q1, and over the last four quarters, its growth was impressive as it averaged 20.8% year-on-year increases. This alternate topline metric grew slower than total sales, meaning the company recognizes revenue faster than it collects cash - a headwind for its liquidity that could also signal a slowdown in future revenue growth.

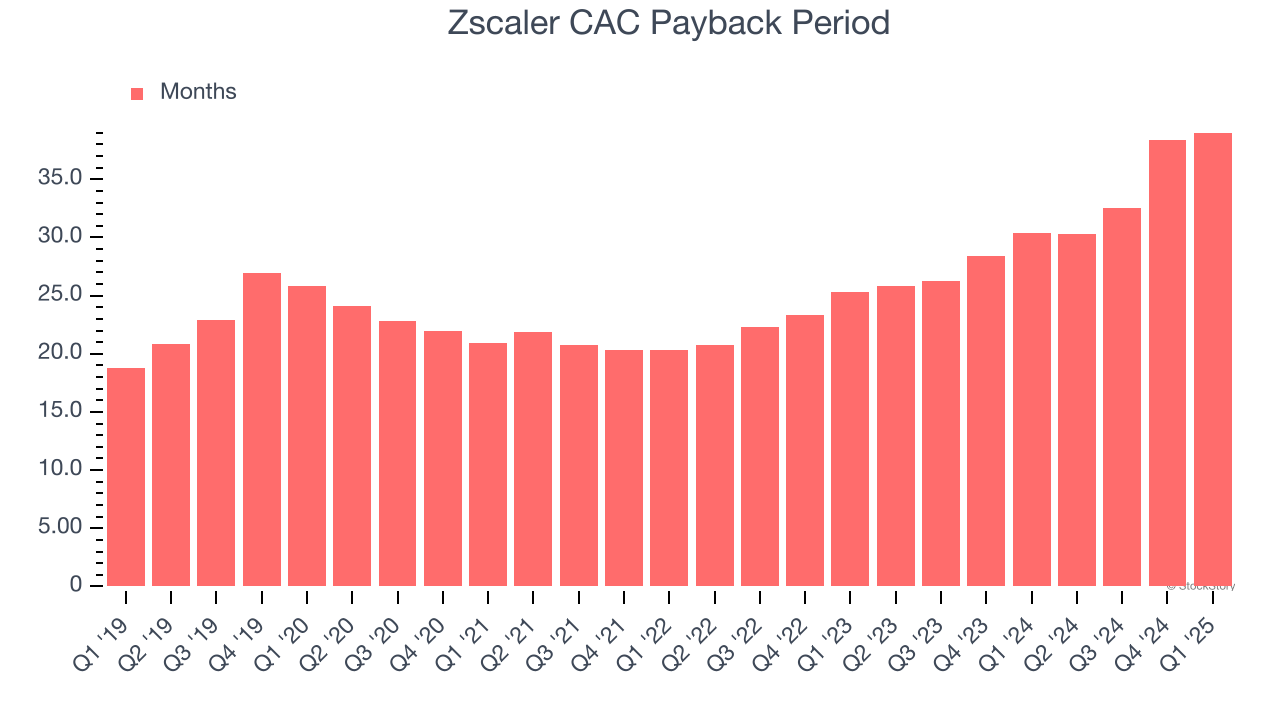

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Zscaler is efficient at acquiring new customers, and its CAC payback period checked in at 39 months this quarter. The company’s relatively fast recovery of its customer acquisition costs gives it the option to accelerate growth by increasing its sales and marketing investments.

Key Takeaways from Zscaler’s Q1 Results

We were impressed by Zscaler’s optimistic full-year EPS guidance, which blew past analysts’ expectations. We were also glad its billings, revenue, EPS, and adjusted operating income outperformed Wall Street’s estimates. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 4.7% to $262.64 immediately following the results.

Zscaler may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.